- Whales Are Staking Massive: A brand new pockets staked over 19,800 SOL, exhibiting long-term confidence, however the market hasn’t reacted a lot but.

- Liquidations and Warning Flags: Lengthy liquidations spiked to $6.1M whereas shorts stayed low, suggesting that overleveraged bulls are being punished and additional draw back danger stays.

- Key Resistance at $193: SOL struggles to interrupt previous $193; momentum is fading, outflows are outweighing inflows, and until that stage flips, worth motion is more likely to stay uneven or head decrease.

A freshly created pockets made waves not too long ago after pulling 20,009 SOL (about $3.53 million) from Binance and staking practically all of it. Roughly 19,875 SOL was staked instantly, and one other 134 SOL received despatched to a distinct staking handle, which now holds a complete of over 9,270 SOL—roughly $1.6 million. Whereas this type of heavy staking screams long-term conviction, the market’s been… kinda quiet about it. No main response, no fireworks.

Nonetheless, the transfer suggests there’s some under-the-surface perception in SOL’s future. However perception isn’t sufficient—broader market circumstances nonetheless have to click on into place earlier than bulls get something to have fun.

Lengthy Liquidations Surge—A Bull Entice in Disguise?

On Could 25, lengthy merchants took a nasty hit—about $6.1 million in lengthy liquidations have been recorded throughout main platforms, in comparison with simply $326K on the brief facet. Ouch. Binance alone accounted for nearly half, with $2.76 million in lengthy positions flushed out.

This sort of lopsided motion normally pops up in overheated markets or alerts a attainable correction. It both marks the ultimate shakeout earlier than a bounce… or the beginning of extra ache. Both manner, the message is evident: warning is warranted should you’re nonetheless holding longs hoping for a rocket journey.

Sentiment Stays Bullish, However At What Price?

Regardless of the slap from liquidations, practically 69% of Binance merchants are nonetheless lengthy on SOL, with an extended/brief ratio of two.22. That’s plenty of hopium.

However excessive bullish skew like this will really backfire. If SOL retains dragging or dips once more, extra longs might get worn out. That’s the chance—when optimism isn’t backed by momentum, corrections might be brutal. Proper now, dealer sentiment is likely to be somewhat too assured for consolation.

$193: The Line within the Sand

At press time, SOL’s worth hovered round $172.34, nonetheless shy of the $193 Fib resistance stage. The Relative Power Index (RSI) has dropped to 61.87, exhibiting that momentum is cooling, though bulls nonetheless have a slight edge.

If SOL reclaims $193 with quantity, we might see a push towards $229. But when it will get rejected once more? The market would possibly simply keep caught—or worse, begin heading again down.

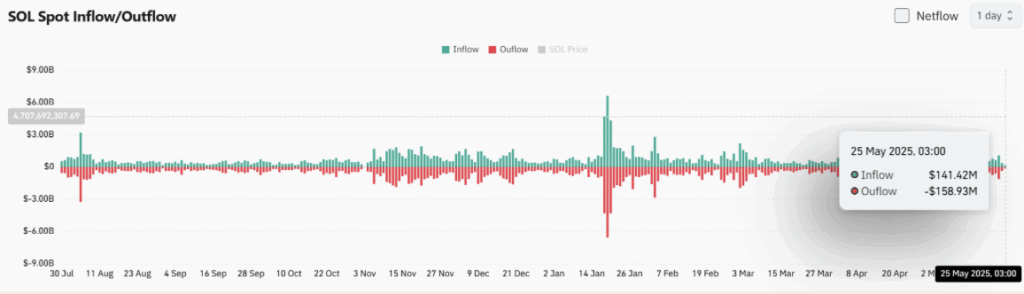

Web Outflows Nonetheless Dominate, Elevating Pink Flags

Even with all of the whale staking buzz, spot market information exhibits outflows outweighing inflows. On Could 25, SOL noticed $158.93M in outflows vs. $141.42M in inflows—a web destructive.

This tells us that, regardless of some massive gamers doubling down, the broader market remains to be exiting or trimming positions. Till inflows begin to outpace outflows persistently, SOL’s worth motion would possibly keep below stress.

Remaining Ideas: Is Solana Prepared or Not?

Solana’s received some robust long-term alerts—like whales staking massive and regular improvement below the hood. However short-term indicators are shakier: large lengthy liquidations, web outflows, and a cussed resistance wall at $193.

If SOL can flip that resistance with some conviction (and possibly just a few fats inflows), the bulls would possibly get their second. Till then, count on extra chop… possibly much more draw back if the leveraged longs preserve getting squeezed.