- GameStop’s inventory dropped over 16% in two days after revealing a $512M Bitcoin buy.

- Buyers seem cautious regardless of the agency following Technique’s Bitcoin treasury playbook.

- CEO Ryan Cohen stated future BTC strikes received’t be telegraphed, leaving buyers guessing.

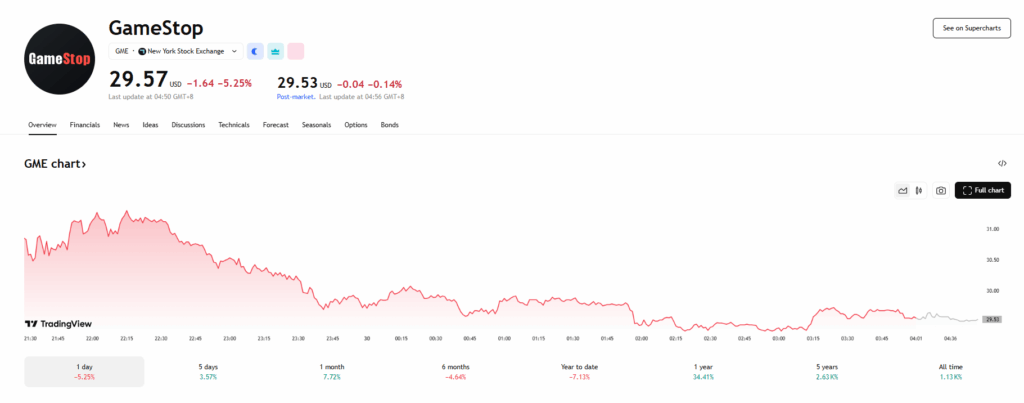

GameStop simply made its largest crypto transfer but—dropping over half a billion {dollars} into Bitcoin. However as a substitute of rallying behind the daring play, the inventory’s tanked for the second day in a row. On Thursday, GME slid greater than 5% to shut at $29.57, tacking on to Wednesday’s 11% drop. No matter pleasure was there on the open—when the inventory touched almost $36—vanished fairly quick.

It’s not the primary time GameStop’s seen this type of rollercoaster round Bitcoin information. Again in March, GME spiked after it first teased the thought of a BTC treasury. Then it dropped simply as rapidly when the corporate stated it could increase $1.5 billion to fund it—quite than utilizing money available. That raised eyebrows. Now, with the acquisition finalized—4,710 BTC for round $512 million—buyers appear… unimpressed.

The Market’s Shifting, Simply Not With GameStop

Whereas GME slid, the broader market was trying higher. The Nasdaq and S&P 500 each closed up about 0.4%, as merchants chewed on information of a commerce courtroom delay on Trump-era tariffs and a weaker-than-expected GDP studying. So it’s not like GameStop was sinking with the ship—the market, on the whole, was doing positive.

In the meantime, Bitcoin itself isn’t precisely hovering both. After setting a recent all-time excessive at $111,814 on Could 22, it’s drifted downward, now sitting just below $106K. Not horrible, however not serving to GME’s narrative both. Different main cryptos like Solana, XRP, and Dogecoin are down more durable over the previous week, whereas Ethereum’s been holding up comparatively nicely.

Ryan Cohen’s Not Giving Away the Playbook

Talking on the Bitcoin 2025 convention on Wednesday, GameStop CEO Ryan Cohen saved issues obscure. He stated the corporate isn’t going to “name our pictures prematurely” concerning any future BTC purchases. That may be sensible technique—however it’s not giving buyers a lot to carry onto.

GameStop’s transfer mirrors what companies like Technique (previously MicroStrategy) have executed—go all-in on Bitcoin as a company treasury asset. Technique’s strategy has pushed its inventory to new highs and impressed loads of copycats. However for now, GameStop’s model of the playbook isn’t getting the identical response.

It’s nonetheless early. But when GME’s hoping its crypto pivot will reignite meme-stock magic, this week’s market response suggests it’s bought some convincing to do.