After surpassing $111,000, Bitcoin’s worth has proven indicators of stalling over the previous two weeks. Some traders have begun to fret a few potential “Double Prime” state of affairs.

This technical sample typically alerts a pointy reversal, just like what occurred in 2021. Nonetheless, skilled analysts argue that this concern is unfounded. They imagine the present market situations are solely completely different from 4 years in the past.

Why a 2021-style double high state of affairs is unlikely in 2025

As BeInCrypto not too long ago reported, sure divergence alerts have emerged. These counsel that Bitcoin may reverse course in June. If this occurs, it is going to full a double-top sample and doubtlessly result in a correction of over 70%, similar to in 2021.

Nonetheless, analyst Stockmoney Lizards believes the RSI-based divergence sign is unreliable. He factors out that this indicator has did not predict market tops accurately in most previous instances.

“Need to know what I discovered? This factor has been lifeless incorrect more often than not. 2015: ‘Divergence means high!’ – BTC went up 10x. 2017: ‘This divergence is completely different!’ – BTC saved pumping for months. 2019: ‘Lastly confirmed!’ – One other 4x transfer incoming. The one time it truly labored was 2021. That’s 1 out of 5. So we’re alleged to promote every part based mostly on an indicator that’s failed 80% of the time?” Stockmoney Lizards mentioned.

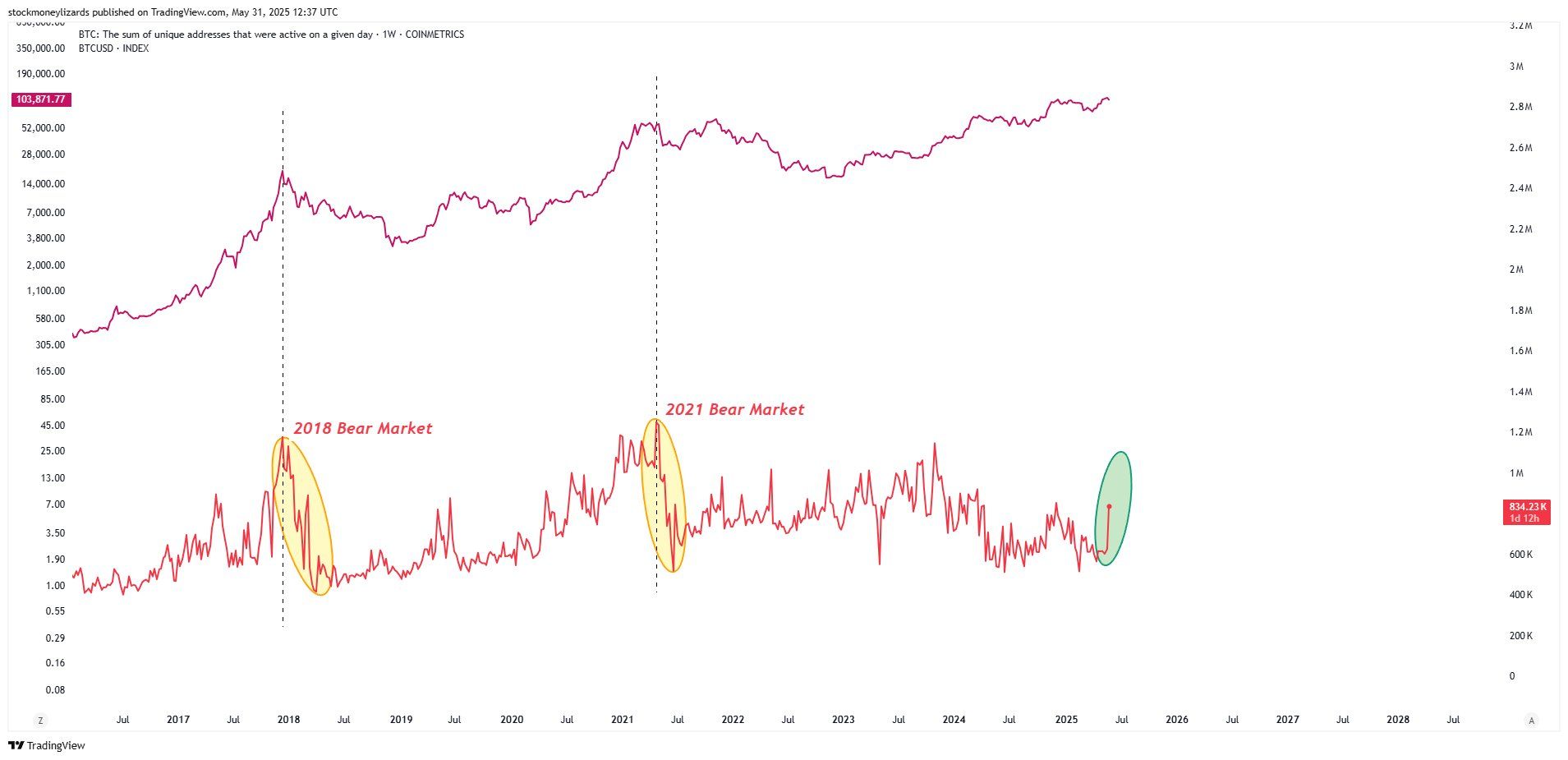

Moreover questioning the reliability of technical indicators, he additionally highlights some neglected constructive alerts. As an example, the variety of lively pockets addresses has surged, suggesting rising participation from each retail and institutional traders.

Furthermore, the MVRV Z-Rating—an on-chain metric that gauges Bitcoin’s valuation relative to its honest worth—is at present low. Traditionally, this means that Bitcoin isn’t overvalued and nonetheless has room for progress.

Past technical and on-chain indicators, Thomas Fahrer, founding father of ApolloSats, factors to elementary variations between now and 2021. He explains that the 2021 market suffered from a number of unfavorable occasions.

A number of components contributed to Bitcoin’s decline after its peak. These included the collapse of the Luna challenge, a well known Ponzi scheme, FTX’s sale of “paper Bitcoin” with out precise backing, and the speedy improve in rates of interest by the US Federal Reserve to fight inflation.

Collectively, these circumstances created an unstable surroundings for cryptocurrency, resulting in a major drop in Bitcoin’s worth.

Nonetheless, Fahrer emphasizes that 2025 is a totally completely different story. He notes that the market now enjoys robust help from constructive developments. These embody the introduction of Bitcoin ETFs, giant firms shopping for billions of {dollars} in Bitcoin as reserves, and even some US states constructing Bitcoin treasuries. These strikes characterize a serious structural shift.

Bitcoin is now changing into a trusted asset amongst establishments, not only a speculative software like prior to now.

“The 2021 double high comparability is dumb,” Thomas Fahrer acknowledged.

Stockmoney Lizards shares Fahrer’s view in regards to the supportive position of institutional capital in 2025.

At first look, the value chart would possibly resemble the one from 2021. This might simply set off considerations amongst technical analysts. However market dynamics consistently evolve and are by no means the identical.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.