Blum — a Telegram mini app that had 42 million month-to-month customers final 12 months — has introduced its airdrop standards and snapshot date after greater than a 12 months of growth.

The challenge transitioned from a tap-to-earn mannequin to a trade-to-earn one and is step by step positioning itself as a decentralized trade (DEX). Nevertheless, obtainable information suggests Blum has but to draw vital buying and selling exercise amid intensifying competitors amongst DEX platforms.

Blum Reveals Airdrop Circumstances and Snapshot Schedule

In its newest announcement, the crew said that the snapshot will happen on June 7. This snapshot will document consumer balances and exercise to find out airdrop eligibility. The distribution is anticipated to observe shortly after.

Blum additionally outlined three circumstances for airdrop eligibility. Contributors should meet no less than one of many following:

- Personal over 100,000 Blum Factors (BP),

- Accumulate no less than 750 Meme Factors (MP) or present proof of lively engagement,

- Refer no less than two customers and cross the Sybil verify (to verify they don’t seem to be bots or duplicate accounts).

These standards have sparked combined reactions throughout the Blum group. Whereas some customers are happy to qualify, others have expressed frustration over the strict necessities.

For instance, one consumer on X posted a screenshot exhibiting he didn’t qualify regardless of logging in for 67 consecutive days. One other consumer known as the Meme Factors requirement “very unfair,” particularly for long-time supporters of the challenge.

These reactions spotlight Blum’s problem in balancing equity with anti-sybil measures to stop abuse.

Though Blum has shared the snapshot date and airdrop guidelines, it nonetheless hasn’t disclosed the tokenomics. This lack of element makes it troublesome for customers to estimate the potential worth of their airdrops.

Blum’s airdrop and snapshot announcement got here shortly after a surprising growth: the arrest of co-founder Vladimir Smerkis on fraud-related expenses.

“We perceive the group’s anticipation across the token launch. Regardless of current challenges following Vladimir Smerkis’ departure, we stay extremely assured in Blum’s proposition and skill to ship excellent worth and returns,” the challenge said.

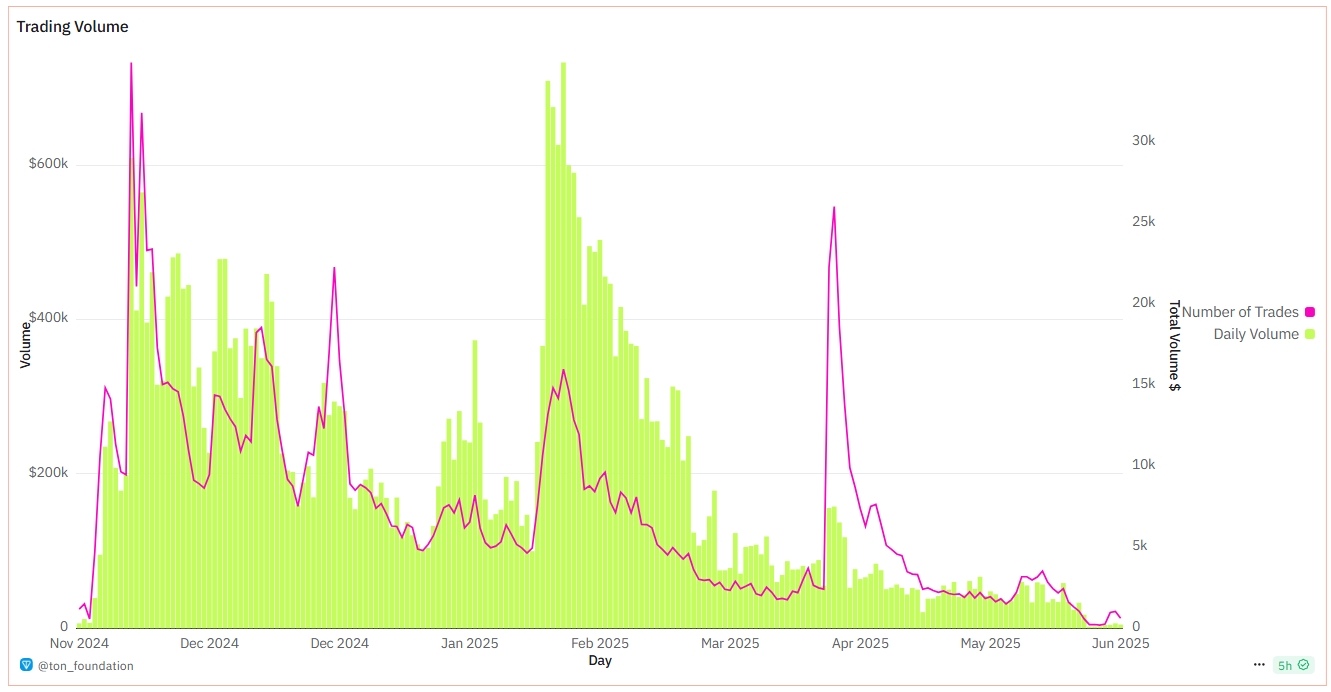

In the meantime, Blum’s each day buying and selling quantity has plummeted in 2025. In accordance with Dune Analytics, each day buying and selling quantity on Blum.io fell from over $700,000 in February to about $6,000 in June.

This sharp drop has severely weakened Blum’s skill to compete within the DEX area — a major downturn for a challenge that after rode the tap-to-earn hype and attracted tens of tens of millions of customers.

Beforehand, Blum raised $5 million in a funding spherical led by gumi Cryptos Capital, with participation from different main enterprise corporations equivalent to Spartan, No Restrict Holdings, YZi Labs, and OKX Ventures.

As of writing, Blum’s pre-market token value stays round $0.0015, down 90% from its early-year peak. This displays ongoing investor skepticism and locations the challenge in a precarious place.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.