Cryptocurrency trade Coinbase is the topic of a newly filed class motion lawsuit. The lawsuit accuses the corporate and its high executives, together with CEO Brian Armstrong and CFO Alesia Haas, of delaying the disclosure of a serious information breach involving insider misconduct and failing to disclose severe regulatory violations within the firm’s UK operations.

It alleges that Coinbase’s lack of transparency round these incidents led to substantial monetary losses for stockholders and seeks compensation for the damages incurred.

Coinbase Faces Lawsuit After Inventory Value Drops

Investor Brady Nessler filed the lawsuit within the US District Court docket for the Jap District of Pennsylvania. The go well with represents shareholders who bought Coinbase inventory (COIN) between April 14, 2021, and Could 14, 2025.

The criticism alleges that Coinbase hid essential details about an information breach. BeInCrypto reported beforehand that Coinbase confronted a $20 million extortion try by cybercriminals who stole delicate buyer information, together with names, addresses, and identification particulars. The criminals bribed abroad help brokers to steal this information.

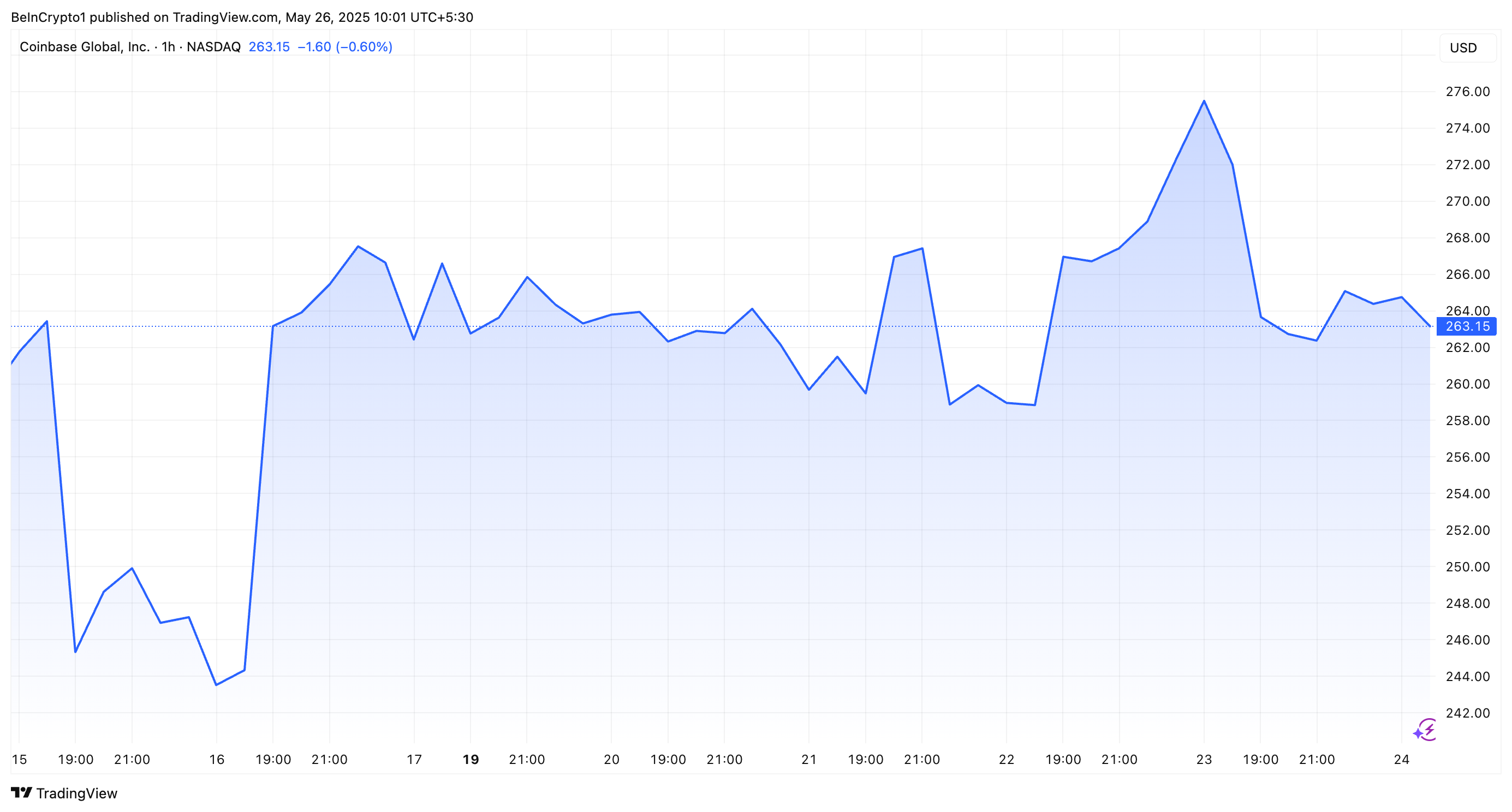

Nonetheless, the corporate burdened that the breach impacted “lower than 1%” of its month-to-month lively customers. In response to courtroom paperwork, the breach, found months earlier, was not disclosed till Could 15, 2025, following the extortion try. As a result of this revelation, COIN fell 7.2%, closing at $244 on the identical day.

“On account of Defendants’ wrongful acts and omissions, and the precipitous decline out there worth of the Firm’s widespread shares, Plaintiff and different Class members have suffered vital losses and damages,” Nessler claimed.

The lawsuit additionally highlights one other incident that negatively impacted inventory costs. On July 25, 2024, the UK’s Monetary Conduct Authority (FCA) publicly fined Coinbase’s UK subsidiary, CB Funds Ltd. (CBPL), £3.5 million (roughly $4.5 million) for breaching a 2020 regulatory settlement that prohibited onboarding high-risk clients.

The FCA revealed that CBPL had allowed 13,416 high-risk customers to entry its providers, enabling practically $226 million in crypto transactions regardless of being explicitly restricted. The lawsuit argues that Coinbase’s failure to reveal these regulatory points additional misled buyers in regards to the firm’s operational integrity.

“On this information, the value of Coinbase’s widespread inventory fell by $13.52 per share, or 5.52%, to shut at $231.52 on July 25, 2024,” the lawsuit learn.

The plaintiff is now requesting class certification and is looking for financial damages, reimbursement of authorized charges, and a jury trial. Coinbase has not but issued a public assertion on the Nessler lawsuit.

In the meantime, COIN managed to get well barely from its Could 15 lows. Nonetheless, Yahoo Finance information confirmed that on Could 23, Coinbase’s inventory misplaced 3.23% of its worth when the market closed. That interprets to a drop of $8.79, bringing the inventory worth all the way down to $263.1.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.