Zebec Community (ZBCN) has surged a powerful 440% over the previous 30 days, making it one of many best-performing altcoins available in the market. Regardless of the current cooling in momentum indicators, ZBCN continues to carry bullish territory, supported by sturdy technical constructions.

Whereas short-term consolidation is feasible, ZBCN continues to be positioned for potential upside continuation if resistance ranges are cleared with conviction.

ZBCN Uptrend Nonetheless Holds

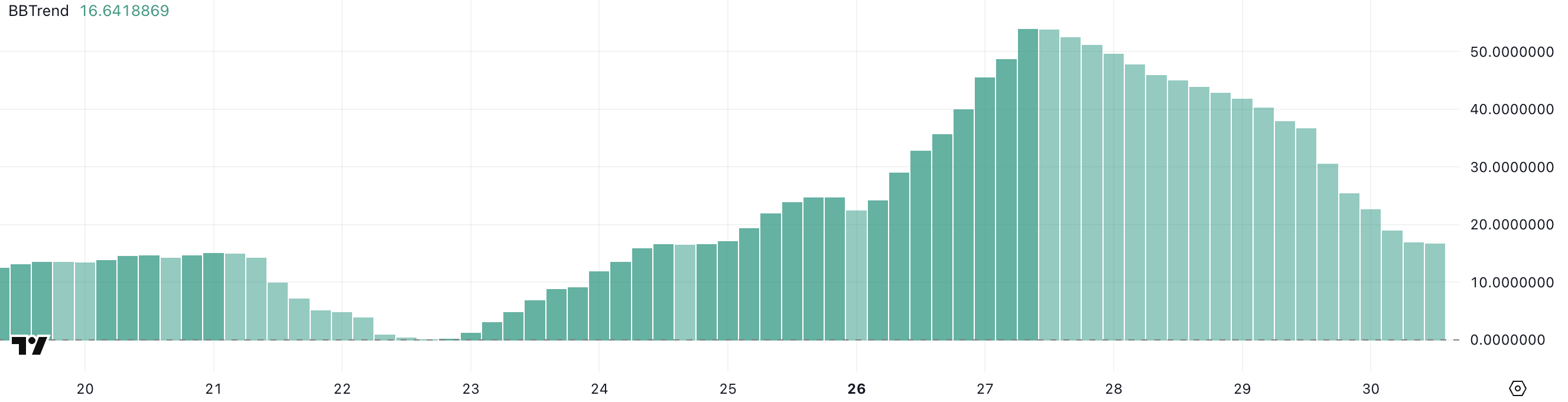

Zebec Community’s BBTrend indicator at the moment stands at 16.64, sustaining optimistic territory for the previous 13 consecutive days—an indication of sustained bullish momentum.

Simply three days in the past, the BBTrend peaked at 53.9, indicating heightened volatility and robust directional energy at the moment. Whereas the present studying is considerably decrease, it nonetheless displays a continuation of upward pattern situations, albeit with a potential slowdown in momentum.

The truth that BBTrend stays above zero after practically two weeks suggests the uptrend is undamaged, although bulls could also be taking a breather after the current surge. ZBCN is up greater than 106% simply within the final seven days, making it one of many best-performing altcoins of the final weeks.

The BBTrend, or Bollinger Band Pattern, measures the energy and course of worth actions by analyzing the unfold between the Bollinger Bands. When BBTrend is above zero, it usually signifies an uptrend, and the upper the worth, the stronger the directional momentum.

A studying under zero would recommend bearish situations. Zebec Community’s BBTrend at 16.64 implies that the asset continues to be in bullish territory, however with lowered energy in comparison with earlier within the week.

If the BBTrend continues to say no, it might sign pattern exhaustion or a possible consolidation section earlier than the subsequent main transfer. Conversely, a rebound would affirm that bullish strain is rebuilding.

ZBCN Bullish Momentum Slows, however Draw back Strain Nonetheless Minimal

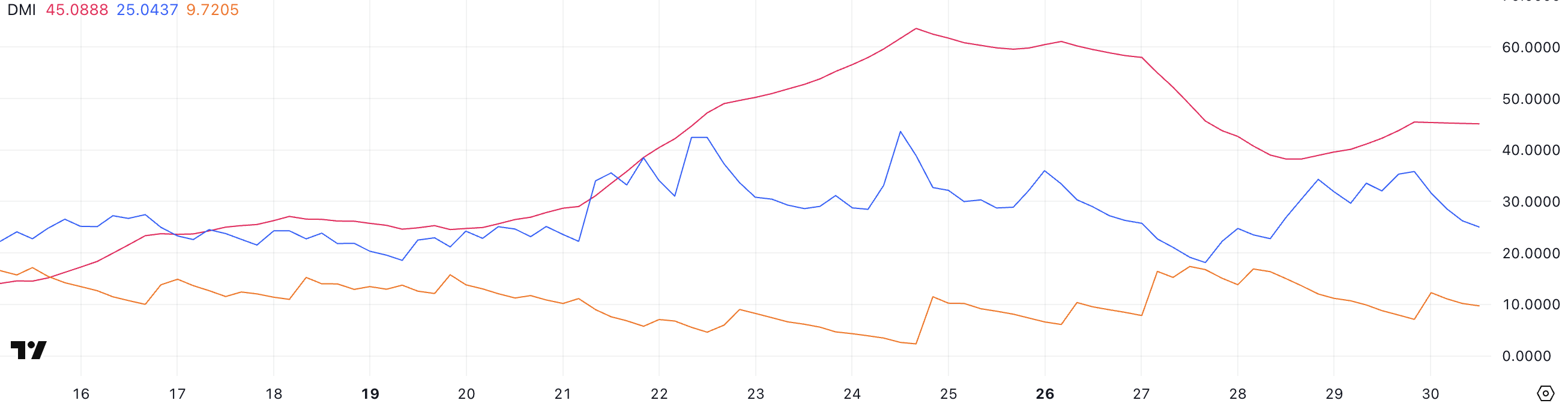

Zebec Community’s DMI chart reveals that its ADX is at the moment at 45, indicating a powerful pattern, although barely down from the 57.9 peak recorded three days in the past.

After a drop to 38.2 two days in the past, the ADX has stabilized, suggesting that whereas the energy of the pattern might have cooled from its peak, it stays firmly intact.

The ADX, or Common Directional Index, measures the energy of a pattern no matter course—values above 25 sign a powerful pattern, and readings above 40 point out very sturdy pattern momentum.

Zebec’s present ADX studying of 45 implies that the continuing pattern nonetheless has vital traction available in the market.

Supporting that pattern bias, the +DI line—which tracks bullish momentum—is at 25, although it has slipped from 35.8 the day earlier than. In the meantime, the -DI stays low at 9.7, just about unchanged from yesterday, exhibiting that bearish strain stays minimal.

The mix of a powerful ADX and a +DI that also considerably outweighs the -DI means that Zebec Community’s worth might stay in an uptrend, even when bullish depth has quickly cooled.

If +DI stabilizes or begins to climb once more, it might point out that consumers are regaining energy; nevertheless, if it continues to fall whereas ADX declines, it’d sign a possible shift towards consolidation or a weakening of bullish momentum.

Zebec Community EMA Construction Stays Bullish as Worth Eyes Breakout

Zebec Community’s EMA construction is at the moment strongly bullish, with short-term shifting averages positioned properly above the long-term ones and a noticeable hole between them—a sign of sturdy upward momentum.

This setup displays constant shopping for strain and pattern energy, suggesting bulls are firmly in management.

If ZBCN can push by way of resistance at $0.0069, it might pave the best way for a breakout towards $0.0080, marking recent all-time highs and confirming continued bullish dominance available in the market.

Nevertheless, a shift in sentiment might convey draw back danger into play. If help at $0.00536 is examined and fails to carry, it might set off a deeper correction, sending ZBCN right down to $0.00384.

Within the occasion of sustained bearish strain, the worth might fall additional towards $0.00196, with an prolonged transfer probably reaching $0.00146.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.