President Trump is contemplating new sanctions on China’s tech business, sparking a downturn in TradFi markets and $800 million in crypto liquidations. Tariff threats triggered basic chaos, and sanctions may reignite bother.

Nonetheless, there may be a long-term silver lining in all this. De-dollarization is main buyers throughout Asia to put money into Bitcoin, and commerce struggle escalation might pull capital away from the USD into crypto.

How Would Trump’s China Sanctions Have an effect on Crypto?

Over the previous few months, Trump’s tariffs have threatened a US-China commerce struggle, bringing deleterious results to the crypto market.

Derailed talks introduced crashes, settled offers meant prosperity, and rumors had a robust influence on the complete market. Unrelated to tariffs, Trump is reportedly contemplating sanctions on China, sending TradFi into panic:

Particularly, this sanctions plan goals at China’s rising tech business, focusing on subsidiaries of main conglomerates like Huawei or semiconductor producers.

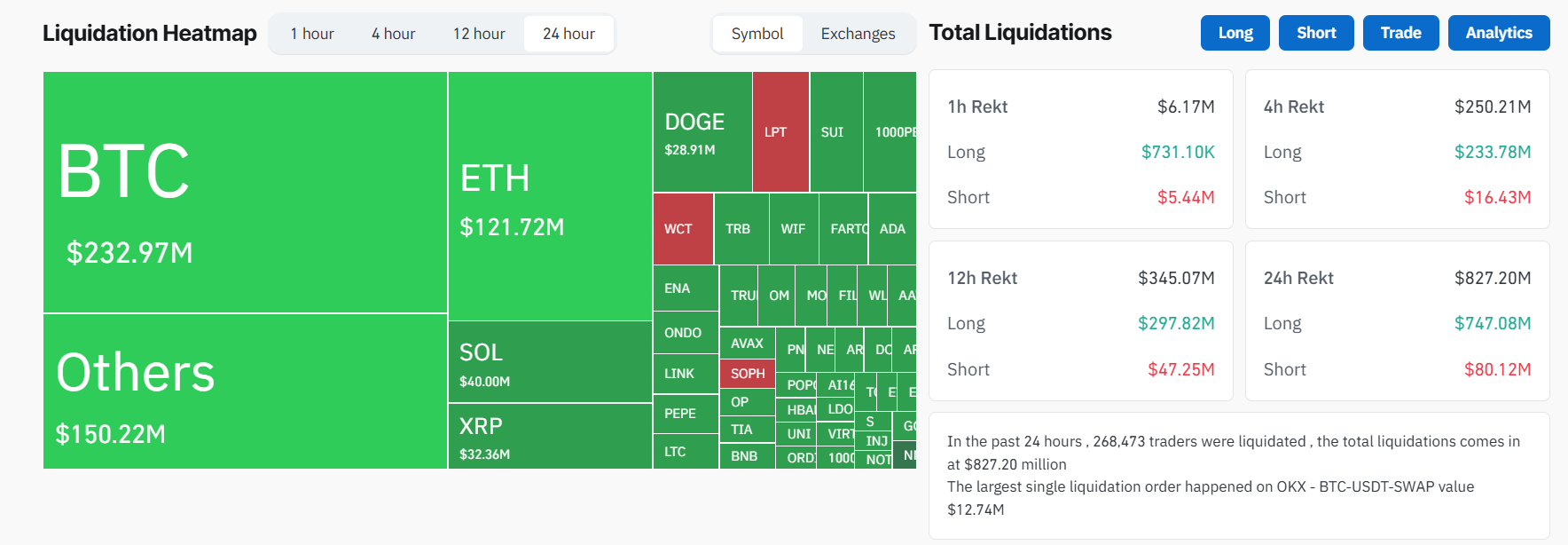

Bloomberg reported that these alleged sanctions gained’t happen till June, however crypto instantly reacted. The entire market fell 5%, Bitcoin fell under $105,000, and whole crypto liquidations reached $827 million.

Even earlier than at the moment’s sanctions information, markets remained cautious of renewed tariffs and a cautious Federal Reserve. In early February, an identical sell-off noticed Bitcoin slide 6 % on fears of a trade-war-induced international slowdown.

Right now’s actions bolstered these worries, triggering a slide in each equities and crypto.

China and the US settled their tariff negotiations lower than a month in the past, however the specter of new sanctions may reignite all the identical recession fears.

Main Chinese language economists warn that this transfer could also be a prelude to additional commerce wars, particularly as a result of the US is focusing on China’s largest progress industries. There are clear causes to be nervous about escalation.

For instance, on Could 29, the US already moved to broaden export controls on chip design software program, sure chemical compounds, and industrial instruments destined for China, revoking current licenses and choking off key semiconductor inputs.

Heightened US-China tech friction spooked risk-asset buyers, who view crypto as a risky barometer of broader market sentiment.

One other spherical of financial saber-rattling will certainly carry chaos, however may there be an upside for crypto? Because the US financial insurance policies flip more and more erratic, de-dollarization is gaining traction in Asia.

As a part of this pattern, economies are shifting from the greenback in the direction of property like gold, the Chinese language yuan, and cryptocurrency.

In different phrases, if the US sanctions China but once more, buyers throughout the entire area may park their capital in Bitcoin as a substitute of USD.

Nonetheless, this can be a marginal benefit, because the US is extra built-in with crypto markets. There’s a whole lot of debate over how crypto would carry out throughout a US recession, and it’s too early to have a definitive reply.

Hopefully, Trump will again down from further China sanctions, similar to he did with tariffs. In that case, this might enable crypto markets to return to enterprise as regular, as they’ve been exhibiting low volatility.

Nevertheless, within the occasion of one other commerce struggle escalation, crypto might behave in some sudden methods.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.