Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana is at the moment consolidating slightly below the $180 stage after a powerful rally, dealing with clear resistance as bulls try to keep up momentum. Whereas the general construction stays bullish, upward progress has stalled, and the market is coming into a extra cautious, tense section. Consumers are nonetheless in management, however they’re struggling to push SOL decisively via this key barrier, retaining the worth range-bound within the quick time period.

Associated Studying

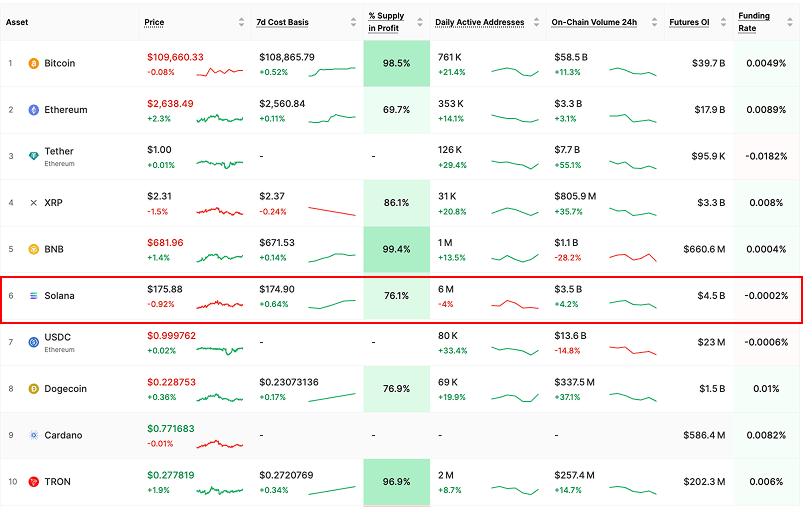

Including to the intrigue, new information from Glassnode reveals that Solana is the one prime 10 cryptocurrency (excluding stablecoins) with a damaging funding price. This might sign the early phases of short-side strain constructing within the derivatives market. Unfavourable funding means that merchants are more and more betting in opposition to the asset, at the same time as spot value motion holds comparatively agency.

This divergence between value consolidation and rising bearish positioning may act as a short-term catalyst if bulls regain momentum. Alternatively, it might trace at hesitation from merchants who see restricted upside within the fast time period. With sentiment on edge and key ranges in play, Solana’s subsequent transfer may set the tone for broader market conduct within the days forward.

Solana Faces Key Check After Rally

Solana is at a vital inflection level after gaining greater than 95% in worth since April. The explosive rally has pushed SOL again to a significant resistance zone, the place earlier provide has repeatedly capped upward momentum. Now, bulls should affirm the uptrend by pushing above this stage and establishing a brand new increased vary. A profitable breakout right here may solidify Solana’s bullish construction and set the stage for a transfer towards $200 and past.

Nonetheless, dangers stay. Whereas Solana has outperformed most prime belongings in current weeks, some analysts warn that the broader crypto market could also be approaching a short-term correction. With Bitcoin consolidating close to its all-time highs and macroeconomic situations tightening, any draw back strain may drag altcoins—together with Solana—decrease earlier than continuation.

Including to the uncertainty, Glassnode shared a notable information level displaying that Solana is at the moment the one prime 10 crypto asset (excluding stablecoins) with a damaging funding price. At -0.0002%, it’s a small shift, however one that will sign the early phases of bearish positioning amongst futures merchants. Unfavourable funding signifies that quick sellers are paying to carry their positions, probably indicating rising skepticism about short-term upside.

This divergence between bullish spot efficiency and delicate bearish sentiment in derivatives may arrange a high-stakes transfer. If bulls can take up the strain and flip resistance into help, Solana may enter a contemporary value discovery section. But when promoting intensifies and funding stays damaging, a deeper pullback could also be on the horizon. For now, SOL is at a key determination level—and the subsequent transfer may set the tone for the weeks forward.

Associated Studying

SOL Approaches Resistance As Weekly Construction Turns Bullish

Solana (SOL) is at the moment buying and selling at $175.68 on the weekly chart, consolidating slightly below the $180 resistance zone. After a powerful rebound from April’s lows close to $90, SOL has gained over 95% and is now approaching a vital stage that has traditionally acted as a provide zone. The current bullish momentum is notable, with three consecutive inexperienced weekly candles and value now buying and selling above the 34-week EMA at $164.82—a stage that beforehand capped upside makes an attempt.

The 50-week SMA at $169.48 has additionally been reclaimed, reinforcing the energy of the present transfer. Quantity stays regular, suggesting purchaser conviction remains to be intact as SOL pushes into this resistance zone. The subsequent key take a look at lies in whether or not bulls can break and shut above the $180–$185 space, confirming a structural breakout and opening the door for a possible retest of the $200–$220 vary.

Associated Studying

Failure to reclaim this zone may result in short-term consolidation or a light pullback towards the 34 EMA or 50 SMA. Nonetheless, the present development favors bulls, with increased lows and stronger weekly closes indicating sustained accumulation. If broader market situations stay secure, Solana appears poised to try a breakout within the coming weeks.

Featured picture from Dall-E, chart from TradingView