Since Binance listed USD1, the stablecoin’s transaction quantity has elevated tenfold. BNB Chain can be supporting USD1, onboarding new on-chain companions to advertise ecosystem utility.

World Liberty Monetary (WLFI) can be taking steps to deliver USD1 nearer to meme coin merchants. Nonetheless, there are lingering considerations concerning the stablecoin’s excessive degree of token centralization.

USD1 Transactions Spike Due to Binance

President Trump is engaged in a number of crypto ventures, and the USD1 stablecoin has been attracting lots of curiosity these days. The Binance itemizing in late Might instantly boosted commerce quantity, however the full significance didn’t instantly materialize.

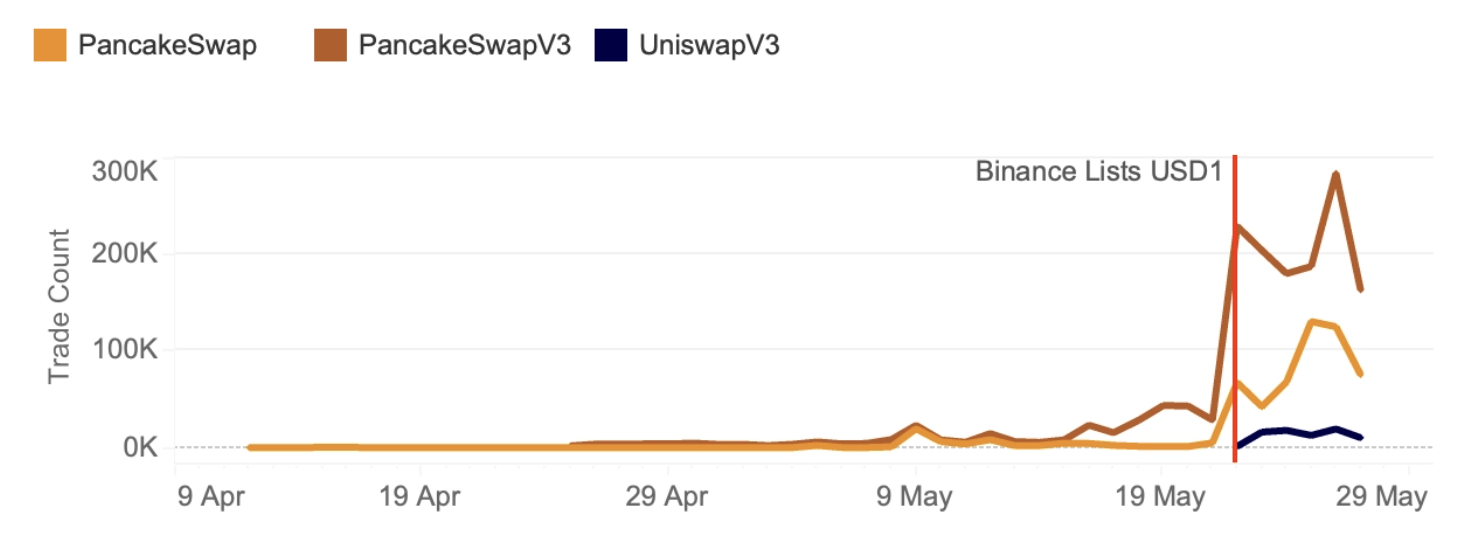

Nevertheless, a brand new report from Kaiko reveals simply how far USD1 transaction ranges have elevated in latest weeks:

Clearly, regardless of a number of controversies, World Liberty Monetary’s stablecoin is doing fairly properly. For the reason that Binance itemizing, WLFI launched USD1 restaking, and that’s not the one measure to boost exercise.

BNB Chain has been taking a number of measures to spice up USD1’s transaction volumes, and it described a number of of them in the present day.

This lively help from BNB Chain reveals Binance’s sustained curiosity in USD1. By onboarding numerous on-chain companions like wallets, CEXs, and on-chain apps, the agency helps World Liberty pursue its ambition of making an vital fee stablecoin.

This will likely sign elevated affinity between the 2 companies sooner or later.

WLFI, in fact, has additionally been launching initiatives of its personal. The agency not too long ago promoted meme coin buying and selling with USD1 on PancakeSwap, additional incentivizing customers to maintain this transaction exercise elevated.

By integrating USD1 with the meme coin sector, it’ll improve merchants’ publicity to this rising stablecoin venture.

At the moment, WLFI has greater than sufficient provide to help these transactions; USD1’s market cap is over $2 billion. Nonetheless, the agency has attracted some criticism about its tokenomics.

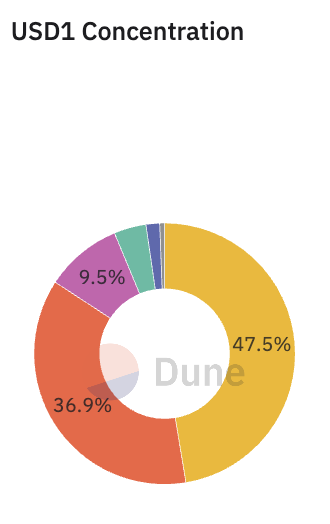

Particularly, this can be very centralized. Greater than 93% of USD1’s market cap is held by three wallets, a really staggering degree of focus.

Nonetheless, all issues thought-about, issues are trying fairly bullish. WLFI has already teased main airdrops, which might give the agency a possibility to cut back this centralization.

If USD1 transaction volumes hold climbing at this charge, it may change into a significant participant within the broader stablecoin ecosystem.

The submit USD1 Transactions Surge 10x, However Provide Stays Extremely Concentrated appeared first on BeInCrypto.