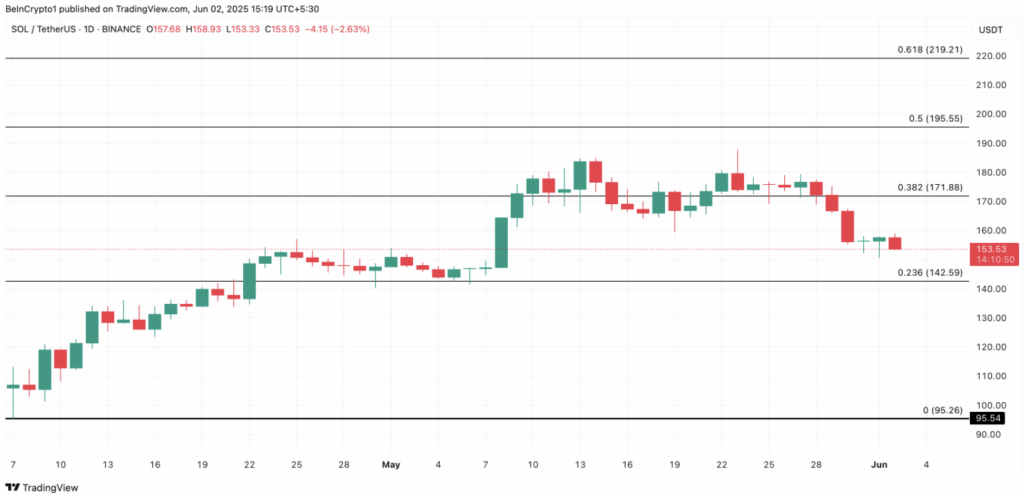

- Solana dropped 15% over the previous week, falling to $153.53 amid a broader crypto market dip.

- On-chain information reveals long-term holders are accumulating, with liveliness at a 14-day low and funding charges turning constructive.

- If help holds, SOL may rebound to $195, however a stronger sell-off would possibly push it right down to $142.59.

Solana’s been sliding quick, dropping roughly 15% during the last week as a part of a broader market dip that’s hit practically each main altcoin. The Layer-1 token’s now sitting round $153.53—fairly a fall from the $180 vary it was pushing not too way back. Whereas this transfer would possibly look tough on the floor, some deeper information hints that we may be close to the top of the drop.

What’s attention-grabbing is how the metrics below the hood inform a barely completely different story than simply panic promoting. Regardless of the pullback, long-term holders aren’t precisely speeding for the exits—actually, they appear to be getting extra concerned, not much less.

LTHs Purchase the Dip as Liveliness Drops

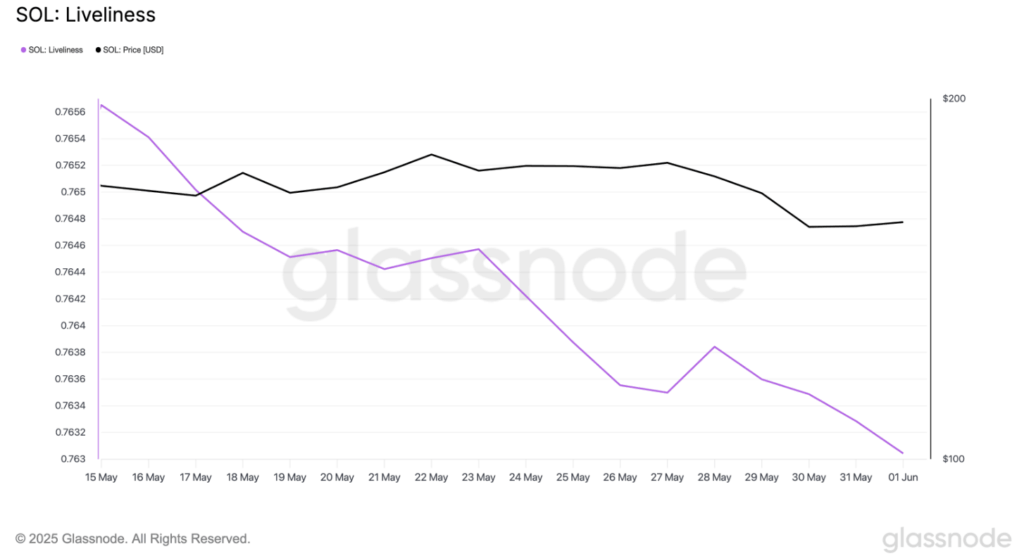

Solana’s “Liveliness” metric has taken a noticeable dip, suggesting that long-term holders are seeing the value drop as an opportunity to load up. Based on Glassnode, that liveliness quantity is right down to 0.76, the bottom it’s been in about two weeks. Mainly, fewer outdated cash are being moved round, which hints that folk who’ve been holding SOL aren’t promoting—they’re seemingly shopping for or a minimum of staying put.

Liveliness is kinda like a gauge of what number of “outdated” cash are all of the sudden energetic once more. When the quantity goes up, that often means long-time holders are cashing in. However when it dips, like now, it factors to accumulation. Which means individuals are pulling cash off exchanges and tucking them away, which is usually seen as a bullish sign.

On prime of that, Solana’s funding charge has simply flipped constructive—at present sitting at about 0.0041%. That may not sound like an enormous deal, nevertheless it’s an indication that extra merchants are leaning lengthy within the futures market.

Merchants Lean Bullish, Eyes on $195

Funding charges are like a tug-of-war charge between bullish and bearish merchants in perpetual futures contracts. When the speed’s constructive, it means lengthy positions are extra common—bullish merchants are paying shorts, anticipating the value to climb. So though SOL’s value is down, a great chunk of the market thinks we’re due for a bounce.

If the long-term holders maintain accumulating and general market sentiment begins to shift, Solana would possibly work its manner again towards the $171.88 degree. And if that spot turns right into a stable help zone, there’s an opportunity it may push as much as round $195.55. However hey, that is crypto—we all know it’s not all the time clean crusing.

Warning Forward: $142 Assist Nonetheless in Play

After all, issues may swing the opposite manner too. If the market stays shaky and sellers dig of their heels, Solana may slide even decrease, probably towards $142.59. That degree’s been a key help earlier than, and if it breaks, the bearish facet would possibly get the higher hand once more. For now although, all eyes are on whether or not SOL’s quiet whales maintain holding the road.