Meta Platforms, the dad or mum firm of Fb and Instagram, has voted overwhelmingly towards a proposal to diversify its company treasury into Bitcoin.

This indicators that Large Tech stays cautious about adopting the highest cryptocurrencies regardless of rising company curiosity.

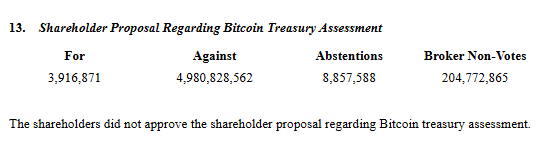

In line with paperwork shared on X, the shareholder movement acquired simply 3.9 million votes in favor, whereas greater than 4.9 billion opposed it. One other 8.9 million shares abstained, and 205 million had been dealer non-votes.

This vote follows the proposal of Ethan Peck, a Mata Shareholder, earlier this yr.

Peck had referred to as on Meta to transform a portion of its money and bond reserves into Bitcoin, citing rising institutional adoption and the asset’s potential to outperform conventional monetary devices.

Nonetheless, Meta’s board rejected the proposal even earlier than the vote, stating that the corporate already has strong treasury administration practices.

The board maintained that there was no compelling purpose to contemplate Bitcoin, although it didn’t totally dismiss digital belongings as an idea.

“Whereas we aren’t opining on the deserves of cryptocurrency investments in comparison with different belongings, we consider the requested evaluation is pointless given our present processes to handle our company treasury,” Meta’s board said.

Nonetheless, Meta hasn’t dominated out blockchain know-how totally. The corporate has reportedly held early-stage discussions with crypto infrastructure companies a couple of potential stablecoin integration to assist international funds.

In the meantime, the vote ends months of hypothesis that Meta may comply with within the footsteps of corporations like Technique, which has aggressively collected Bitcoin as a reserve asset.

The Fb’s dad or mum firm choice additionally mirrors latest shareholder rejections at Amazon and Microsoft, each of which declined comparable proposals.

A few of the hypothesis surrounding Meta stemmed from CEO Mark Zuckerberg’s ties to crypto tradition, together with the truth that certainly one of his goats is called Bitcoin.

Notably, market analysts had floated the concept Meta may lead a brand new wave of tech companies embracing digital belongings.

“If a Meta or Microsoft provides BTC to its steadiness sheet, it is going to arguably have an even bigger influence than all of the smaller corporations doing it. Kinda like when Tom Hanks bought COVID, which made it really feel actual although the circumstances had already been mounting,” Bloomberg ETF analyst Eric Balchunas defined.

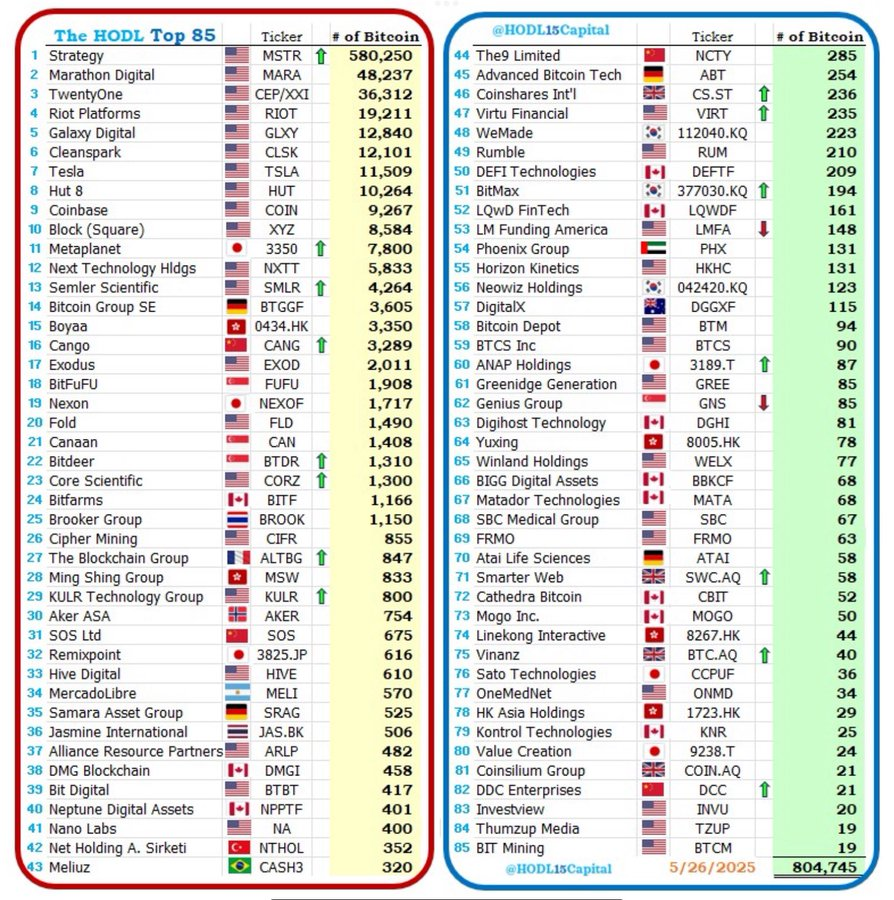

As of Could 2025, greater than 85 public corporations collectively maintain over 804,000 BTC, in accordance with Hodl15Capital. Technique leads the pack with greater than 580,000 BTC underneath its management.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.