- XRP is pushing for institutional dominance with over 100 monetary companions, whereas Stellar is focusing on the underbanked with grassroots monetary instruments.

- Stellar’s open-source method and $3B tokenization objective intention to reshape entry to world finance from the bottom up.

- Whereas XRP leads in adoption and market cap, XLM’s smaller measurement and mission-driven focus supply excessive upside for long-term believers.

For those who’ve been watching crypto for greater than a minute, you already know XRP isn’t simply one other random token floating round within the altcoin sea. It’s been one of many key contenders within the race to overtake world finance—and Ripple’s pushing that imaginative and prescient onerous. Their objective? Change the sluggish, costly, middleman-heavy system of worldwide banking with one thing sooner, cheaper, and far more fashionable. XRP, constructed on the XRP Ledger, acts because the go-between for currencies around the globe, chopping down cross-border switch instances from days to actually seconds. And whereas it’s had its fair proportion of authorized and regulatory complications, the momentum is beginning to swing in its favor once more.

Now that we’re in mid-2025, Ripple’s community of companions is large—over 100 monetary establishments throughout the globe, from banks in Japan to remittance providers in South America. The world is lastly beginning to catch as much as what XRP has been quietly constructing all alongside. And with new updates, contemporary partnerships, and bullish market indicators rolling in, XRP isn’t simply again within the highlight—it may be able to make a severe play for dominance.

XLM Needs to Financial institution the Unbanked—And It’s Simply Getting Began

Stellar’s story is rooted in accessibility. It was co-founded by Jed McCaleb—yep, the identical man who helped launch Ripple—after a philosophical fallout about how blockchain ought to be used. Whereas Ripple veered towards banks and enterprise-level finance, Stellar went grassroots. The mission? Construct infrastructure for individuals who don’t have entry to conventional banking techniques. Suppose growing nations, migrant employees, and underbanked communities. It’s a giant imaginative and prescient, and Stellar’s making actual strikes.

With its personal protocol—SCP, or the Stellar Consensus Protocol—Stellar affords blazing-fast transactions for virtually no price. Its native asset, Lumens (XLM), performs a key function in serving to cash transfer throughout borders quick. And it’s not only for crypto nerds: NGOs, authorities packages, and fintech apps are all utilizing Stellar to maneuver cash globally, particularly for remittances and micro-transactions. The Stellar Improvement Basis is doubling down too, aiming to onboard $3 billion in tokenized belongings by the tip of 2025.

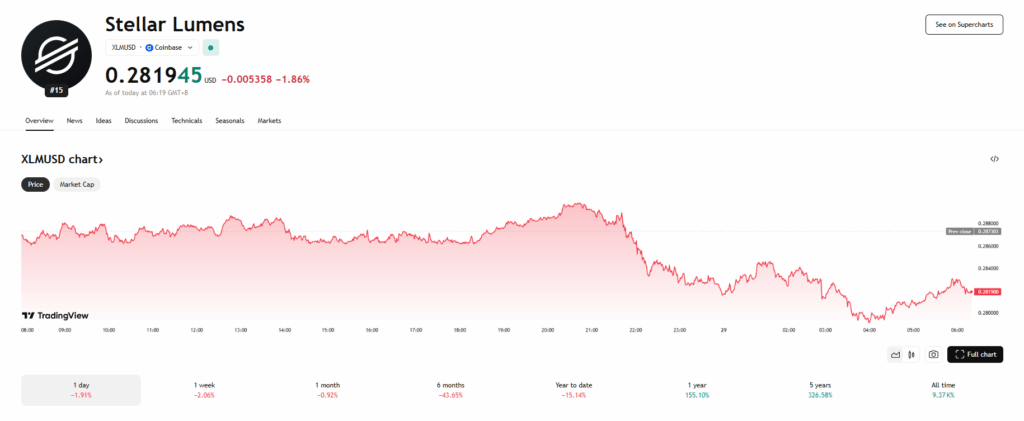

Value-wise? XLM hasn’t blown the roof off currently, sitting at round $0.28 regardless of Bitcoin ripping larger. However fundamentals don’t at all times present up within the value straight away—and Stellar’s constructing one thing that might flip the script when the following adoption wave hits.

Ripple vs. Stellar: Identical Roots, Completely Totally different Paths

To actually perceive the stress—and potential—between XRP and XLM, you’ve received to have a look at their shared origin. Jed McCaleb helped launch Ripple however bailed after disagreements about how the corporate ought to function and the way XRP ought to be dealt with. In 2014, he co-founded Stellar with a brand new mission: monetary inclusion as an alternative of monetary overhaul.

Whereas Ripple’s all about enjoying good with banks, Stellar’s constructing the longer term for individuals who’ve by no means even had a checking account. And that elementary distinction is mirrored in all the things they do—from partnerships to code construction. Ripple’s gone extra non-public and permissioned, making it simpler for establishments to plug in. Stellar’s gone full open-source, constructing a public good that anybody can entry. Two visions. Two playbooks. Identical finish objective: repair the damaged world monetary system.

What Units Stellar Aside—And Why It Issues

Ripple and Stellar could have began in the identical lab, however at present they’re enjoying very totally different video games. Ripple needs XRP to be the lubricant for the present monetary machine—working with central banks, compliance departments, and legacy infrastructure. Stellar? It’s constructing a wholly totally different machine.

Stellar is bottom-up. It companions with fintech startups, humanitarian orgs, and builders who wish to create instruments for the plenty. It’s not about changing SWIFT—it’s about bypassing it fully. Stellar’s blockchain is public, decentralized, and simple to construct on. That’s why it’s been adopted by initiatives centered on tokenizing real-world belongings (RWAs), powering remittances, and creating programmable cash that’s quick and low cost.

And don’t sleep on their tokenization recreation. Their objective to convey $3 billion in RWAs on-chain by yr’s finish isn’t simply bold—it’s doubtlessly game-changing. That target actual utility units Stellar aside in a market filled with hype cash and damaged guarantees.

XRP and XLM Transfer Collectively—However They’re Not the Identical

Within the wild world of crypto charts, XRP and XLM are type of like shadow twins. When one pumps, the opposite normally follows. It’s been that approach because the early days. Whether or not it’s investor psychology, shared tech roots, or simply behavior, they’ve been linked within the minds—and portfolios—of many merchants.

Take the 2017 bull run: XRP exploded 35,000% and XLM wasn’t far behind with a 28,000% rally. Even in 2025, when Bitcoin begins to run, XRP and XLM normally catch a chunk of the motion. Retail merchants usually deal with XLM like a “low cost XRP,” betting on it to observe go well with.

However let’s be clear—they’re not the identical asset. Ripple’s pushing huge institutional offers. Stellar’s leaning into humanitarian and fintech use. That hole in technique is sure to develop wider, and in the future quickly, it might break their value correlation. So yeah, they nonetheless transfer in sync… for now.

XRP Dominates in Scale—However XLM Nonetheless Has Room to Run

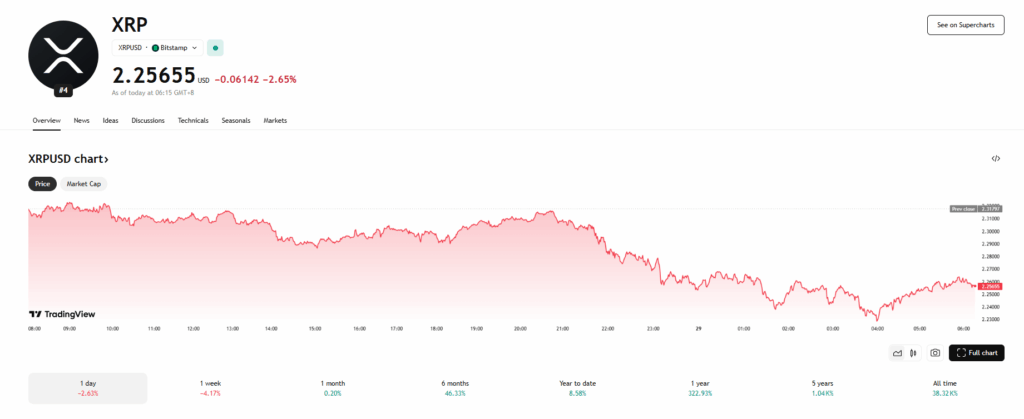

If we’re speaking uncooked adoption and visibility, XRP’s clearly out in entrance. Mid-2025 numbers put its market cap round $55 billion, versus XLM’s $8 billion. That’s a giant hole. Ripple has enterprise muscle. It’s signed offers with central banks, helped check digital currencies (CBDCs), and gotten cozy with regulators in key areas like Japan and the Center East.

XLM? It’s carved a extra mission-driven lane. It’s utilized by NGOs, pilot initiatives with the UN, and low-fee remittance apps. But it surely hasn’t seen the identical flood of institutional cash. But.

And that “but” is vital. Smaller market cap = larger upside. If a single killer use case lands for Stellar—like a significant authorities tokenizing billions in belongings on-chain—it might ship XLM flying. So whereas XRP has the institutional edge, XLM’s potential isn’t priced in but.

Which Is the Higher Funding—XRP or XLM?

Ah, the million-dollar query: must you go together with XRP or XLM? Truthfully, it relies on your vibe as an investor. Need institutional publicity, regulatory readability, and one thing that’s already confirmed itself in the actual world? XRP’s most likely the safer play.

However for those who’re the type of investor who likes uneven upside and bets on long-term social influence, XLM has severe attraction. Particularly for those who imagine tokenized belongings and monetary inclusion are the following huge wave. Plus, if XRP will get overheated, a few of that cash nearly at all times trickles into XLM.

Sensible traders? They’re watching each. Holding each. Pivoting as wanted. As a result of this area strikes quick—and being early issues greater than being good.

XRP or XLM? Perhaps the Reply Is Each

So, ultimate ideas: XRP’s the heavy hitter. XLM’s the underdog with a mission. They’ve received shared DNA however completely totally different outlooks. One needs to work with the system. The opposite needs to construct a brand new one. Each are legit contenders within the combat to modernize cash as we all know it.

Which one must you again? Truthfully… possibly each. Diversification exists for a purpose. And when crypto strikes, it strikes quick. The secret is staying knowledgeable, watching the basics, and driving the wave when it comes. And if these two initiatives preserve executing? The wave may be nearer than you suppose.