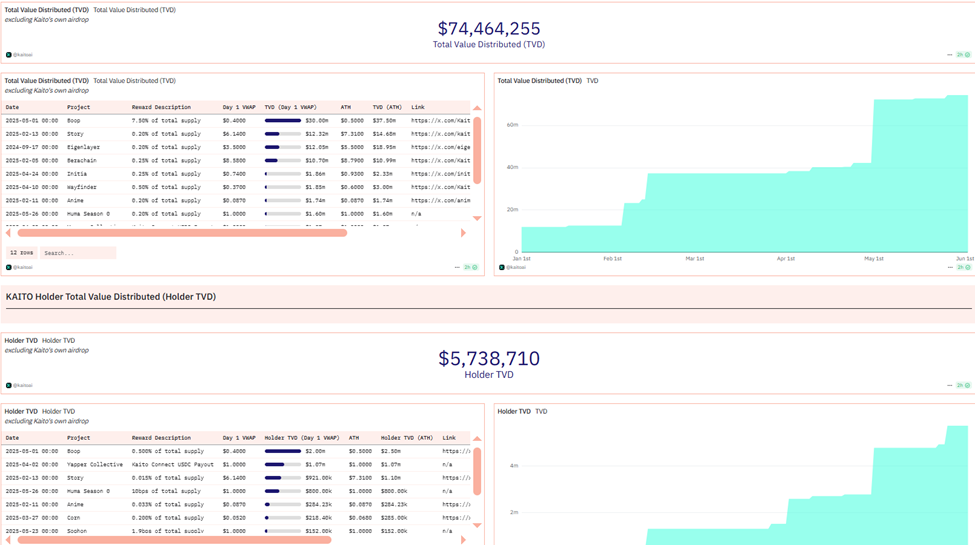

Web3 AI platform Kaito has quietly grow to be one of many largest distributors of on-chain incentives. Based on Dune Analytics knowledge, it has surpassed $74 million in whole worth distributed, airdropped to over 5.7 million pockets holders.

It comes amid the emergence of a brand new narrative in crypto: Consideration Capital Markets, a distinct segment time period loosely derived from Solana’s Web Capital Markets.

Kaito’s Consideration Financial system: Airdrops, Incentives, and Community Results

Knowledge on Dune reveals Kaito has distributed over $74 million in airdrops to five.7 million wallets. In the meantime, the platform’s token, KAITO, has rebounded over 150% for the reason that begin of Might.

Key drivers embody elevated staking participation and alignment with a brand new attention-based financial system.

In the meantime, greater than 28 million KAITO tokens are actually staked, representing over 10% of the circulating provide. These stakers or platform customers search additional airdrop publicity and yield by Kaito’s staking and farming applications.

The numbers place Kaito on the forefront of an rising development, monetizing social consideration in crypto by incentivized content material creation and identity-building.

Considered one of Kaito’s most vocal energy customers is Simon Dedic, CEO and Companion at Moonrock Capital. In a submit on X (Twitter), he credited the platform with altering how he earns and engages on-line.

“I’ve been utilizing Kaito AI for nearly a 12 months now, and I can truthfully say it’s probably the most impactful instruments I’ve ever adopted in crypto. Not simply because it’s helped me earn near $200,000 for doing nothing, as a result of it’s basically modified how I create, how I have interaction, and the place my profession is headed,” Dedic mentioned.

By connecting his X account and contributing to Kaito’s “Yap” system—a social layer constructed round high-signal commentary—Dedic earned an enormous KAITO airdrop.

He then staked it to farm extra rewards from tasks like Wayfinder, Boop.enjoyable, and Huma Finance. Past monetary upside, Dedic additionally emphasised Kaito’s behavioral influence.

“Kaito’s launch — with yaps, leaderboards, and visibility metrics — gave me an actual motive to grow to be extra constant, intentional, and considerate in how I tweet. That alone kicked off an enormous development flywheel… founders realized I wasn’t simply throwing baggage round — I used to be truly serving to construct consideration,” he added.

From Passive Earnings to Affect: How Kaito Rewards Participation

Kaito Founder Yu Hu has framed this motion as a part of a deeper “InfoFi” imaginative and prescient, arguing that focus is now a core driver of worth and valuation in crypto.

“In an consideration financial system, consideration is inherently invaluable. The nuanced take is the worth of consideration is dependent upon the retention, the consensus, the underlying topic (i.e. product), the standard, and lots of different elements,” Hu defined.

He additionally defined how Kaito’s infrastructure bridges consideration to motion. Particularly, options like Kaito Earn allow consumer conversion, whereas the upcoming Capital Launchpad is for capital formation.

The objective is to show high-quality content material and engagement into community development and funding alternatives.

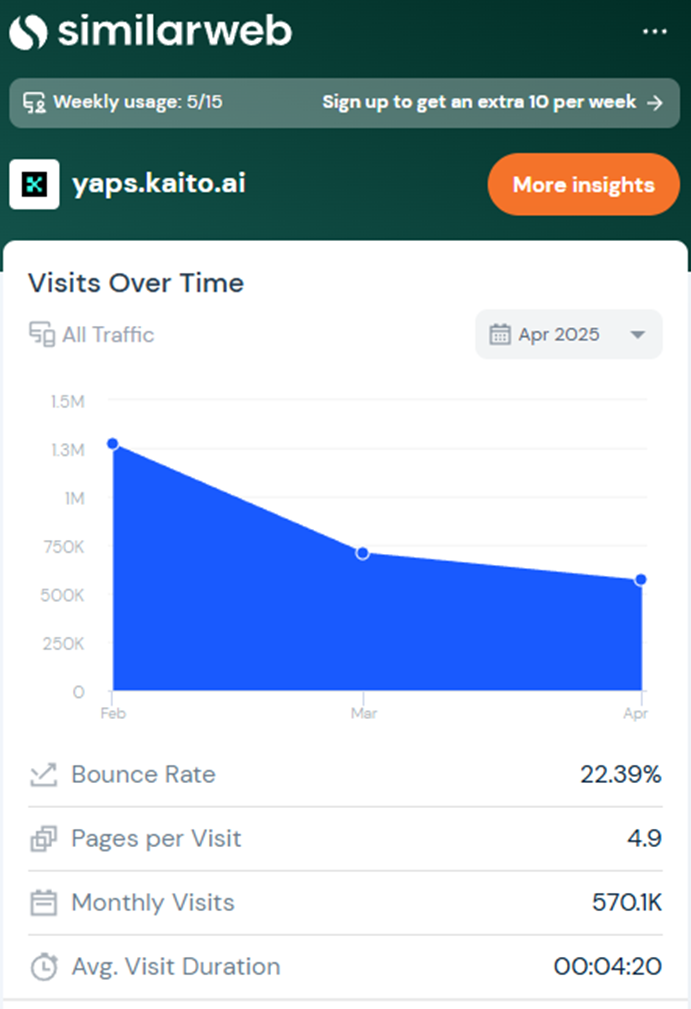

Nonetheless, not all of the metrics paint a rosy image. Based on Similarweb knowledge, Kaito’s site visitors fell from 1.3 million month-to-month visits in February to 570,000 in April. The 56% drop suggests waning curiosity or a shift in consumer conduct.

Moreover, with KAITO’s token unlocks paused till August, analysts warning that promoting stress might return later this summer time.

However, as consideration turns into more and more commoditized in Web3, Kaito’s development indicators a brand new meta about yield, on-chain id, affect, and long-term alignment.

The submit Kaito Airdrops Over $74 Million Amid Rise of Consideration Capital in Crypto appeared first on BeInCrypto.