- HBAR is consolidating round $0.17 after a drop from $0.195, with open curiosity and quantity displaying lowered dealer conviction.

- Regardless of slight features and elevated quantity, key resistance at $0.175–$0.180 stays unbroken, conserving the short-term outlook impartial.

- Weekly indicators like RSI and BBP counsel weak momentum, and a break under $0.16 might open the door to additional draw back towards $0.12.

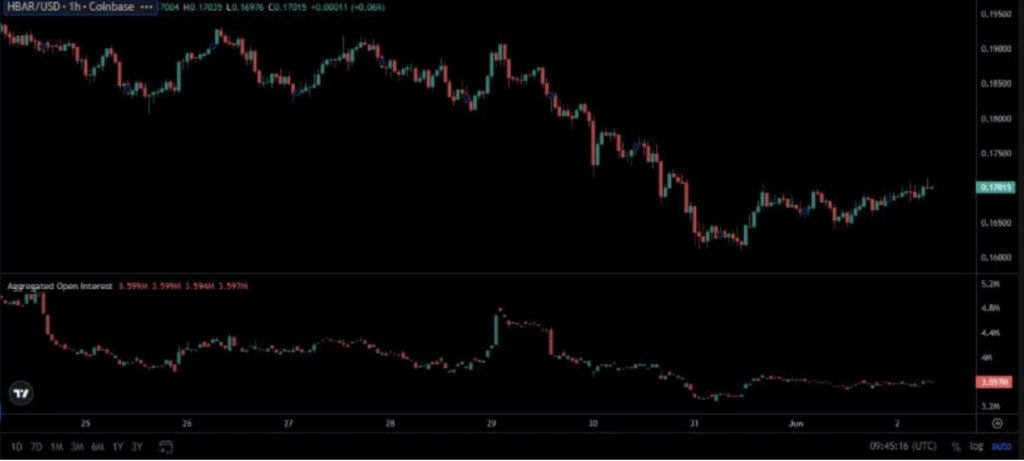

Hedera Hashgraph’s been caught in a decent little vary these days—hovering round $0.17 after falling from latest highs. The dip wasn’t precisely small both, with HBAR sliding from $0.195 to $0.162 between Could 27 and Could 30. Large purple candles on the hourly chart made it clear: sellers have been in management. However now? Issues have cooled off a bit, and worth motion’s began to settle someplace between $0.165 and $0.170.

There’s a little bit of indecision within the air. Open curiosity spiked round Could 29—in all probability a whole lot of of us making an attempt to catch a backside—but it surely fell off once more shortly after. That drop, paired with sideways worth motion, means that neither bulls nor bears are totally dedicated for the time being. It’s just like the market’s holding its breath, ready to see the place issues go subsequent.

Quantity Hints at Quiet Accumulation—however No Breakout But

Zooming out a bit, the 24-hour chart from June 2 exhibits a tiny bounce, with HBAR up 1.08% on the day. Not earth-shattering, however higher than purple candles. Quantity ticked up too—hitting $105.94 million at one level—which makes it really feel like there’s at the very least some actual shopping for occurring, not simply bots messing round. That mentioned, the features are nonetheless modest, and there’s no actual signal of a breakout. But.

If HBAR’s gonna make a transfer, it’ll want extra quantity behind it—in any other case, it’d simply preserve bouncing round between help and resistance. And proper now, that resistance zone is sitting round $0.175 to $0.180. With no push previous that space, backed by actual momentum, bulls are simply spinning wheels.

Weekly Charts Nonetheless Look… Meh

On the weekly chart, the image doesn’t change a lot. As of June 2, HBAR was up simply 0.77% for the week—barely noticeable while you zoom out. Candles have small our bodies, combined colours, and never a complete lot of route. The BBP indicator is sitting at -0.03333, which implies worth is chilling nearer to the decrease Bollinger Band—not precisely the place you wanna see power.

RSI is one other snooze fest. It’s parked at 47.08—slightly below the impartial line—and hasn’t damaged above its personal shifting common. For bulls to get something going, RSI would wish to leap previous 50 and be backed by quantity. Till that occurs, the danger of drifting again towards $0.16 and even as little as $0.12–$0.13 stays on the desk.

Nonetheless Ready for the Break—Up or Down

So yeah, the outlook proper now? Fairly impartial. HBAR’s displaying indicators of much less promoting and a few minor power, however nothing stable but. Except it pushes above that $0.175–$0.180 stage with stable open curiosity and quantity, merchants are in all probability in wait-and-see mode.

If worth slips below $0.16 with quantity creeping up, that would set off a transfer decrease towards the subsequent help zone. But when bulls step up, and quantity spikes with momentum, then perhaps—simply perhaps—we’ll lastly get a breakout to speak about. For now, although, it’s only a sideways grind.