- Large Expiry Incoming: $13.8B in Bitcoin choices expire Could 30, with bulls aiming to push BTC above $110K to maximise earnings.

- Name Dominance: Most places sit under $109K; calls closely outweigh places above present value ranges, favoring bulls by as much as $4.7B.

- ETF Assist & Dangers: $1.9B in ETF inflows enhance bullish sentiment, however macro components like tariff tensions might nonetheless swing momentum.

Bitcoin (BTC) is gearing up for its largest month-to-month choices expiry of 2025 — with complete publicity climbing to $13.8 billion. And yeah, bulls are watching this one carefully. After a powerful 25% run over the past month, they’ve acquired a shot at locking in costs above $110,000.

Choices Market at a Turning Level

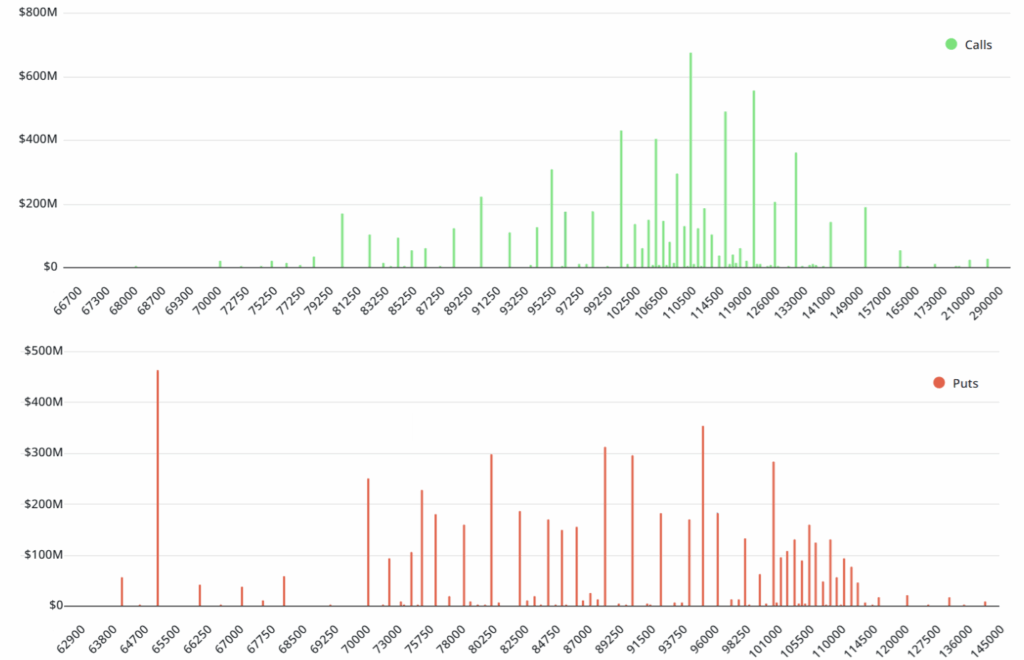

In line with Laevitas, there’s about $6.5 billion in put (promote) choices open — however right here’s the kicker: 95% of these are under $109,000. If BTC stays the place it’s (or pushes larger), most of these places will expire nugatory. That leaves lower than $350 million in play.

On the flip aspect, there’s $3.8 billion in name (purchase) choices as much as $109,000. However not all of that’s bullish. Some merchants would possibly’ve bought these calls to hedge publicity or accumulate premium — it’s not at all times a moon wager.

Technique Breakdown

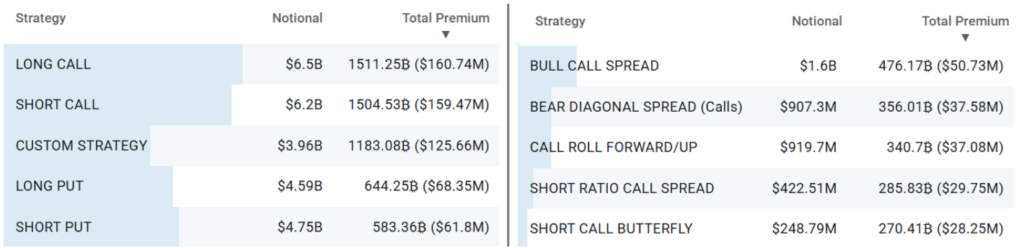

Among the most energetic methods not too long ago on Deribit embody “quick calls” — utilized by people trying to earn earnings if BTC stays put. Then there’s the “bull name unfold,” which caps earnings but additionally reduces draw back threat. Both method, positioning’s heating up.

ETF Inflows Add Extra Gas

Bulls are additionally getting backup from ETFs. Between Could 20 and 22, U.S. spot Bitcoin ETFs noticed $1.9 billion in internet inflows. That’s a giant confidence enhance, particularly with BTC buying and selling above $105,000.

Nonetheless, bears aren’t out of the sport. There’s $79 billion in open curiosity on Bitcoin futures, a lot of it tied to quick positions. If BTC pops above $110k, although, these shorts might get squeezed onerous.

Could 30: All Eyes on $110K

Right here’s a tough breakdown of potential expiry outcomes:

- $102K–$105K: $2.75B in calls vs $900M in places → Internet acquire for bulls: $1.85B

- $105K–$107K: $3.3B calls vs $650M places → Bulls forward by $2.65B

- $107K–$110K: $3.7B calls vs $350M places → $3.35B benefit

- $110K–$114K: $4.8B calls vs $120M places → $4.7B in favor of bulls

Backside line? If bulls can push BTC above $110K by Could 30, they’re in for a critical payday. That might even open the door for a brand new all-time excessive. However so much rides on macro stuff too — like the continuing tariff drama. One headline might change the sport quick.