BlackRock has been buying massive portions of Ethereum, contributing to rumors that it’s planning to launch staking on its ETF. The SEC just lately dominated that “staking-as-a-service” protocols aren’t securities, which is additional driving the speculations.

When the Fee modified this rule, it attracted fiery condemnation from present and former workers. Presently, BlackRock’s greatest impediment may be in combating a political battle.

BlackRock is Promoting Bitcoin for Ethereum

BlackRock presently points the most important Ethereum ETF, and this market is doing notably effectively proper now. Nevertheless, because the SEC up to date its coverage on ETF staking just a few days in the past, a number of asset managers have already submitted proposals to make the most of it.

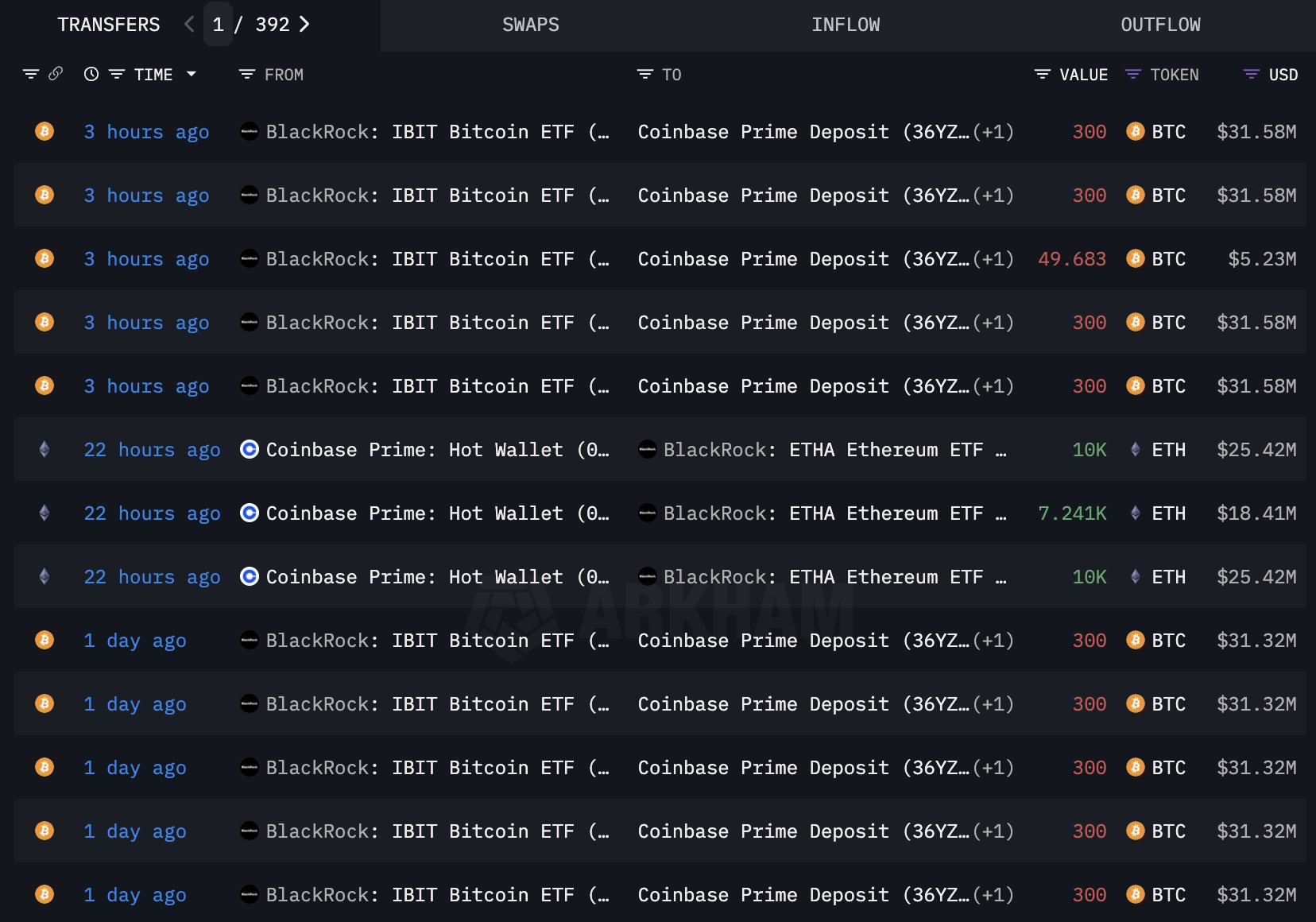

On-chain information reveals that BlackRock is shopping for numerous Ethereum, resulting in rumors that it’s aiming for a staking ETF:

Particularly, BlackRock is promoting large portions of Bitcoin to pay for this Ethereum. This might, in all probability, be because of the growing demand for Ethereum ETFs within the US market proper now.

Ethereum ETFs noticed 11 consecutive days of inflows, and complete web property are approaching $10 billion. Nevertheless, just a few key items of proof help the ETF staking rumors.

Main issuers have been persistently demanding ETF staking, and the SEC punted on a choice in April. Now that the Fee dominated that “staking-as-a-service” protocols aren’t securities, it may open up room for this new product.

Reportedly, BlackRock executives are lobbying the SEC to formally affirm this new rule change.

So, what’s the issue? If the SEC is amenable, and the trade significantly wishes it, why couldn’t the Fee formally approve staking integration in spot ETFs?

In a phrase, the primary hurdles appear to be political. The SEC has already drawn controversy over its latest crypto-friendly coverage shifts. Its latest resolution on PoS solely introduced worse condemnation.

Caroline Crenshaw, an anti-crypto Commissioner, additionally attacked the SEC’s ETF staking resolution, claiming that its crypto coverage is virtually outlined by wishful pondering.

Your entire crypto trade is receiving elevated hostility and diminished help within the political sphere. If this request turns into a giant combat, it might show a expensive one. Is it the very best precedence proper now?

Additionally, despite the fact that crypto staking doesn’t fall beneath the present securities legislation, the SEC will nonetheless must scrutinize how staking mechanics work together with custody and threat disclosures. It should be comfy that retail buyers received’t face hidden slashing or liquidity constraints.

Merely put, this hypothetical product providing just isn’t the one profitable alternative that wants political help. The SEC may nonetheless approve ETF staking, however that is the most important impediment in the mean time.

BlackRock’s inner logic is opaque; it might be getting ready for a significant effort or specializing in different priorities. Wanting forward, it may go both means.

The put up BlackRock’s Ethereum Buy is Fuelling ETF Staking Rumors appeared first on BeInCrypto.