Bitcoin has skilled a large rally over the previous month, marking a brand new all-time excessive (ATH) at $111,980. This vital worth surge has raised questions concerning the sustainability of Bitcoin’s momentum shifting into June.

Whereas some traders are optimistic about additional positive factors, others are questioning if the value will quiet down or if Bitcoin holders will take a extra cautious path.

Bitcoin Traders Purchase Closely

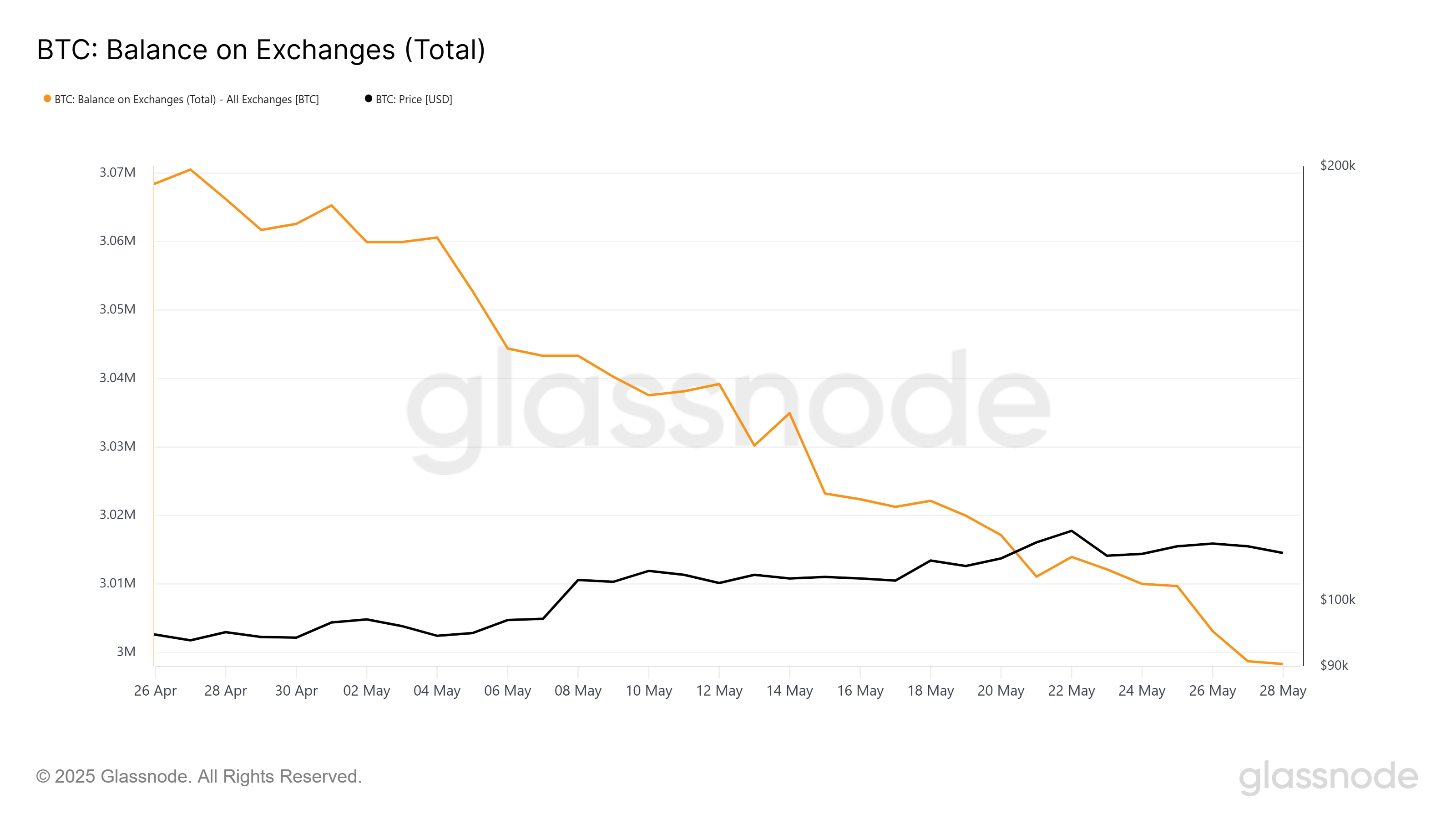

Bitcoin’s market sentiment is presently pushed by sturdy accumulation. The stability on exchanges has dropped by 66,975 BTC, value over $7.2 billion, indicating that traders are shifting their holdings off exchanges and into personal wallets. This vital decline in accessible Bitcoin on exchanges suggests rising belief within the asset and perception in additional worth will increase.

The buildup is partially pushed by FOMO (worry of lacking out), as new traders rush in, however additionally it is backed by a rising conviction in Bitcoin’s long-term potential. Nevertheless, Juan Pellicer, VP of Analysis at Sentora, not too long ago mentioned with BeInCrypto how elements past easy accumulation have influenced Bitcoin’s worth surge.

“Traders’ willingness to achieve for threat this spring has been formed by a good set of macro currents which can be all shifting in a “looser-financial-conditions” route without delay. Inflation is gliding down, central-bank easing is again on the desk, actual yields and the greenback are slipping, international liquidity is increasing, and financial spigots stay large open. These forces have lifted all threat belongings, Bitcoin included, and so they additionally clarify why BTC’s worth has been strongly correlated to the S&P 500 by Could,” Pellicer famous.

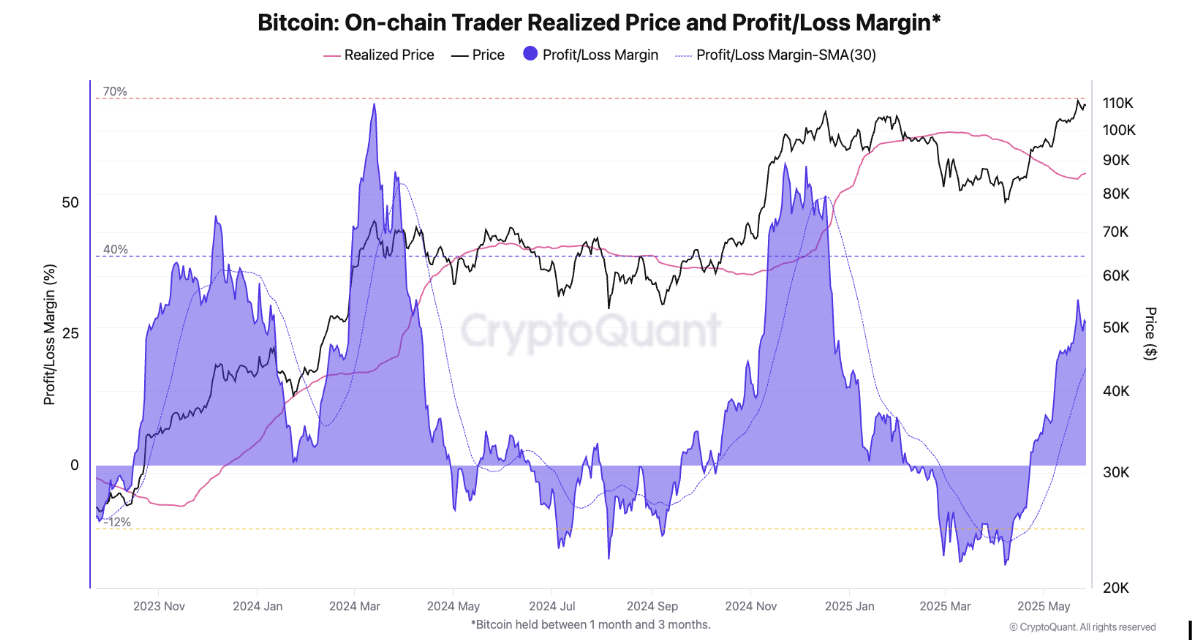

On-chain information reveals key indicators that recommend Bitcoin’s macro momentum stays sturdy. The On-chain Dealer Realized Worth and Revenue/Loss Margin have been spiking, signaling that Bitcoin traders, particularly those that purchased 1 to three months in the past, are sitting on vital unrealized income. This information helps gauge investor habits and signifies that many are nonetheless holding, anticipating additional worth rises.

Julio Moreno, Head of Analysis at CryptoQuant, mentioned with BeInCrypto how the rising income amongst these short-term holders may threaten Bitcoin.

“Within the brief time period, there might be some revenue taking from merchants as their unrealized revenue margins are approaching overheated ranges round 40%. See the chart the place we estimate the On-chain revenue margin of Bitcoin merchants reaching 31% prior to now few days (purple space),” Moreno said.

BTC Worth Goals At A New Excessive

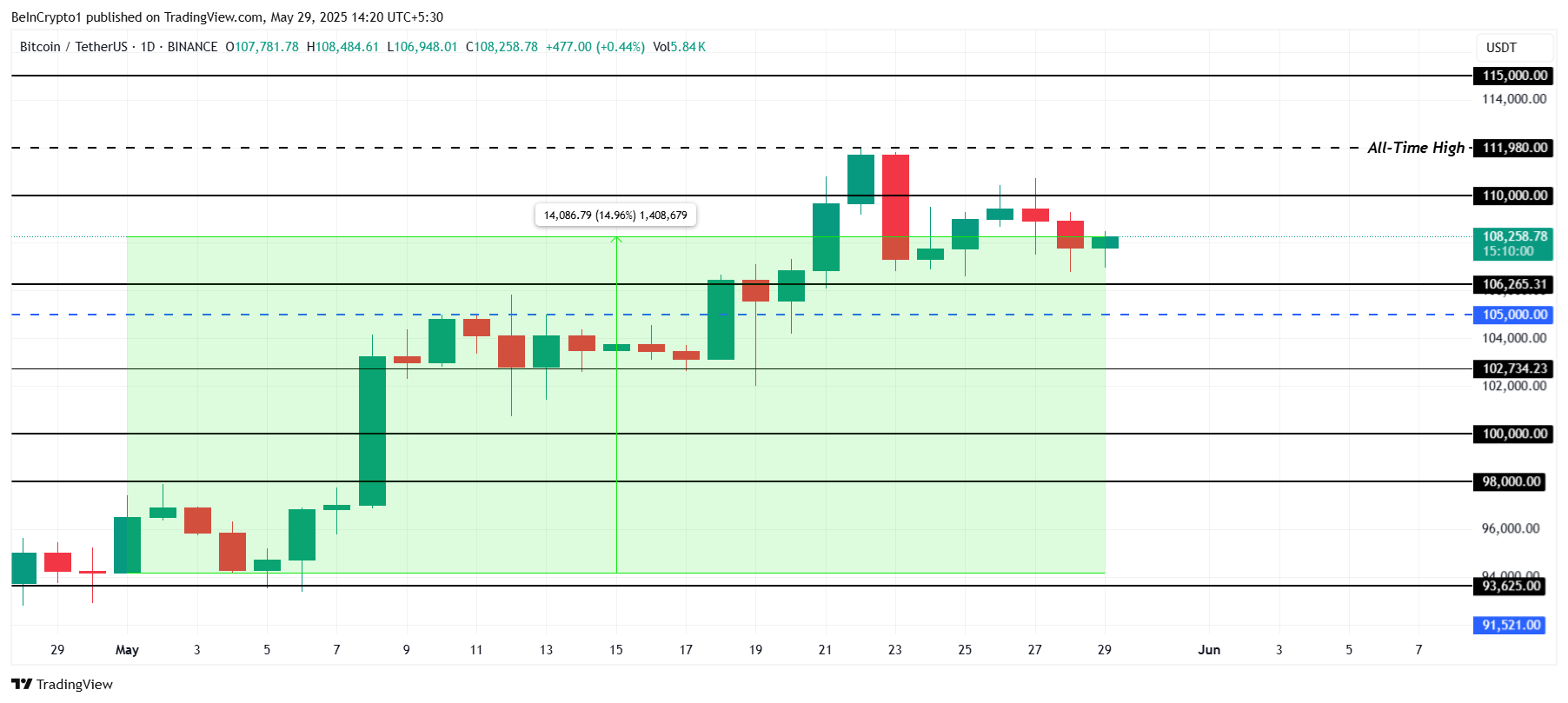

Bitcoin’s worth surged by 14% all through Could, reaching a brand new all-time excessive of $111,980. At the moment buying and selling at $108,258, Bitcoin is testing the $110,000 resistance stage. The following few days will likely be essential in figuring out if Bitcoin can maintain its momentum.

If the buildup by the hands of institutional and retail holders continues in June, the value may preserve its uptrend.

Moreover, the “Promote in Could and go away” technique has confirmed ineffective for inventory markets over the previous 12 months, with markets persevering with to rise regardless of the seasonal development. Bitcoin’s correlation with inventory markets, significantly in gentle of macroeconomic circumstances, suggests it could proceed to expertise upward momentum by June. Given Bitcoin’s resilience, it’s more likely to push increased even amid broader market uncertainty.

Bitcoin’s worth may finally breach $110,000, establishing it as a strong assist stage earlier than pushing previous the ATH to focus on $115,000. Nevertheless, if profit-taking intensifies, Bitcoin could expertise a correction. Whereas a pointy downturn appears unlikely, Bitcoin may face some consolidation earlier than persevering with its upward development, with assist ranges at $102,734 and $106,265 offering a buffer.

The publish What To Count on From Bitcoin (BTC) Worth In June? appeared first on BeInCrypto.