Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Unbiased market technician EGRAG CRYPTO posted an up to date weekly XRP/USD chart on X. The visible, constructed on Bitfinex information, frames the complete post-July 2024 advance by XRP because the flag-pole of a traditional bull-flag continuation sample and argues that the next ten-week drift has traced out a near-textbook, downward-slanted consolidation channel whose higher and decrease rails are highlighted in magenta.

XRP Poised For Breakout

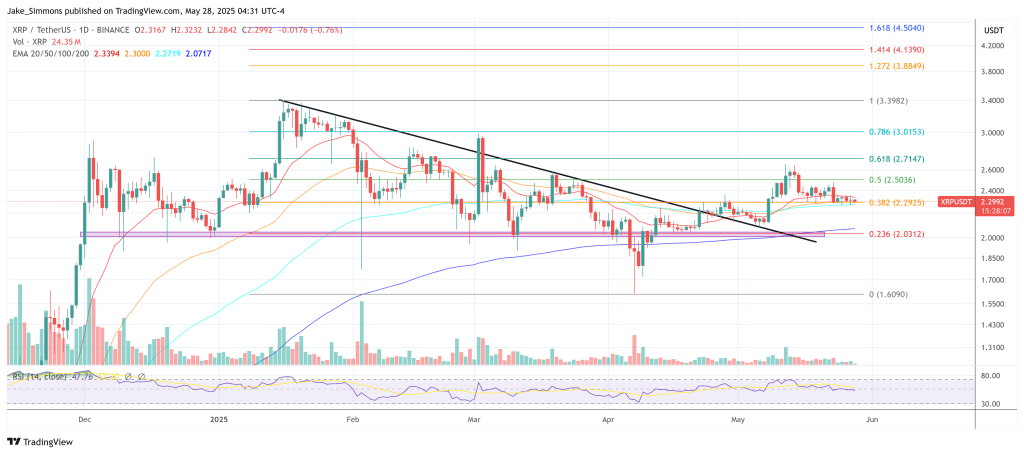

“The success fee of breaking upwards is round 67–70 p.c,” the analyst writes, citing bulk pattern-recognition research that underpin the set-up’s statistical edge. XRP is buying and selling close to $2.30, a price marked on the chart by a blue dotted horizontal line intersecting the physique of the flag.

Associated Studying

Beneath that, a white line at $1.50 data the late-2024 breakout shelf that now capabilities as first higher-time-frame help, whereas a deeper pink horizontal at roughly $0.60 flags the bottom from which the present cycle started. Threading up via the complete construction is a rising yellow transferring common—visually in keeping with the 20-week EMA (at present at $2.21)—underscoring what Egrag calls the market’s “still-positive long-term development bias.”

From that basis the technician derives three measured-move goals. “For long-term breakouts I want logarithmic charts, particularly in crypto, due to its exponential progress over brief intervals,” he defined. On that foundation a log-scale projection extrapolates the total peak of the flag-pole and lands at $18.00. A linear projection, which treats every greenback of advance equally, prints a markedly decrease $5.50. Taking what he describes as a “liquidity-adjusted common — my most well-liked technique for crypto targets,” Egrag settles on $11.75.

Associated Studying

As a result of digital-asset order books stay comparatively skinny, the analyst overlays a variability band of fifteen to twenty p.c, stretching the log goal to roughly $20.70–$21.60, the typical to $13.51–$14.10 and the linear to $6.33–$6.60. “I often apply a 15–20 p.c variability as a result of crypto liquidity remains to be smaller in comparison with legacy markets, so targets can prolong each methods,” he cautioned.

A disclaimer printed straight on the graphic reiterates that the numbers and targets are “for simulation functions solely and never monetary recommendation.” Even so, the roadmap is evident for Egrag: as long as XRP defends the mid-flag zone close to $2.30 and, critically, the structural pivot at $1.50, the technician contends that an eventual breakout may vault the token into double-digit territory, with the headline log goal sitting simply beneath the psychologically resonant $20 deal with.

At press time, XRP traded at $2.28, nonetheless hovering just under the higher trendline of the bull flag. A detailed above the resistance may speed up the XRP worth shortly in direction of the 0.5 and 0.618 Fibonacci retracement ranges at $2.50 and $2.71 respectively.

Featured picture created with DALL.E, chart from TradingView.com