Japanese “Bitcoin-first” agency Metaplanet simply lifted its treasury to 7,800 BTC (≈$842 million) after a $50 million buy. It has now overtaken El Salvador as Asia’s largest company holder.

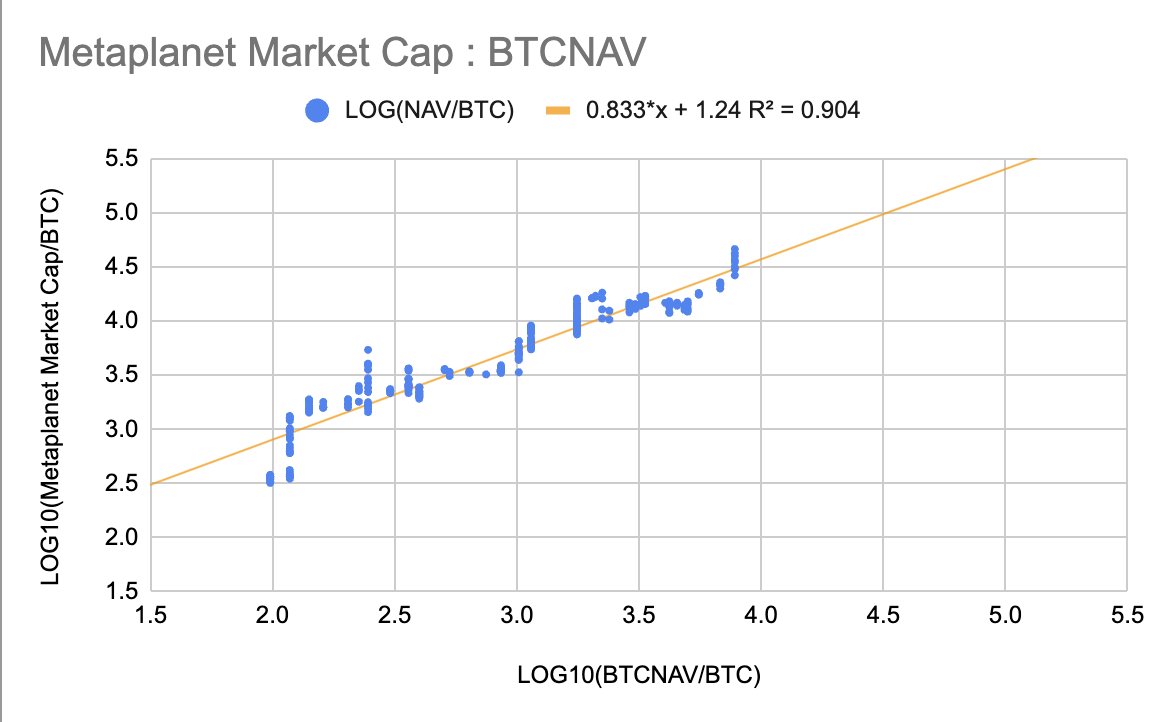

On X, Metaplanet investor TakaAnikuni utilized a power-law match that hyperlinks an organization’s BTC-denominated Internet Asset Worth (BTC NAV) to its fairness market cap:

mNAV ≈ e[(0.89 – 1) ln (BTC NAV) + 4.11]

For right this moment’s stack, the mannequin outputs an mNAV a number of of three.75-4.0, whereas Metaplanet’s web site quotes 3.25, implying the inventory trades 15-20 % beneath power-law “truthful worth”. The desk he printed reveals the a number of compressing as holdings scale, mirroring Technique’s trajectory, the place measurement dampens premium.

Why it issues:

- Re-rating potential. Even with a number of compression, doubling BTC each two months, as Metaplanet has since January, tasks ≈15 okay BTC by early August, which the mannequin pegs at a still-healthy mNAV ~3.5, lifting implied fairness worth ~40 %.

- Gasoline within the tank. Metaplanet continues to situation bonds and warrants to finance buys, signalling administration is dedicated to the buildup flywheel.

- Retail froth verify. After a 1,560 % Y/Y rally, the share closed right this moment at ¥1,222, but the mannequin suggests room earlier than froth units in.

Backside line: Anikuni’s framework provides a quantifiable undervaluation thesis and a useful lookup desk that would resonate with each fairness and crypto-native audiences as Metaplanet races towards five-digit BTC holdings.

The put up Bitcoin Energy-Legislation mannequin factors to 40% achieve in Metaplanet inventory – Right here’s why appeared first on CryptoSlate.