- BNB noticed a modest 2% worth enhance, backed by a spike in on-chain exercise, together with a 17% bounce in transaction charges and 13 million transactions processed in 24 hours.

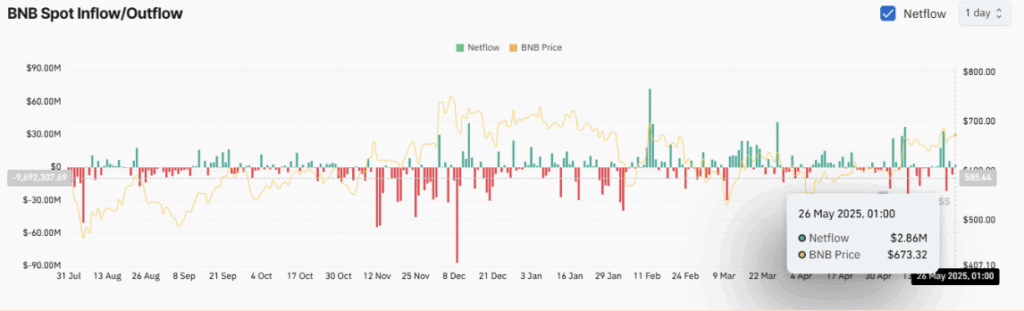

- Retail buyers stay cautious, promoting practically $2.9 million price of BNB, which can restrict additional positive factors regardless of sturdy community utilization.

- Futures and choices markets present bullish indicators, with excessive long-to-short ratios on Binance and OKX, and a 43% rise in choices quantity, pointing to potential upside if retail sentiment shifts.

BNB managed to notch a modest 2.02% achieve not too long ago, intently monitoring the broader crypto market’s 2.70% uptick. Not unhealthy, however whenever you peek beneath the hood, there’s extra happening than the value motion suggests. In accordance with CoinMarketCap, the altcoin index has climbed to 29%, setting a good backdrop. Nonetheless, BNB’s present development feels kinda underwhelming given what’s occurring on-chain.

Transaction Surge Fuels Hopes – However It’s Not So Easy

Over the past 24 hours, BNB utilization has popped off a bit. Community exercise? By means of the roof.

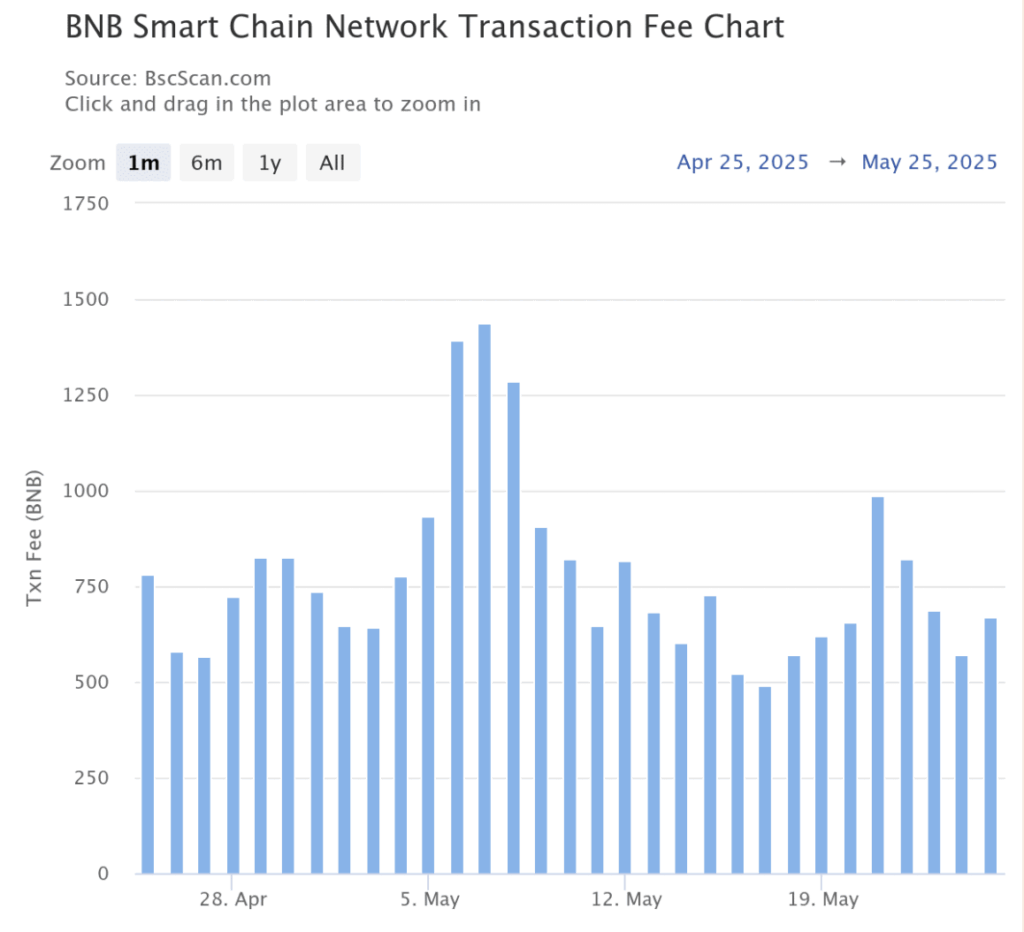

Transaction charges? Up 17%—about 671 BNB burned, price practically $451K on the time. Not too shabby. That spike in charges largely got here from an uptick in finalized transactions. The truth is, over 13 million of them had been wrapped up in a single day. That’s wild.

Now, if this pattern retains up, extra BNB might be put into circulation for transactional use. That’s often a recipe for worth appreciation… however there’s a catch.

Retail’s Not Enjoying Alongside – At Least Not But

Regardless of all this community exercise, retail merchants don’t appear too satisfied. AMBCrypto’s evaluate of Coinglass information confirmed spot buyers are leaning bearish. Like, $2.87 million price of BNB simply acquired dumped. That form of offloading doesn’t precisely assist upward momentum.

Retail gamers transfer markets greater than folks suppose, and in the event that they preserve pulling again, BNB’s rally would possibly hit a ceiling before bulls would really like.

Derivatives Say “Purchase,” Particularly On Binance and OKX

In the meantime, futures merchants are exhibiting a bit extra optimism—particularly on platforms like Binance and OKX. Their long-to-short ratios inform the story: 1.83 on Binance, 1.29 on OKX. Something above 1 = extra patrons stepping in.

High merchants on Binance, specifically, have saved issues bullish, holding a gentle 1.09 purchase quantity ratio. So, even with the broader derivatives market staying kinda flat, these indicators present bullish stress remains to be in play.

Choices Market Beginning to Buzz

Now right here’s the place it will get just a little extra attention-grabbing—choices. Within the final 24 hours, quantity jumped 43.57% to $721K. Open curiosity? Pushed previous the $10 million mark. That form of motion often indicators rising confidence. If this continues, it may assist push BNB out of its present hesitation zone.

Last Take

So yeah, BNB is climbing, however the worth is simply a part of the story. On-chain exercise is heating up, futures and choices merchants are getting daring—however until retail joins in, that rally would possibly stall out. In the event that they do hop again in although… issues may transfer quick.