Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin (BTC) continues to commerce close to its current all-time excessive (ATH) of $111,980, exercise on main crypto exchanges means that institutional buyers could also be strengthening their BTC holdings. Most notably, Coinbase – the main US-based crypto trade – recorded a web outflow of seven,883 BTC, elevating hypothesis about renewed institutional demand and a possible continuation of the rally.

Coinbase Sees 7,883 Bitcoin Outflow

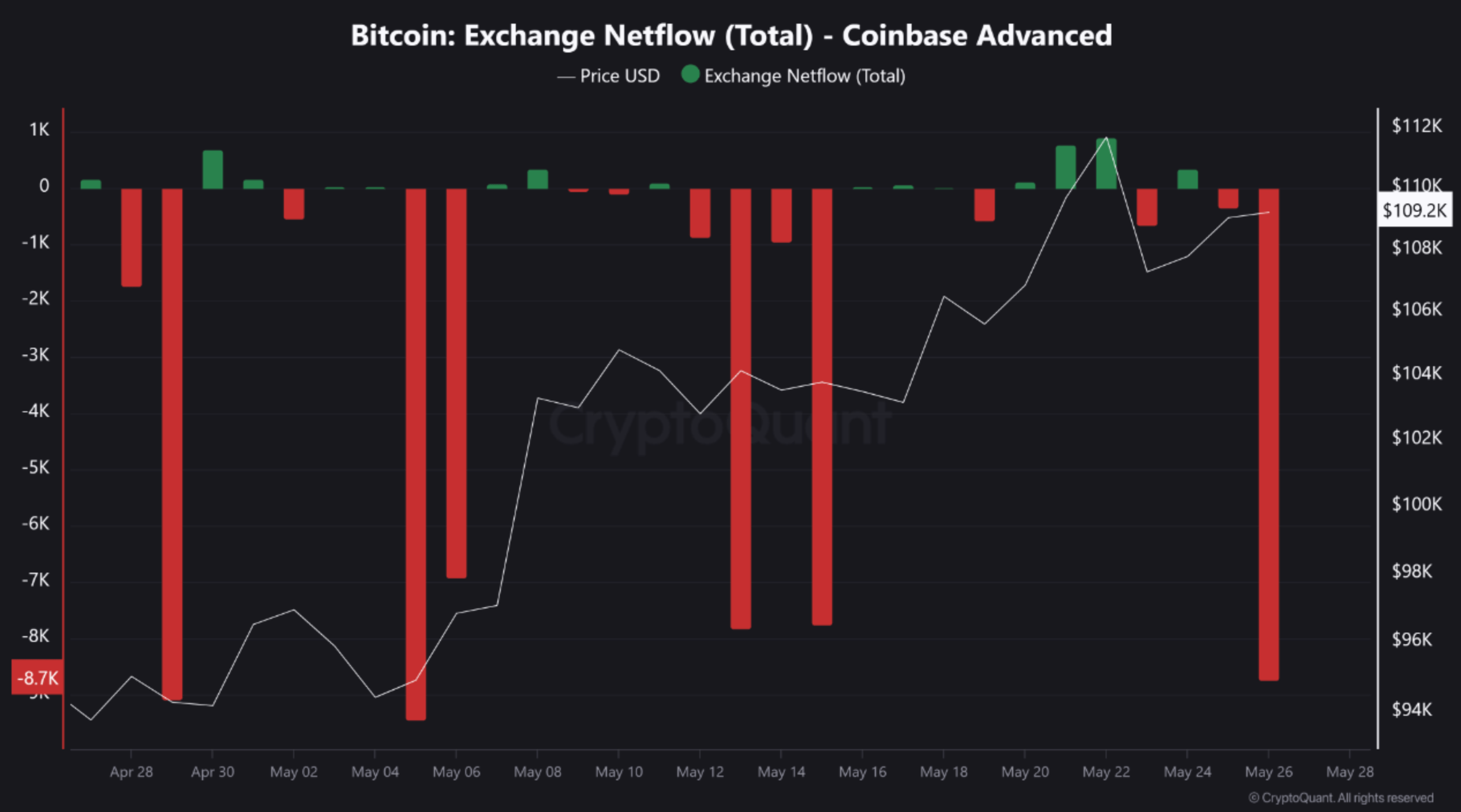

Based on a current CryptoQuant Quicktake submit by contributor burakkemeci, Coinbase skilled a every day outflow of 8,742 BTC on Might 26. After accounting for BTC deposits, the online outflow stood at 7,883 BTC – marking the third-largest single-day BTC outflow from the trade prior to now month.

For the uninitiated, every day BTC outflow refers back to the whole quantity of Bitcoin withdrawn from an trade inside a day, whereas web outflow is the distinction between BTC withdrawn and deposited – exhibiting the precise web motion of funds. A constructive web outflow means extra BTC left the trade than entered, usually signaling accumulation.

Associated Studying

Traditionally, massive BTC outflows from Coinbase are sometimes adopted by institutional bulletins or spot Bitcoin exchange-traded fund (ETF) inflows. Since all US-listed spot Bitcoin ETFs – besides Constancy’s – supply their BTC from Coinbase, the dimensions of this transaction suggests potential ETF involvement or a company acquisition.

One probably candidate is Technique, led by Michael Saylor. The corporate just lately disclosed a purchase order of seven,390 BTC, bringing its whole holdings to 576,230 BTC. Saylor has additionally hinted at one other massive acquisition, though solely time will inform whether or not the most recent Coinbase outflows are related to the agency.

Supporting this institutional narrative is the Coinbase Premium Index, which has remained constantly constructive over the previous month. This metric displays stronger shopping for stress from US-based buyers, usually linked to institutional demand. The analyst concluded:

These outflows mirror sustained demand from U.S.-based establishments. If this urge for food continues, it might lay the groundwork for an additional leg up in Bitcoin’s worth. Particularly when fueled by ETF inflows, such strikes can result in sharp worth breaks and new highs.

New BTC ATH Quickly?

On the time of writing, Bitcoin is buying and selling at $109,589, simply 1.9% under its all-time excessive. Nonetheless, a number of on-chain and technical indicators recommend that BTC may quickly break into uncharted territory.

Associated Studying

CryptoQuant contributor ibrahimcosar just lately famous that Bitcoin could also be concentrating on the $112,000 mark after forming a double backside sample on the hourly chart. In the meantime, the Bitcoin Spot Taker CVD (Cumulative Quantity Delta) has flipped again to constructive, signaling bullish momentum.

Furthermore, on-chain metrics present that holders are not speeding to promote, even whereas sitting on important unrealized beneficial properties, suggesting perception in additional worth appreciation. At press time, BTC trades at $109,589, down 0.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com