Regardless that Bitcoin has faltered since reaching a brand new all-time excessive, the most important crypto asset has remained robust at ranges above the $100,000 mark. Nevertheless, BTC’s current waning efficiency has impacted key traders’ motion as indicated in its Web Place Realized Cap metric.

Veteran Bitcoin Holders Hit The Pause Button

Bitcoin’s worth is slowly recovering from its current pullback because the asset attracts nearer to the $106,000 stage. In the course of the worth pullback, Kyle Doops, a market professional and the host of the Crypto Banter Present, revealed a regarding development in BTC’s on-chain information.

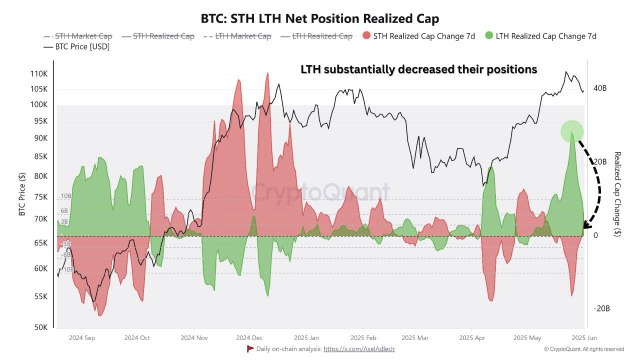

Particularly, the Bitcoin Web Place Realized Cap has dropped considerably, signaling a waning sentiment amongst main traders. This measure has traditionally been a vital reflection of market confidence, with steep drops often portending unsure instances or corrective motion.

Knowledge from the essential sentiment metric reveals that the Web Place Realized Cap had fallen from $28 billion to barely $2 billion by the top of Could. In response to the professional, this sharp drop implies that long-term BTC holders, who are sometimes thought of the market’s spine, have massively stepped again.

Lengthy-term Bitcoin holders have considerably exited and decreased their positions in the course of the current pullback, reflecting rising profit-taking from these gamers. As these seasoned traders step apart, this raises considerations in regards to the sustainability of Bitcoin worth power and whether or not a change in market temper is subtly happening.

Nevertheless, Kyle Doops highlighted that BTC’s current rally continues to be on regardless of the large slowdown within the Web Place Realized Cap metric. Bitcoin’s upward development should still be on, however the professional said that sensible cash is just not speeding into the market. Whether or not the event indicators warning from seasoned traders or quiet distribution, Kyle Doops believes that the key metric is value keeping track of.

Large Pockets Addresses Are Promoting Their BTC

In one other submit on X, Kyle Doops revealed a cut up conduct between massive wallets holding 1,000 to 10,000 BTC and mid-size pockets addresses containing 100 to 1,000 BTC. Knowledge from the Bitcoin Accumulation vs. Distribution by all cohorts metric reveals that whale traders look like taking earnings whereas the lesser traders are steadily stepping in to scoop up the digital gold.

Throughout Bitcoin’s rally from the $81,000 stage to the $110,000 mark, these massive pockets addresses have been slowly promoting their cash into the current power. In the meantime, the mid-sized wallets proceed to purchase at a speedy price, benefiting from the notable upward transfer.

Kyle Doops talked about that this disparity between the cohorts might be an indicator that the BTC’s ongoing rally is within the later phases. This altering dynamic suggests that offer could also be redistributed and market sentiment might be reshaped, which implies that mid-size traders would majorly affect BTC’s subsequent worth motion.

Featured picture from Getty Photos, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.