Bitcoin has posted seven consecutive weeks of features, pushing its worth above $100,000. Nonetheless, new alerts recommend this bullish streak would possibly quickly finish.

Figuring out the exact second of a worth reversal is difficult. Nonetheless, sure indicators could point out rising dangers, notably for buyers who haven’t established robust positions but.

Two Indicators Point out Revenue-Taking Might Finish the 7-Week Rally

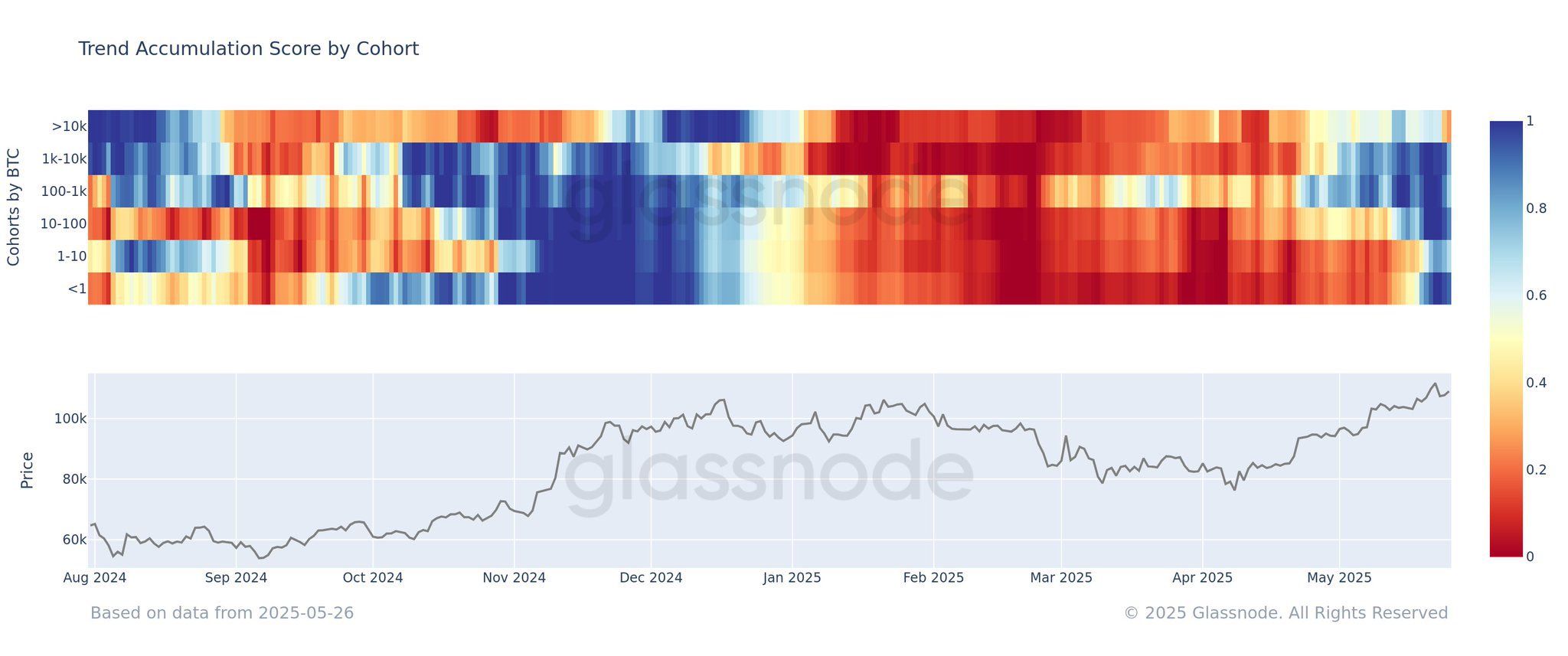

The primary notable signal is that wallets with giant balances have stopped accumulating and have began distributing their cash.

Glassnode information confirms this pattern. In Might, the buildup rating for wallets holding over 10,000 BTC dropped from round 0.8 to under 0.5. This shift is visually represented by a change in shade from blue to orange.

“The group of wallets holding essentially the most BTC has began distributing,” Thuan Capital acknowledged.

Moreover, wallets between 1 BTC and 10,000 BTC present weaker accumulation conduct, as seen via steadily fading blue tones. Solely wallets with lower than 1 BTC are exhibiting a transparent shift from distribution to robust accumulation, triggered by Bitcoin reaching a brand new all-time excessive.

These information factors replicate a profit-taking tendency amongst giant buyers. On the identical time, smaller retail buyers seem pushed by FOMO (concern of lacking out) as they chase short-term alternatives.

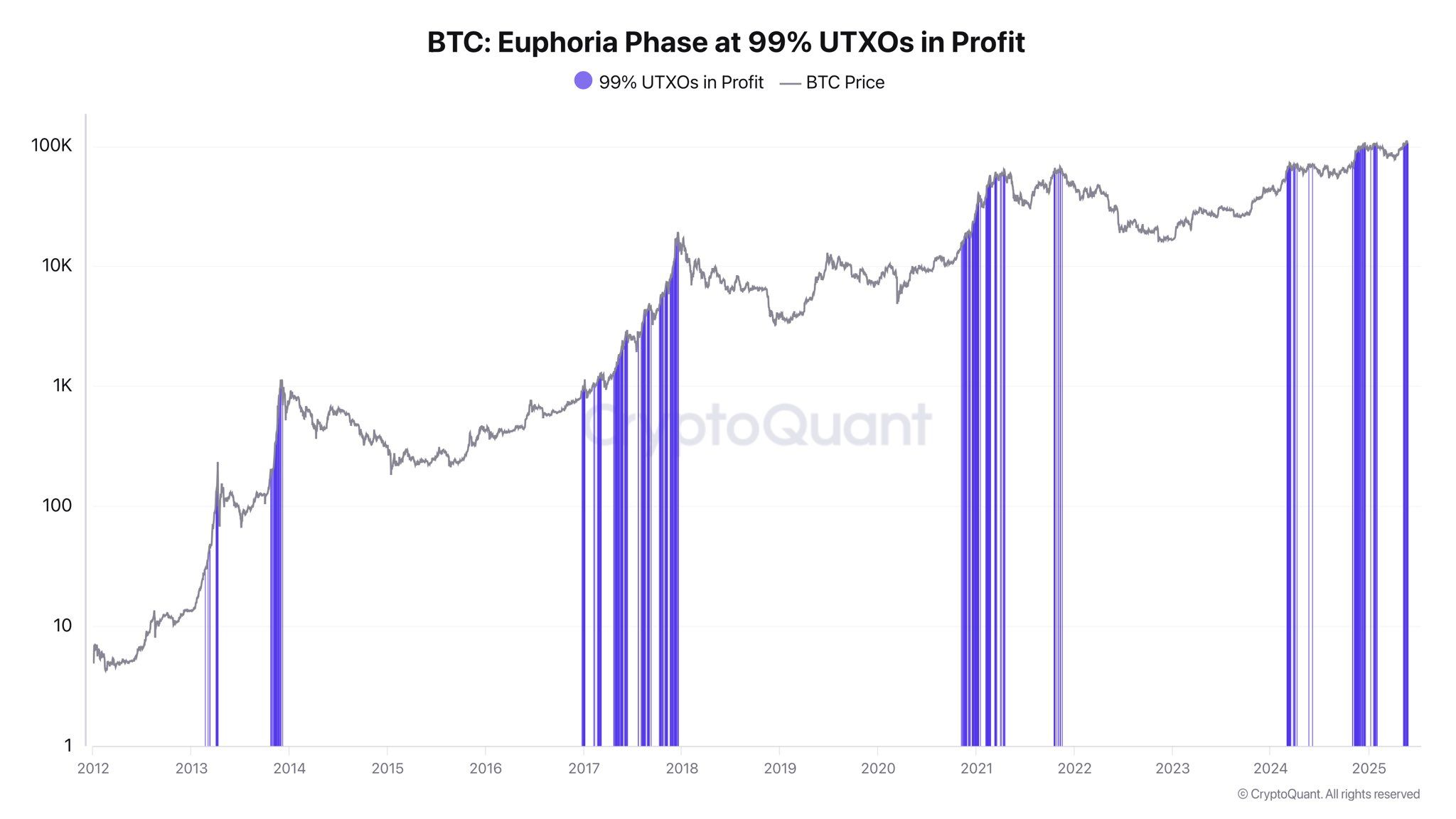

One other warning signal comes from Unspent Transaction Outputs (UTXOs). UTXOs are a technical mechanism that ensures every particular person BTC can solely be spent as soon as on the blockchain. Additionally they present a technique to consider unrealized revenue throughout all unspent BTC.

CryptoQuant information reveals that when 99% of UTXOs are in revenue, it often alerts a market overheating section. Traditionally, such phases usually precede worth corrections. Whether or not the correction is short- or long-term, this sign nonetheless highlights a rising threat for consumers.

“Proper now, it’s exhausting to say we’re in a euphoric section. The broader macroeconomic context and the uncertainty surrounding the Trump administration’s coverage route make it tough for buyers to flip totally risk-on. When this 99% sign drops, unrealized earnings shrink and may set off extra profit-taking and push latecomers to capitulate and promote at a loss,” analyst Darkfost stated.

As of now, Bitcoin’s rally has paused round $108,000. There are not any clear indicators of a correction but. BeInCrypto reviews a robust wave of Bitcoin accumulation amongst firms worldwide. Many consultants stay optimistic about Bitcoin’s future worth.

“A tidal wave of institutional demand is reshaping bitcoin’s market dynamics: Wealth‐administration platforms poised to roll out entry to bitcoin ETFs, company treasuries including bitcoin to spice up shareholder returns, and sovereigns diversifying reserves into bitcoin to hedge geopolitical threat. Collectively, these forces are making a structural provide/demand imbalance—and over the subsequent 18 months, bitcoin is about to cement its function as a worldwide retailer of worth,” Juan Leon, Senior Funding Strategist at Bitwise Asset Administration, instructed BeInCrypto.

Due to this fact, whereas these short-term indicators might trace at a pullback from present highs, they don’t appear to have an effect on analysts’ broader expectations for this yr and subsequent.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.