US President Donald Trump introduced plans to impose a 50% tariff on all items imported from the European Union, efficient from June 1. The announcement has precipitated some nervousness within the crypto market, as earlier bullish momentum has corrected.

The proposed tariffs are available in response to what Trump described as persistent commerce imbalances and regulatory obstacles. He accused the EU of sustaining unfair commerce practices which have harmed US companies.

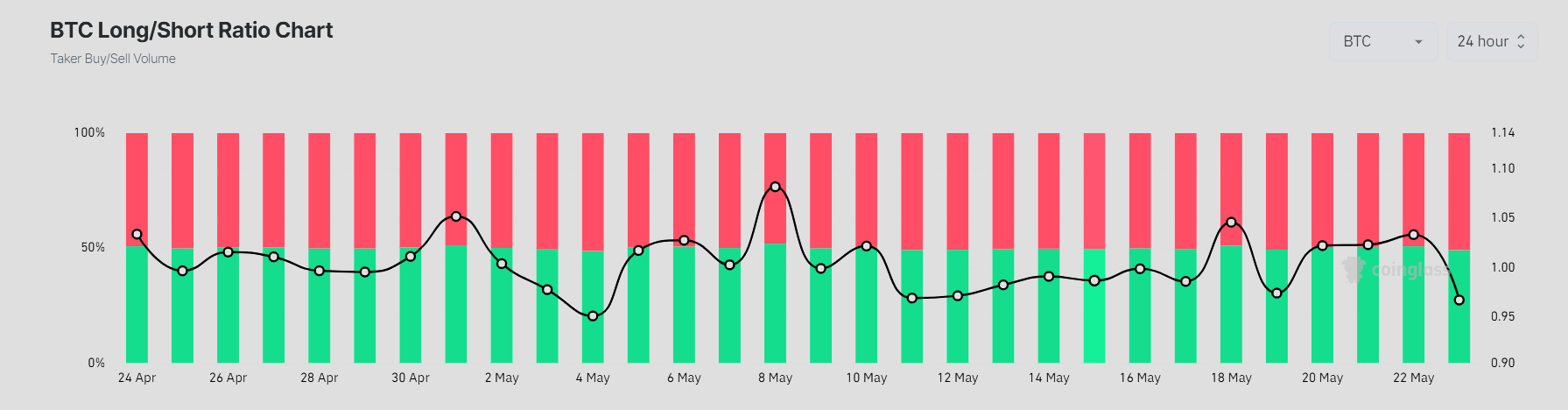

Lengthy-Quick Ratio Exhibits Market Confusion

Bitcoin dropped to $108,000 following the announcement, down from a session excessive of $111,000. It has since recovered to round $109,000 however stays beneath strain. The general crypto market is down 4% over the previous 24 hours.

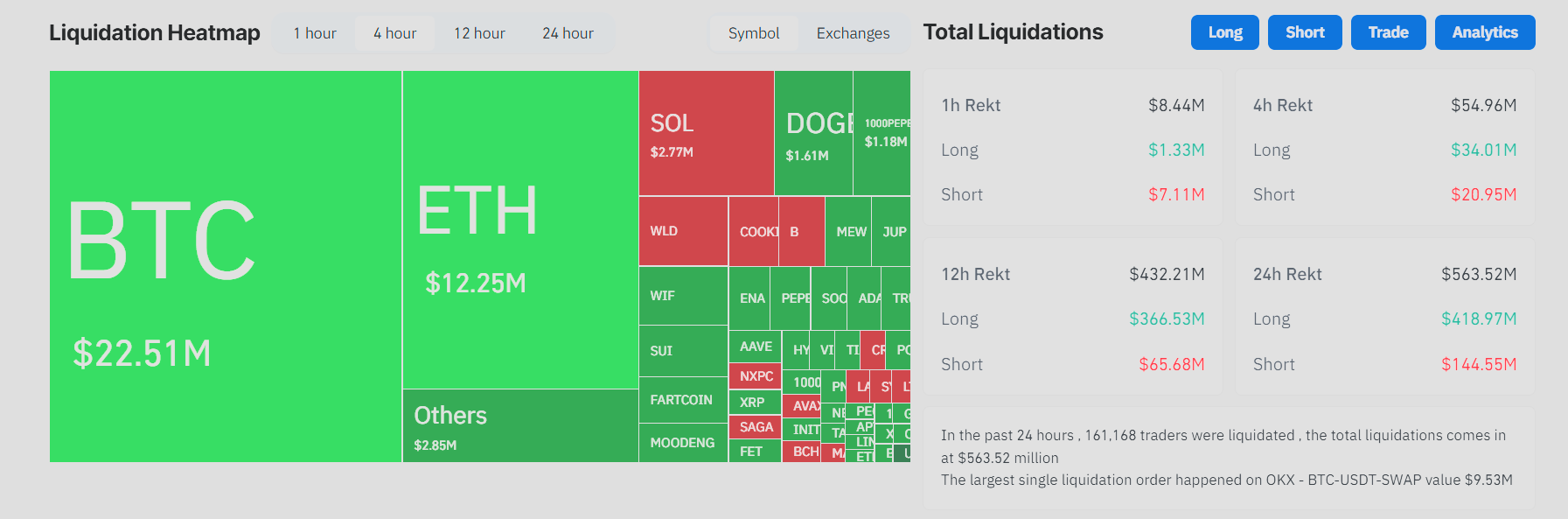

Information from Coinglass reveals $64.13 million in crypto liquidations over the past 4 hours. Lengthy positions accounted for $34.05 million, whereas quick positions made up $30.09 million.

Bitcoin alone noticed $24.4 million in liquidations, with Ethereum at $15.16 million.

In the meantime, Bitcoin’s long-short ratio stays nearly equal, which reveals a short-term uncertainty available in the market’s route. Yesterday, Bitcoin lengthy positions dominated the charts at 54%.

Solana, XRP, and several other altcoins additionally skilled sharp volatility, reflecting heightened volatility throughout the board.

Most altcoins noticed a higher wipeout in lengthy positions, suggesting retail merchants have been caught off guard by the sudden coverage shift.

Rising concern over macro volatility

The US-China commerce deal earlier this month supplied a much-needed increase to the crypto market. It was a sign that the macroeconomic uncertainty is likely to be priced in. Nonetheless, Trump’s EU threats have injected renewed issues.

Analysts warn that the tariff announcement may very well be the beginning of broader financial disruption. European inventory indices fell sharply, and US tech shares additionally confronted promoting strain.

In crypto, the liquidation heatmap displays a market caught between downward worry and upward retracement makes an attempt.

The state of affairs is fluid. If the tariff menace escalates right into a full commerce dispute, threat belongings, together with cryptocurrencies, could face further headwinds. Merchants are watching carefully for any EU response or indicators of negotiation.

Previously 24 hours, 162,419 merchants have been liquidated, totaling $567.65 million. Whereas crypto has usually acted as a hedge throughout conventional market stress, as we speak’s strikes present it’s not proof against world coverage shocks.

Volatility could persist as geopolitical uncertainty mounts.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.