- SUI leads in market cap, adoption, and TVL, boasting $11.9B market cap and $1.6B locked in DeFi, with robust institutional backing and integrations like USDC and VanEck.

- SEI focuses on pace and compatibility, utilizing Cosmos SDK and supporting EVM/CosmWasm, making it simpler for Ethereum and Cosmos builders to undertake.

- Technically, SUI affords a novel object-based structure, whereas SEI builds on acquainted buildings with area of interest progress in buying and selling apps and potential upside from a key help zone.

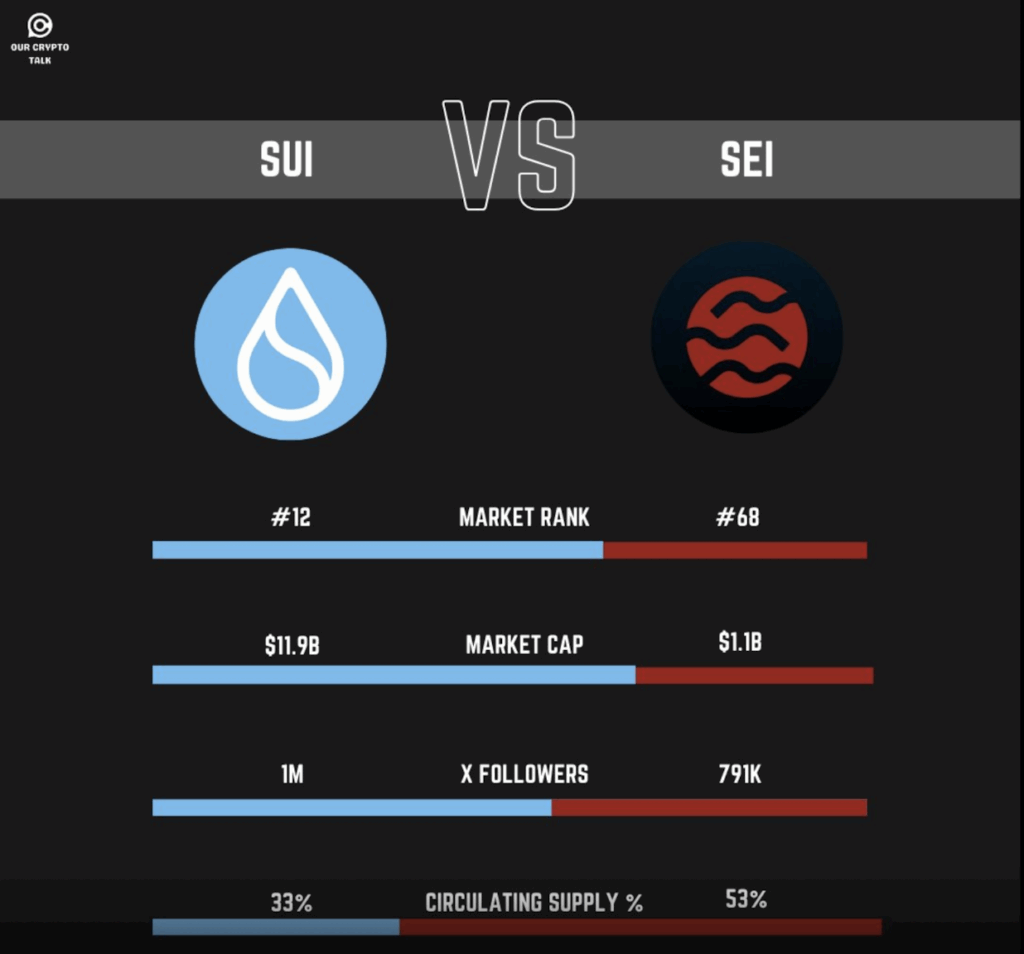

Alright, let’s discuss SUI and SEI—two up-and-coming blockchains doing massive issues however in very other ways. Information pulled from Our Crypto Speak paints a fairly clear image: SUI’s sitting up excessive at #12 with a fats market cap of $11.9 billion. In the meantime, SEI? It’s holding onto #68 with about $1.1 billion. Not precisely a detailed race.

SUI additionally wins in terms of group numbers. It’s acquired a strong 1 million followers on X (previously Twitter), whereas SEI trails a bit at 791K. However right here’s the place issues flip a little bit—SEI’s acquired extra of its tokens in circulation, about 53%, in comparison with SUI’s 33%. That’s extra liquidity on SEI’s aspect, which some merchants like for apparent causes.

Beneath the Hood: Radical vs. Refined

Now for the nerdy half. SUI goes laborious on innovation—it ditches the traditional account-based construction and rolls with an object-based system as an alternative. This lets it course of tons of easy transactions in parallel, which is a elaborate method of claiming: it’s quick. Sub-second finality? Yep. That’s because of one thing known as Narwhal + Mysticeti. Appears like SUI is gunning for every thing—DeFi, NFTs, gaming, RWAs… you identify it.

SEI’s method is a little bit totally different, however no much less cool. It’s constructed on Cosmos SDK and focuses on pace and efficiency, particularly for buying and selling. Twin-Turbo Consensus retains finality tremendous snappy, and it’s the primary chain to rock a local central restrict order e-book for DeFi. The latest V2 improve introduced in SeiDB and higher parallel execution too. Mainly, SUI is new tech all-around, whereas SEI is about turbocharging one thing already confirmed.

Dev Life: New Language vs. Acquainted Instruments

For devs, SUI would possibly really feel like leaping into the deep finish—it makes use of Sui Transfer, a Rust-based language that’s safe however not precisely beginner-friendly. Nonetheless, over 1,400 devs are constructing on it every month. No EVM compatibility, although, so Ethereum tasks gotta do some rewriting.

SEI, then again, performs good with each EVM and CosmWasm. So in the event you’re already constructing on Ethereum or Cosmos, SEI’s method simpler to undertake. They’ve even acquired a $10M dev incentive fund and IBC baked in, making cross-chain stuff much less of a headache.

Charts, Buying and selling, and What’s Subsequent

SEI’s chart—shared by Michaël van de Poppe—reveals it holding a key help zone after a dip. Merchants are eyeing this spot as a base for the “subsequent leg up.” RSI’s impartial, quantity’s regular, and patrons appear to be quietly stepping in. It’s a wait-and-see vibe proper now.

Then again, SUI’s numbers are wild. $1.6B locked in DeFi, $265M common every day DEX quantity, and partnerships with massive names like USDC, VanEck, and Phantom Pockets. It’s diving into all of the sectors—RWAs, NFTs, gaming… the works.

Remaining Ideas: Huge Toolbox vs. Sharpened Blade

SEI’s narrower however targeted. It’s doing nicely within the buying and selling area of interest with Vortex and DragonSwap. TVL is $492M, and so they’re rising in gaming too, because of Galxe and the Creator Fund. And since it’s Cosmos-native, it’s acquired that cross-chain edge out of the field.

SUI appears like a multi-tool—bold, wide-reaching, and constructed for every thing. SEI? Extra like a precision scalpel, tremendous tuned for pace and buying and selling. Each are strong, simply relies upon what sort of blockchain taste you’re after.