- Hyperliquid had its finest month ever in Could, with buying and selling quantity hitting $242 billion and its HYPE token hovering over 327% to almost $40. The platform’s market cap jumped to $10.9 billion, making it a severe contender amongst prime crypto exchanges.

- It outperformed main DeFi protocols in payment technology, pulling in $69 million—greater than Ethereum, Raydium, and BSC Chain. This surge was fueled by renewed crypto market power, with Bitcoin reaching $111K and whole market cap surpassing $3.5 trillion.

- The token’s chart shaped a bullish cup-and-handle sample, and whereas HYPE has pulled again barely, merchants anticipate a break-and-retest on the $28 degree earlier than probably resuming the rally.

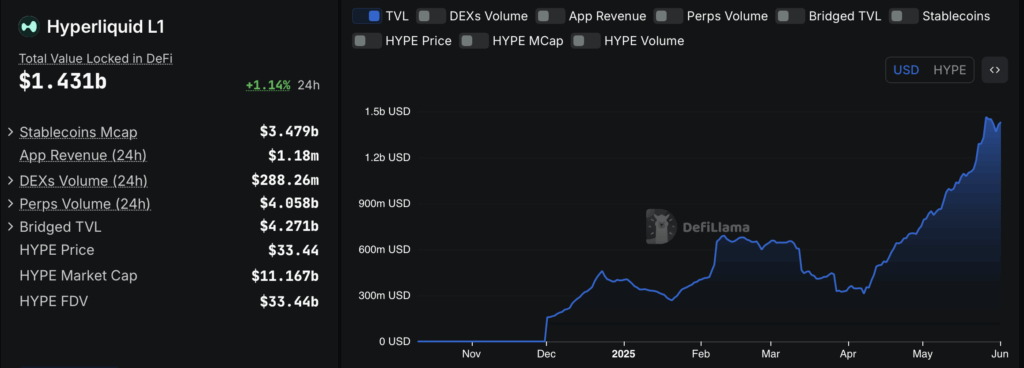

Hyperliquid had a fully huge Could—its greatest month thus far. The decentralized perpetual futures big noticed its HYPE token spike to $39.92 on Could 26, taking pictures up greater than 327% since early April. That leap pushed the platform’s market cap past $10.9 billion, with a completely diluted worth topping $35 billion. And the quantity? Unreal. Hyperliquid clocked over $242 billion in buying and selling exercise final month, dwarfing opponents like Jupiter ($19.78B) and others that didn’t even break $10 billion. For context, that’s method up from April’s $187B and March’s $175B.

All-time, Hyperliquid has now dealt with greater than $1.6 trillion value of tokens. It’s closing in on centralized alternate huge canines—Binance, Bybit, and Bitget—in each day buying and selling quantity, having managed over $4 billion within the final 24 hours alone. Binance nonetheless dominates with $41.27B, however Hyperliquid’s rise is spectacular. Much more jaw-dropping: it pulled in over $69 million in charges final month. That’s greater than Ethereum, BSC, and Raydium managed in the identical stretch.

Technical Patterns Flash Bullish Indicators

Technically talking, HYPE’s rally was no fluke. The chart exhibits a clear “cup and deal with” formation—an excellent bullish sign in dealer converse. The cup’s rim shaped round $28.40 earlier than the token ripped upward to almost $40. However after that explosive transfer, it began to chill off a bit because the broader crypto market stumbled. Analysts suppose this might result in a “break-and-retest” sample, the place HYPE dips again to that $28 zone after which, if assist holds, takes off once more.

Bullish Market Vitality Fuels the Fireplace

A part of this complete surge was because of the crypto market flipping bullish general. Bitcoin shot previous $111K, and whole market cap crossed $3.5 trillion. That renewed power undoubtedly bled into Hyperliquid’s numbers. With quantity booming and costs flowing in like loopy, it’s positioned not simply as a prime DeFi venture—however as an actual risk to some centralized powerhouses. Whether or not the uptrend retains rolling is determined by a couple of key ranges, however Could confirmed what this platform’s able to when the celebs align.