Welcome to the US Crypto Information Morning Briefing—your important rundown of crucial developments in crypto for the day forward.

Seize a espresso as we proceed to look at what Bitcoin (BTC) might be for Eire amid world financial uncertainty. For the island in Europe, El Salvador’s achievements below President Nayib Bukele proceed to serve for example to emulate, a minimum of based on MMA star Conor McGregor.

Crypto Information of the Day: Conor McGregor’s Bitcoin Blueprint for a Sovereign Eire

In a latest US Crypto Information publication, BeInCrypto reported McGregor’s curiosity in having Eire create a Bitcoin strategic reserve.

Particularly, he desires the nation to undertake El Salvador’s profitable adoption of Bitcoin, replicating Bukele’s Bitcoin technique. McGregor sees this as an enabler to remove monetary corruption in Eire and safe long-term stability.

“An Irish Bitcoin strategic reserve will give energy to the folks’s cash,” McGregor stated on X.

Within the newest growth, the Irish presidential hopeful has proposed utilizing Bitcoin to ascertain a decentralized blueprint for Eire’s sovereignty.

The previous UFC champion lauded El Salvador’s Bukele for his transformative achievements, notably his adoption of Bitcoin as authorized tender.

McGregor goals to reflect Bukele’s success, slashing El Salvador’s crime and corruption charges. To do that, he seeks to leverage Bitcoin to empower the Irish folks and reclaim nationwide autonomy.

McGregor, who introduced his presidential bid in March 2025, invited Bukele for a dialogue.

Nevertheless, McGregor’s use of “crypto” as a substitute of “Bitcoin” drew sharp suggestions from supporters on X (Twitter).

In the meantime, because the presidential hopeful eyes Bitcoin in Eire, elsewhere, Panama and El Salvador advocate for Bitcoin adoption in Latin America.

Talking on the Bitcoin Convention, Panama Metropolis mayor Mayer Mizrachi known as for a Panama–El Salvador alliance to steer world monetary freedom utilizing Bitcoin.

“Panama and El Salvador are pushing Bitcoin adoption in latin america,” Mizrachi shared on X.

US Financial institution Earnings Tick Up, However FDIC Warns of CRE Weak spot—What It Means for Bitcoin

Elsewhere, the FDIC (Federal Deposit Insurance coverage Company) report reveals the US banking sector posted a modest earnings rebound in Q1 2025.

FDIC-insured establishments reported a web revenue of $70.6 billion and a return on property (ROA) of 1.16%, up from 1.11% in This autumn 2024.

Nevertheless, beneath the floor, rising stress in industrial actual property (CRE) portfolios has caught the eye of regulators and crypto buyers alike.

The FDIC’s Quarterly Banking Profile flagged continued weak point in non-owner-occupied CRE loans. Previous-due and nonaccrual (PDNA) charges are climbing sharply.

Giant banks with over $250 billion in property reported a CRE PDNA fee of 4.65%, far above the pre-pandemic common of 0.59%.

Though these banks are much less uncovered to CRE than their complete property, mid-sized establishments with increased CRE concentrations are more and more susceptible.

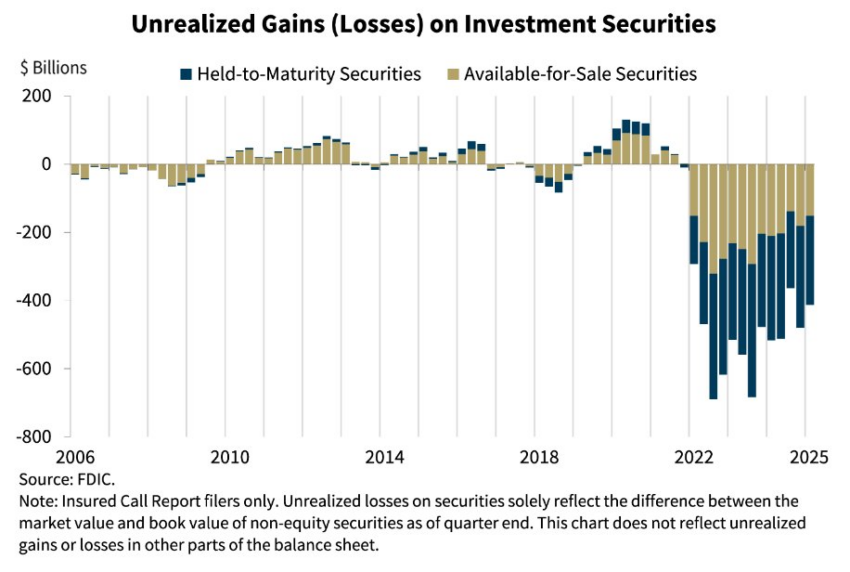

This structural stress comes amid tight credit score circumstances, excessive rates of interest, and elevated unrealized losses on securities portfolios. If broader financial stress escalates, these components danger constraining lending and liquidity.

Implications for Crypto

CRE stress might sign each danger and alternative for Bitcoin and digital property. Ought to CRE-linked defaults ripple by means of mid-sized banks, investor confidence within the conventional monetary (TradFi) system might weaken.

Such an end result might catalyze a flight to decentralized alternate options like Bitcoin, much like the March 2023 banking turmoil.

Furthermore, persistent stress in banks’ long-duration property might revive hypothesis round fee cuts or liquidity backstops. These macro shifts are traditionally bullish for crypto markets.

With unrealized losses on securities nonetheless hovering close to $413 billion, any future sell-off might speed up a coverage pivot.

In brief, whereas headline financial institution earnings recommend resilience, mounting CRE dangers might reopen the playbook for Bitcoin’s “secure haven” narrative, particularly if monetary cracks widen.

Indicators are already manifesting, with Bitcoin held by ETFs (exchange-traded funds) and public firms going parabolic.

Particularly, Bitcoin’s institutional stack is hovering, with BlackRock’s ETF holding over 663,000 BTC. In the identical approach, MicroStrategy can be stacking.

Chart of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe at present:

- SEC clarifies that sure Proof-of-Stake blockchain staking actions should not securities transactions below federal laws.

- Arkham reveals 97% of Michael Saylor’s Bitcoin holdings, elevating centralization and market collapse fears over his crypto affect.

- Technical analysts spot a number of bearish divergence indicators, hinting Bitcoin’s rally might reverse as early as June 2025.

- Chinese language AI firm Webus Worldwide plans to take a position as much as $300 million in XRP to enhance cross-border cost methods.

- Solana noticed solely $0.5 million in institutional inflows throughout Might, falling behind rivals like SUI ($23.9 million), Cardano, and Chainlink.

- PancakeSwap dominates the DeFi area with 66.9% buying and selling share and $149 billion month-to-month quantity, outpacing Uniswap and Pump.enjoyable.

- Thailand’s SEC will block entry to 5 unlicensed crypto exchanges beginning June 28, 2025, to curb cash laundering and shield buyers.

- After months of negotiations, Binance and the SEC filed a joint movement at present to resolve their ongoing authorized battle.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of Might 29 | Pre-Market Overview |

| Technique (MSTR) | $370.63 | $368.46 (-0.59%) |

| Coinbase International (COIN) | $248.84 | $247.25 (-0.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $27.05 | $26.79 (-0.95%) |

| MARA Holdings (MARA) | $14.61 | $14.47 (-0.96%) |

| Riot Platforms (RIOT) | $8.18 | $8.13 (-0.61%) |

| Core Scientific (CORZ) | $10.69 | $10.71 (+0.19%) |

The publish MMA Star Conor McGregor Pushes Bitcoin for Irish Sovereignty | US Crypto Information appeared first on BeInCrypto.