Bitcoin is buying and selling at a essential juncture following a risky week marked by sharp strikes and heightened uncertainty. After reaching its all-time excessive of $112,000, BTC has entered a consolidation part, hovering round key help and resistance ranges. The market now watches carefully for indicators of the subsequent decisive transfer—both a breakout to new highs or a deeper correction.

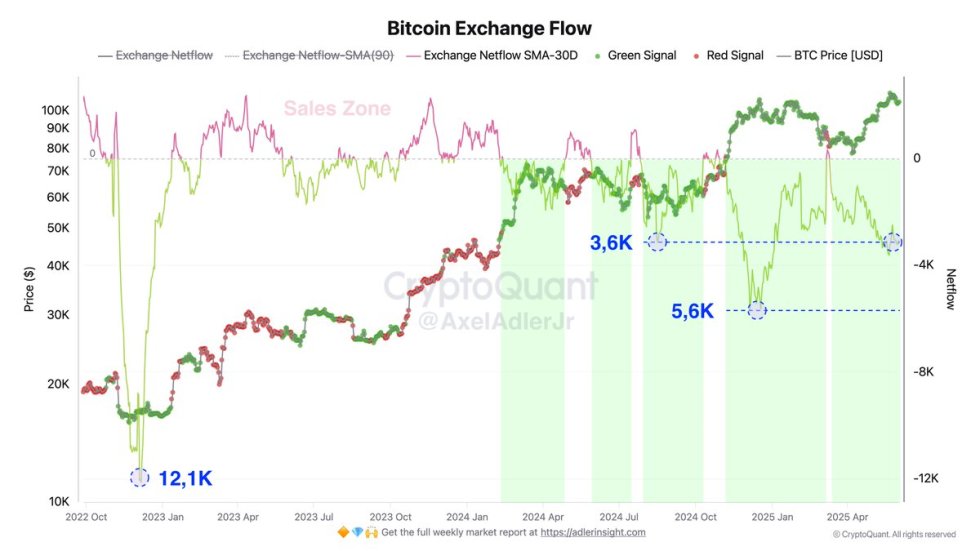

Regardless of the worth cooling off, on-chain information suggests underlying energy available in the market. In keeping with CryptoQuant, Bitcoin’s common Netflow has shifted into adverse territory since March 10, 2025. This metric tracks the stability between BTC deposits to exchanges (sometimes for promoting) and withdrawals (usually related to accumulation). A constant internet adverse move signifies extra Bitcoin is being withdrawn than deposited.

At the moment, about 3,600 BTC are being withdrawn from exchanges each day by retail merchants. This sustained pattern is broadly seen as a bullish sign, reflecting investor confidence and decreased promoting stress. It additionally implies that many market contributors are selecting to carry moderately than commerce or liquidate at present costs. As Bitcoin stabilizes close to essential ranges, this persistent withdrawal pattern might present the gas wanted for the subsequent leg up within the ongoing bull cycle.

Bitcoin Caught Between Uncertainty And Energy As Netflows Sign Accumulation

Bitcoin is presently navigating a part of excessive uncertainty because it struggles to ascertain a transparent route. After peaking close to $112,000, the worth has entered a uneven consolidation, with bulls on the lookout for a breakout above the all-time excessive and bears anticipating a pointy correction. The sentiment stays divided, fueled by rising volatility and rising macroeconomic dangers.

One of many key exterior elements weighing on the crypto market is the bond market. Rising U.S. Treasury yields are heightening systemic stress and affecting investor habits throughout danger property, together with cryptocurrencies. As yields climb, the price of capital will increase, making speculative investments extra delicate to broader financial alerts.

But amid the uncertainty, on-chain information continues to counsel robust underlying demand for Bitcoin. In keeping with prime analyst Axel Adler and insights from CryptoQuant, Bitcoin’s common Netflow has turned adverse since March 10, 2025. Which means every day, roughly 3,600 extra BTC are being withdrawn from exchanges than deposited, indicating sustained accumulation by retail traders and long-term holders.

This pattern, marked in inexperienced, stands in sharp distinction to the height Netflow noticed in December 2022, when over 12,100 BTC flowed into exchanges, signaling heavy promote stress. Immediately’s adverse move factors to a more healthy market construction, the place provide on exchanges steadily declines. Whereas the worth could lack short-term route, this persistent withdrawal pattern helps a bullish case over the medium time period, because it displays decreased promoting stress and long-term investor confidence.

BTC Value Holds Key Assist As Bulls Try Restoration

Bitcoin is presently buying and selling at $105,338, exhibiting resilience after retesting the $103,600 help degree. This space has held firmly regardless of latest volatility and stays a essential demand zone for bulls to defend. The chart exhibits BTC bouncing off the 200-period SMA (crimson line), with a gentle uptrend forming on the 4-hour timeframe. Value is now making an attempt to reclaim the 34 EMA ($105,554) and problem the 50 and 100 SMAs, each of which converge close to $106,900 and act as dynamic resistance.

The latest decrease excessive round $109,300 stays a major barrier for bullish continuation. A decisive breakout above this degree would doubtless sign a recent try on the all-time excessive close to $112,000. On the draw back, dropping the $103,600 mark would open the door for a deeper correction, doubtlessly dragging BTC again towards the $100,000 psychological degree.

Quantity has been comparatively muted in the course of the newest bounce, which suggests the transfer could lack conviction until accompanied by a spike in shopping for stress. For now, Bitcoin stays range-bound between $103,600 and $109,300, with bulls needing to maintain larger lows and reclaim short-term transferring averages to regain momentum. The approaching days will likely be pivotal in figuring out whether or not BTC resumes its uptrend or enters a broader consolidation part.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.