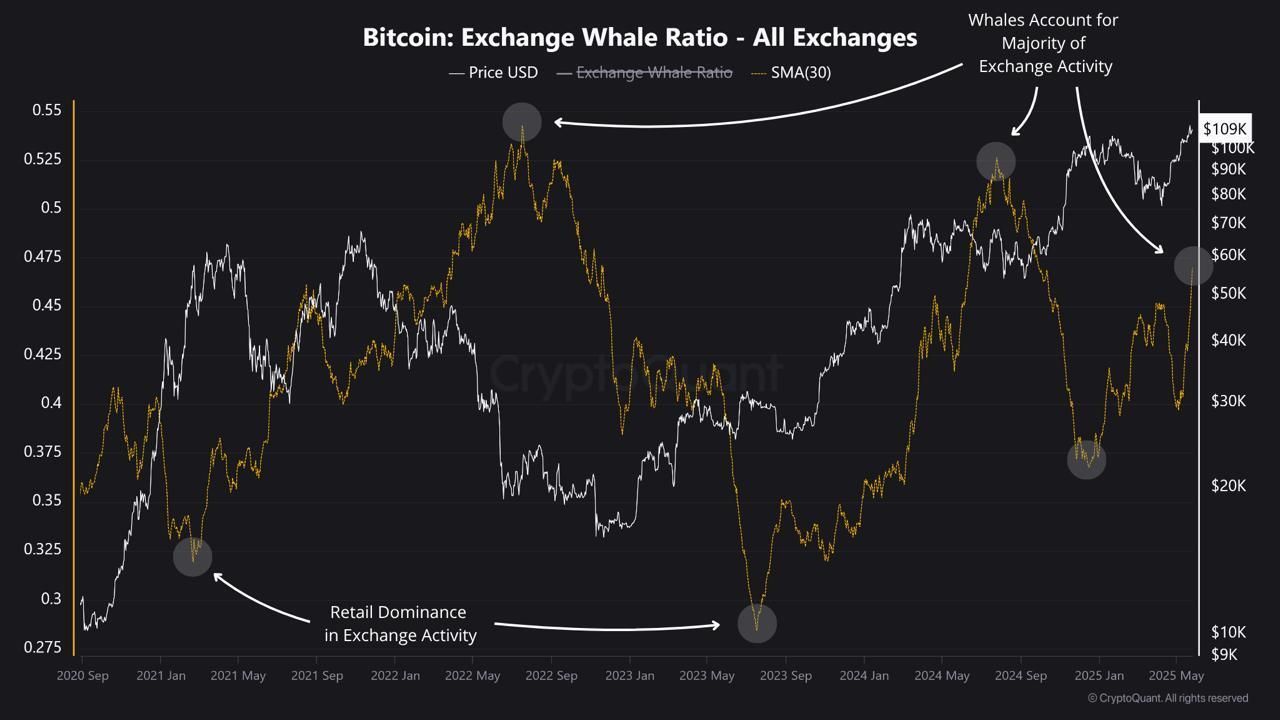

Bitcoin whales are regaining dominance over trade exercise. The Trade Whale Ratio’s 30-day shifting common has surged to 0.47—its highest stage in seven months—indicating that just about half of all BTC inflows to exchanges at the moment are coming from the biggest transactions.

Traditionally, such spikes in whale exercise have preceded main market tops, as massive holders have a tendency to maneuver funds in preparation to promote. With retail participation fading and whale affect rising, the market could shift right into a distribution part, elevating the danger of a short-term correction.

Is a Deeper Bitcoin Crash Coming?

Bitcoin just lately surpassed $111,000, making new all-time highs. But, profit-taking from whales and one other potential macroeconomic downturn has prompted BTC to drop over 6%, and it’s at present buying and selling at $104,000.

Knowledge from CryptoQuant reveals a pointy rise within the Trade Whale Ratio, suggesting warning.

Traditionally, when this ratio exceeds 0.5—indicating that whales account for almost all of trade inflows—worth tops usually comply with.

The Trade Whale Ratio measures how a lot of all Bitcoin flowing onto exchanges comes from the ten largest transactions. A 30-day shifting common at 0.47 means practically half of each BTC deposit is a “whale” transaction.

This sample performed out throughout earlier market cycles, similar to mid-2022 and late 2024, when elevated whale exercise coincided with important corrections.

The implication is that enormous holders have a tendency to maneuver funds to exchanges in anticipation of promoting, usually at or close to native peaks.

In distinction, intervals when the whale ratio dips under 0.35 have usually marked phases of accumulation or early bull market momentum, dominated by retail individuals.

One clear instance is mid-2023, when the ratio hit a low level and Bitcoin started to climb steadily afterward.

“There’s a rising dominance of enormous holders in current trade exercise. This sharp improve mirrors the surge seen within the Trade Whale Ratio throughout Bitcoin’s worth rally in late 2023 and early 2024,” CryptoQuant analyst JA Maartunn informed BeInCrypto.

The present spike within the 30-day shifting common of the ratio additional reinforces the notion that whales are as soon as once more turning into extra lively in trade exercise.

If historical past repeats, important whale promoting may set off a pullback or elevated volatility.

Whereas Bitcoin worth stays robust for now, this shift in behavioral dynamics suggests the market could also be transitioning from accumulation to distribution, growing the likelihood of a near-term high or correction.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.