Bitcoin’s worth has declined since late Might, at present hovering round $105,000. This stage acts as a psychological help, however BTC faces unsure prospects that might form its June efficiency.

BTC is at present weighing bullish optimism in opposition to potential promoting pressures as the ultimate month of Q2 begins.

Bitcoin Is But To Face “Mass Revenue Taking”

The MVRV Deviation Pricing Bands point out Bitcoin is close to overheated ranges however has not but crossed the +1σ band. Traditionally, this threshold triggers mass profit-taking as buyers search to lock in beneficial properties. For now, the market seems to have room to develop, delaying a widespread sell-off.

Till Bitcoin crosses this crucial MVRV stage, bullish momentum could persist, encouraging continued funding.

Nevertheless, warning is warranted. Monitoring the MVRV band carefully is necessary, as surpassing this level can rapidly shift sentiment. This makes June a vital month, the place Bitcoin’s worth motion may swing sharply relying on investor conduct and macroeconomic influences.

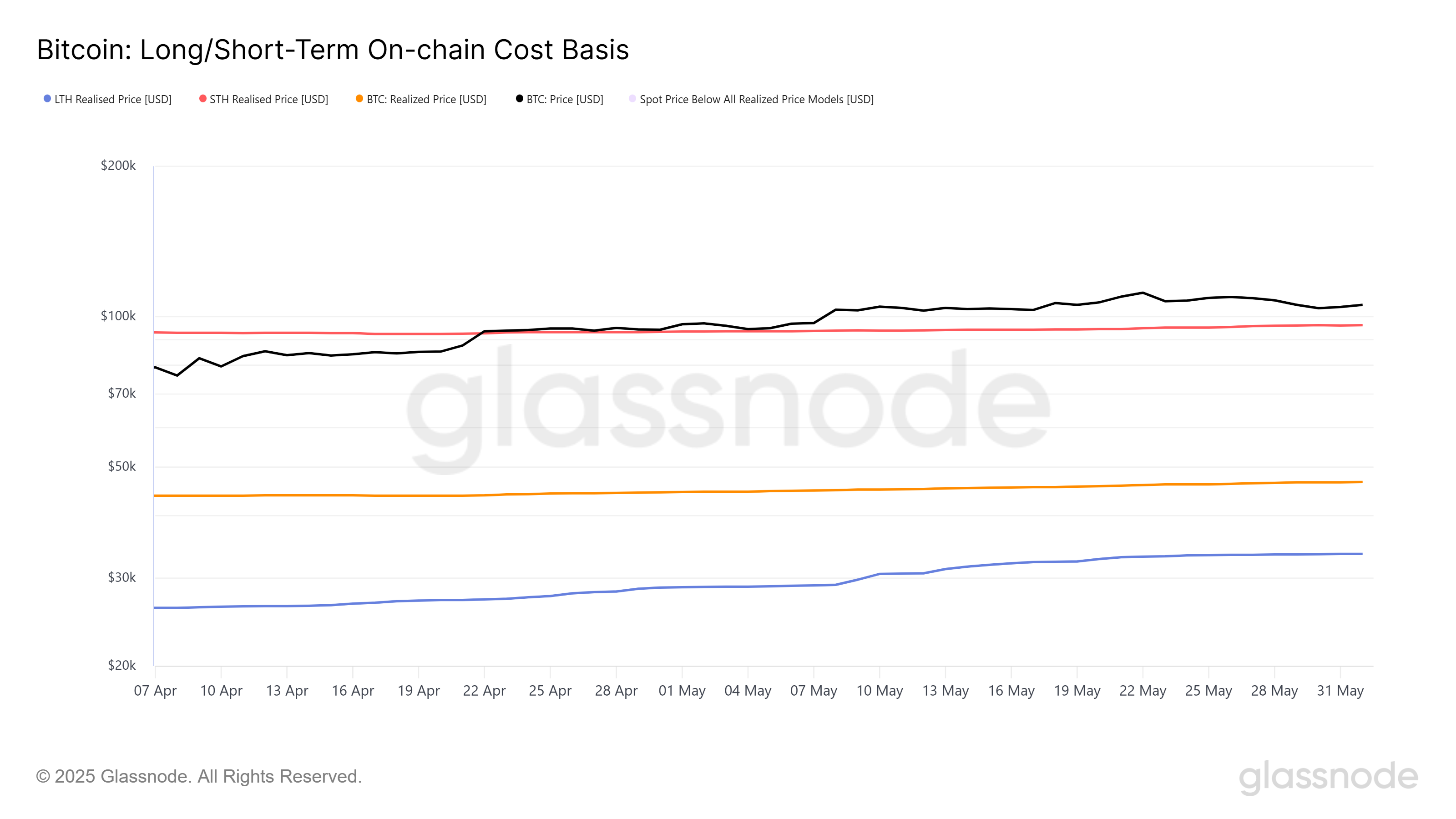

On-chain knowledge reveals the Lengthy-Time period Holder (LTH) and Quick-Time period Holder (STH) price foundation dynamics, shedding mild on Bitcoin’s momentum. The STH Realized Worth stands at $96,113, beneath the present market worth of $105,238. This hole means that short-term holders are in revenue, which is usually a bullish signal as these buyers usually tend to purchase or maintain.

Moreover, the LTHs’ price foundation at $33,555 is nicely beneath the market worth. Nevertheless, since these holders are inclined to chorus from promoting more often than not, their rising earnings aren’t a right away concern for Bitcoin’s worth.

However, STH profitability raises considerations as they could select to promote to understand beneficial properties, which may exert downward stress on BTC’s worth. This balancing act between holding and promoting will likely be crucial in figuring out Bitcoin’s trajectory by means of June.

BTC Worth Wants Stability

Bitcoin is buying and selling at $105,238, sustaining the essential psychological help stage of $105,000. This stability has restored some investor confidence after current volatility, setting the stage for potential upward motion.

If bullish momentum continues, Bitcoin is more likely to breach the resistance of $106,265 and flip it into help. Nevertheless, surpassing the $110,000 barrier could show difficult because of profit-taking stress and historic resistance at this stage.

Conversely, if short-term holders start to promote and safe earnings at present ranges, Bitcoin may drop beneath $105,000. A decline to $102,734 or decrease would invalidate the bullish outlook and recommend elevated vulnerability, presumably signaling the beginning of a deeper correction.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.