Knowledge exhibits Bitcoin has outperformed the key fairness indices on the Sortino Ratio. Right here’s what this says in regards to the cryptocurrency’s efficiency.

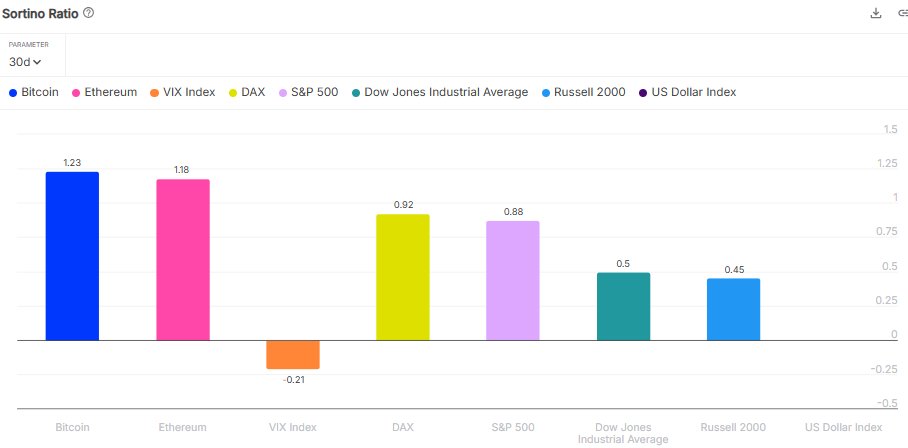

Bitcoin’s 30-Day Sortino Ratio Is At present At 1.23

In a brand new publish on X, the institutional DeFi options supplier Sentora (previously IntoTheBlock) has talked in regards to the Sortino Ratio of Bitcoin. The “Sortino Ratio” is an indicator that’s much like the Sharpe Ratio, which compares the returns of an asset in opposition to its volatility.

The Sharpe Ratio takes the “volatility” or the danger concerned with the asset as the usual deviation of returns over a given interval. Notice that the indicator doesn’t differentiate between constructive and destructive returns. That is the place the Sortino Ratio differs.

The Sortino Ratio takes solely the usual deviation of the destructive returns, aiming to seize simply the ‘dangerous’ volatility. In consequence, the metric’s worth tells us how the returns of an asset stack up in opposition to the draw back threat related to it.

Now, right here is the chart shared by the analytics agency, displaying how the 30-day Sortino Ratio seems to be for Bitcoin in addition to different property and indices:

The metric's worth appears to be the very best for BTC in the intervening time | Supply: Sentora on X

As is seen within the above graph, the Sortino Ratio of Bitcoin has just lately stood at 1.23, which means the asset’s returns over the previous month have outweighed its draw back volatility.

It’s additionally obvious that the identical has been true for Ethereum and the indices listed within the chart as effectively, however clearly, BTC has come out on high in comparison with all of them. The one one which comes shut is ETH, a fellow cryptocurrency, with its metric sitting at 1.18.

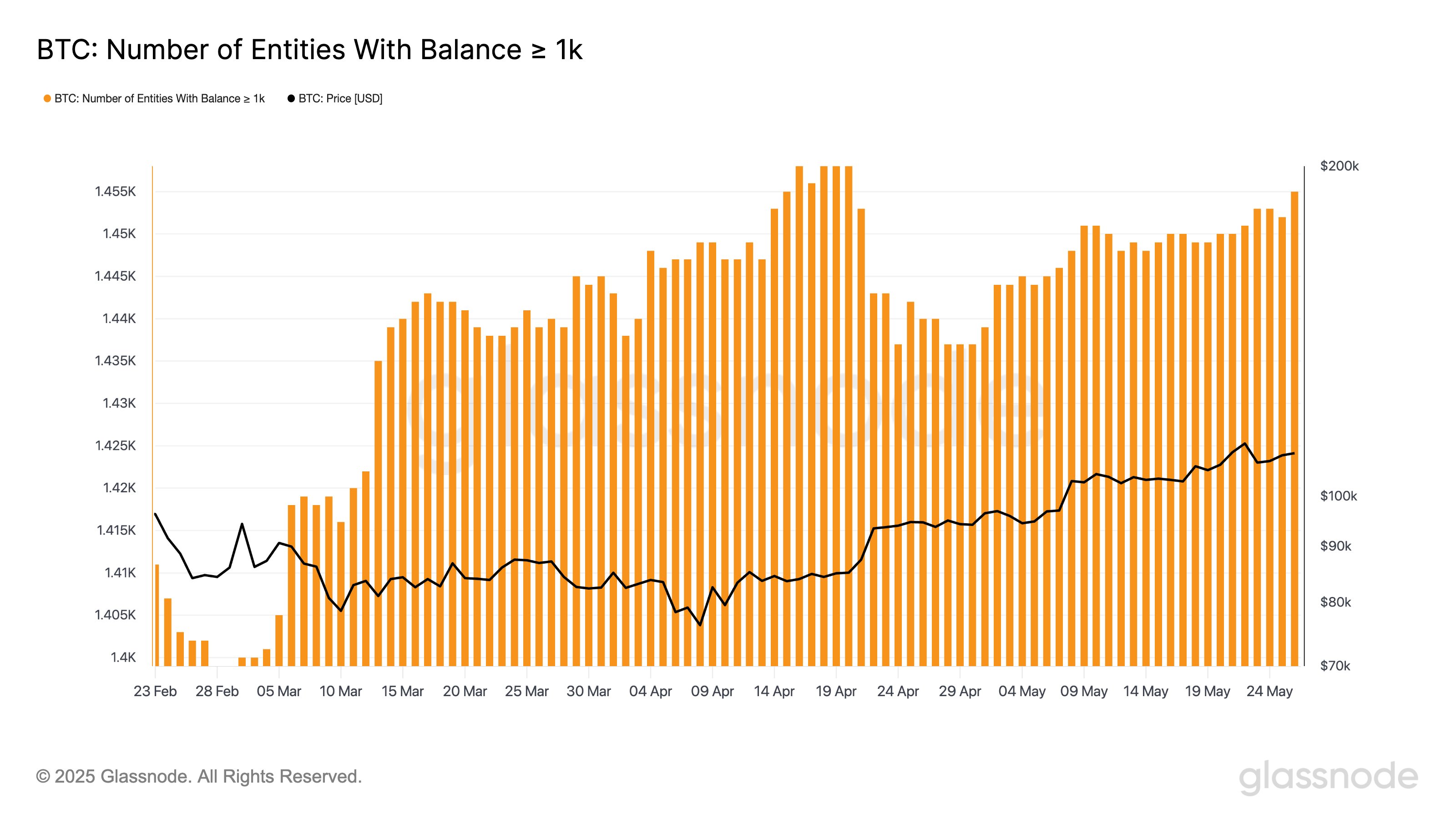

In another information, the whale inhabitants on the Bitcoin community has resumed development just lately, because the on-chain analytics agency Glassnode has shared in an X publish.

“Whales” within the context of BTC seek advice from the entities holding 1,000 or extra cash. Here’s a chart that exhibits the development within the variety of traders of this dimension who exist on the blockchain:

Seems just like the indicator took successful final month | Supply: Glassnode on X

As displayed within the chart, the variety of whale-sized Bitcoin traders noticed a part of decline in April, an indication that among the big-money traders exited from the cryptocurrency.

This month, nevertheless, the metric resumed an uptrend and has continued to go up even with the asset’s value hitting a brand new all-time excessive (ATH). At current, there are 1,455 whale entities on the blockchain.

Notice that ‘entities’ right here don’t merely seek advice from particular person addresses carrying 1,000 or extra BTC. Relatively, an ‘entity’ is a cluster of addresses that the analytics agency has decided to belong to the identical investor by way of its evaluation.

BTC Value

On the time of writing, Bitcoin is floating round $109,700, up 3% during the last seven days.

The development within the BTC value in the course of the previous 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.