Bitcoin enters the week with heightened volatility, formed largely by unfolding macroeconomic developments and geopolitical tensions. In the beginning of June, Bitcoin is buying and selling across the $105,000 degree, however market sentiment displays warning as a number of key danger components emerge.

One main occasion impacting market outlook is the upcoming Might jobs report. Historically a powerful market mover, this information launch might affect how traders value in rate of interest expectations and broader financial momentum.

Moreover, inflation stays a central concern, with present readings round 2–2.1%—a spread the Federal Reserve considers acceptable. Whereas no rapid coverage modifications are anticipated this week, any indication of forthcoming easing or tightening will doubtless sway Bitcoin and broader crypto markets.

One other issue contributing to uncertainty is ongoing commerce stress between the US and China. A current pause and subsequent reinstatement of tariffs, notably relating to uncommon earth minerals, has fueled investor unease.

The back-and-forth between U.S. and Chinese language officers has solid a shadow over world commerce dynamics, which, in flip, is spilling over into digital property.

Over the previous week, the overall crypto market capitalization has dropped by over $250 billion, falling from roughly $3.5 trillion to $3.25 trillion, largely attributed to this geopolitical instability. Regardless of the prevailing uncertainty, there’s additionally a way of optimism amongst some market watchers.

Supply – Austin Hilton on YouTube

Bitcoin Worth Prediction

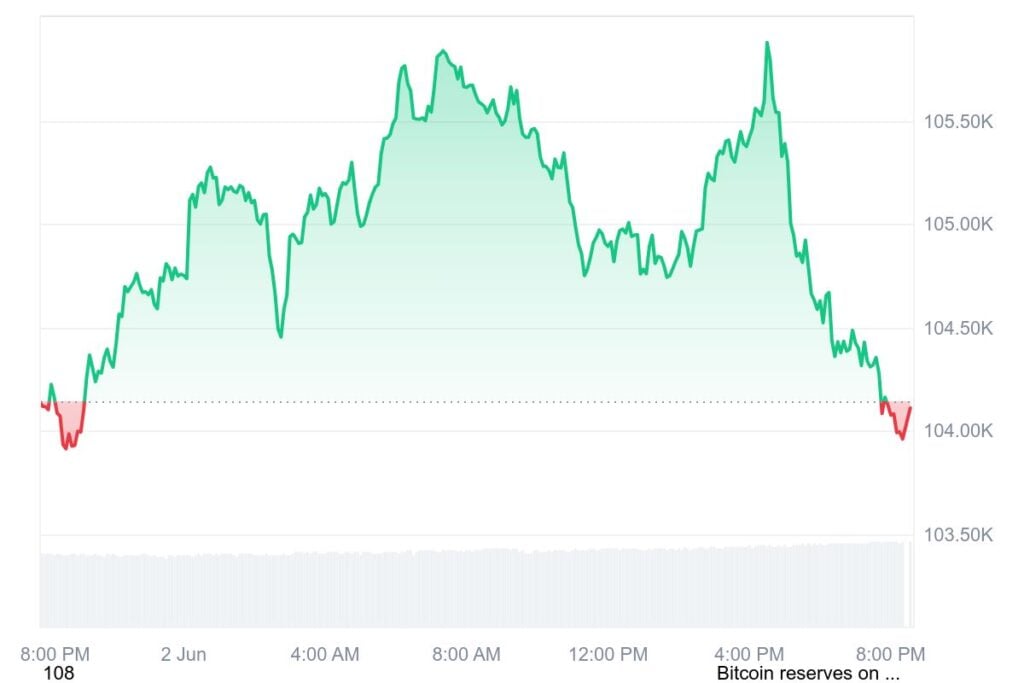

Bitcoin’s current value motion has been comparatively secure however considerably subdued, particularly over the weekend when buying and selling quantity tends to drop. Regardless of the low-volume atmosphere, the market exhibits constructive motion, although the conviction behind value modifications seems restricted.

Presently, Bitcoin is holding an necessary vary between roughly $103,500 and $105,000, which signify key assist and resistance ranges primarily based on earlier value conduct this 12 months.

On larger timeframes, Bitcoin stays in an total uptrend, however the short-term momentum has weakened, suggesting a potential consolidation section or range-bound buying and selling for the close to future.

Breaking decisively above $105,000 might sign a renewed bullish push, whereas a drop beneath $103,500 would possibly point out additional draw back danger. Market fundamentals present a cautiously optimistic outlook, supported by ongoing optimistic developments in fairness markets, however uncertainties and volatility stay.

Merchants ought to look ahead to vital quantity shifts and exterior components resembling upcoming financial information releases, together with manufacturing PMI studies and employment numbers, which can affect Bitcoin’s course subsequent week.

For now, the market outlook stays impartial with an in depth eye on these essential value ranges to find out the following main transfer.

BTC Bull Bridges Bitcoin Utility with Small-Cap Development Potential – Presale Nears $7M

In the meantime, Bitcoin-related property like BTC Bull (BTCBULL) are attracting consideration, not just for their explosive development potential but additionally for the added utility they provide—resembling rewarding holders with free Bitcoin. BTC Bull has already raised over $6.7 million in its presale, with tokens at the moment priced at $0.00254.

Potential traders now have 27 days remaining to affix the presale. The idea behind BTC Bull is constructed round providing tangible worth to its token holders by straight tying token utility and rewards to Bitcoin’s value actions.

As Bitcoin rises, so does the potential profit for $BTCBULL holders. as Bitcoin hits milestones like $125K, $150K, and past, BTC Bull will set off token burns and distribute free Bitcoin to its group. Probably the most notable occasion will likely be a further airdrop when Bitcoin hits $250,000.

To supply $BTC rewards to the BTC Bull group, a partnership was shaped with a pockets supplier providing superior options. Greatest Pockets, a multichain crypto pockets, is seamlessly built-in with the Neighborhood Sale.

This integration permits Bitcoin to be airdropped on to the multichain wallets of all presale contributors by means of the Greatest Pockets cell app.

Whereas meme cash and unstable altcoins can supply quick, high-risk rewards, BTC Bull supplies a hybrid alternative—combining the explosive development potential of a brand new token with direct publicity to Bitcoin’s success.

With long-term Bitcoin value predictions starting from $500,000 to over $2 million by 2030, many analysts stay bullish.

Diversification turns into key right here; slightly than going all-in on anyone asset—be it Bitcoin, meme cash, or gold—a diversified method throughout cryptocurrencies, conventional shares, and rising tokens like BTC Bull might help maximize upside whereas managing danger.

BTC Bull is designed to rise alongside Bitcoin’s broader trajectory, making it a compelling choice for traders who wish to capitalize on $BTC’s future with out lacking out on the multiplier impact that smaller-cap tokens can ship. To participate within the $BTCBULL token presale, go to btcbulltoken.com.

This text has been offered by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember our business companions might use affiliate applications to generate revenues by means of the hyperlinks on this text.