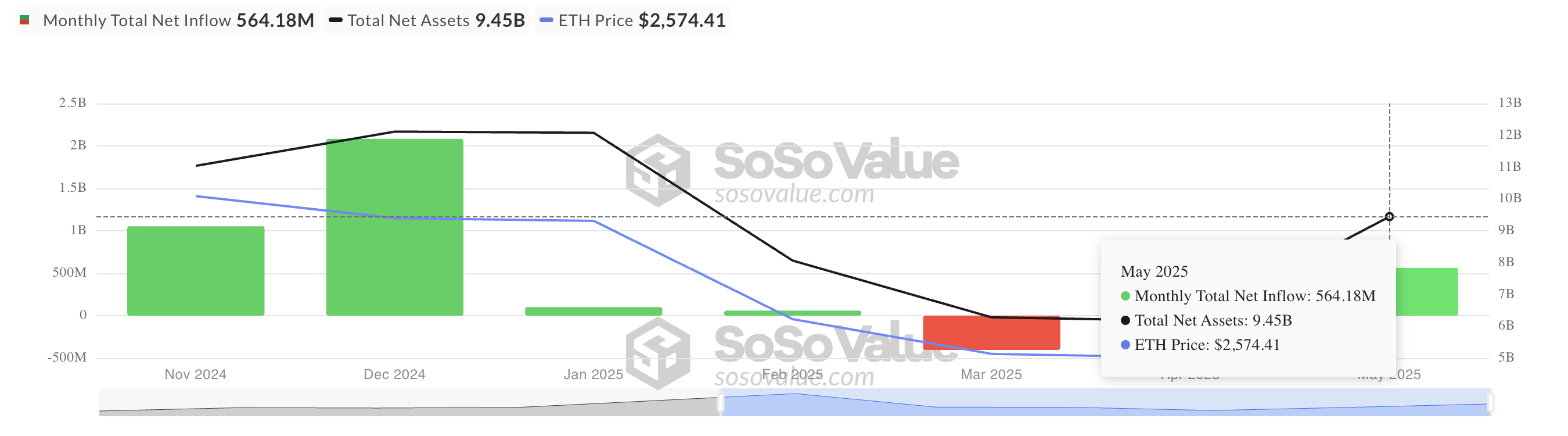

Ethereum’s worth rally in Might reignited investor curiosity in ETH-backed exchange-traded funds (ETFs). In the course of the 31-day interval, capital inflows into these investmemt merchandise exceeded $550 million, marking the best month-to-month netflow into ETH ETFs because the yr started.

Whereas the coin’s worth has witnessed a pullback over the previous week, technical indicators trace at a attainable near-term rebound.

ETH ETFs Log Highest Month-to-month Inflows of 2025

In line with knowledge from SosoValue, ETH spot ETFs recorded a mixed influx of $564.18 million in Might, surpassing all earlier month-to-month totals this yr.

The inflow of capital was largely pushed by ETH’s sturdy efficiency, with the main altcoin breaking above the important $2,000 degree and trying to consolidate good points above $2,500 through the month. This renewed bullish sentiment inspired institutional buyers to extend their publicity via spot ETFs and place forward of a sustained rally within the coin’s worth.

Ethereum Prepares for Subsequent Leg Up

Readings from the day by day chart present that ETH witnessed a 49% surge between Might 8 and Might 13, earlier than settling right into a consolidation section that has now fashioned a bullish pennant sample.

A bullish pennant sample is fashioned when a powerful upward worth motion (flagpole) is adopted by a interval of consolidation that resembles a small symmetrical triangle (the pennant). This sample means that patrons are briefly pausing earlier than persevering with the uptrend.

If ETH breaks out of the pennant to the upside, it may set off a renewed rally that mirrors the preliminary 49% surge. Such a breakout would verify continued bullish momentum and appeal to extra capital inflows.

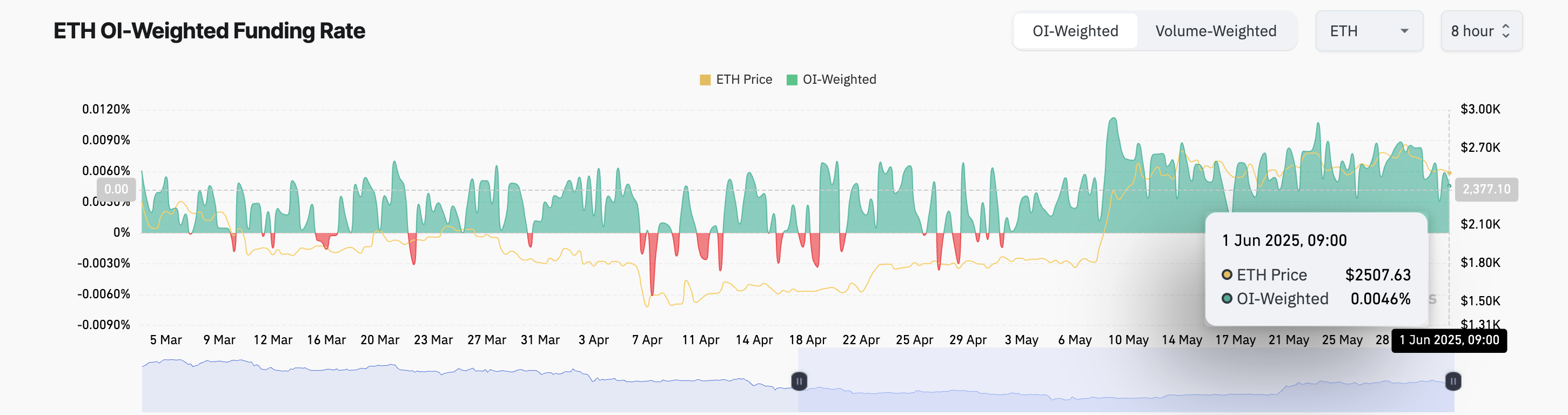

Furthermore, the coin’s funding fee continues to print values above zero, indicating a desire for lengthy positions even amid the continued consolidation section. As of this writing, ETH’s funding fee stands at 0.0046%.

A constructive funding fee like which means long-position holders are paying short-position holders, indicating bullish sentiment and that extra merchants are betting on worth will increase.

Ethereum’s Subsequent Transfer: Can Bulls Push ETH 49% Larger From Right here?

ETH presently trades at $2,489, sitting above the decrease line of its pennant, which types help at $2,479. If a bullish breakout happens, ETH’s worth may rally by the flagpole’s size (49%) to commerce at $3,907.

Nonetheless, if selloffs resume, the coin’s worth may break beneath the pennant and commerce at $2,419.

The submit Ethereum ETF Inflows Hit 2025 Peak — How Will ETH Worth React? appeared first on BeInCrypto.