Whereas institutional adoption is in full circulate and macro-conditions are driving retail buyers to Bitcoin, most merchants are extraordinarily bullish on Bitcoin. So is the Hyperliquid whale, James Wynn.

However his publicized trades is perhaps why BTC remains to be dropping regardless of a brand new all-time excessive two weeks in the past. Are merchants deliberately urgent Bitcoin decrease to set off Wynn’s liquidations?

James Wynn’s Bitcoin Saga Would possibly Not Be Serving to the Market

At the moment, Bitcoin trades close to $105,000, down 11% from its all-time excessive two weeks in the past. However bullish headlines counsel BTC must be rallying proper now.

This week alone, South Korea’s new president has sparked ETF hope, a Spanish espresso chain deliberate a $1 billion buy, and Russia made new Bitcoin developments. Even Trump Media raised $2 billion to put money into BTC.

So, why is the market stalling? Some level fingers at James Wynn, the Hyperliquid whale, whose outsized lengthy bets and public outbursts have drawn scrutiny.

At the moment, on‐chain knowledge reveals Wynn’s leveraged lengthy was liquidated for 240 BTC (about $25.16 million) when Bitcoin dipped towards his $104,720 liquidation worth.

In the meantime, his tweets reveal frustration, as he accused market makers of manipulation. These tweets counsel he believes coordinated sellers intention to hunt his liquidation.

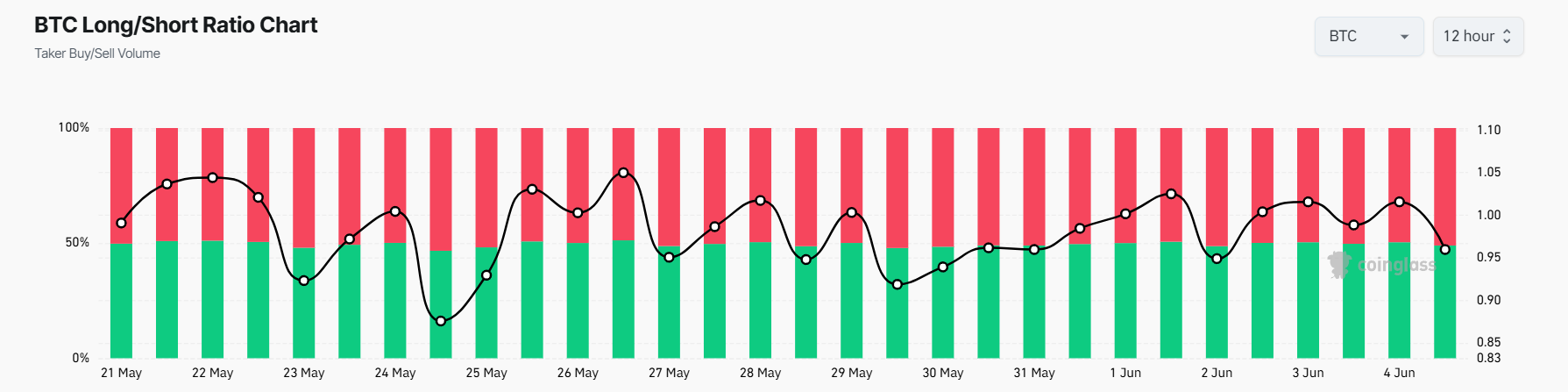

A look at right now’s 12-hour lengthy/quick ratio reveals shorts at 51.03% and longs at 48.97%. Although quick quantity marginally exceeds lengthy quantity, the divergence is slight.

If bearish sentiment really stemmed from a vendetta to liquidate Wynn, one may count on a extra pronounced quick skew and sudden, large inflows into promote orders.

As a substitute, on‐chain circulate aligns extra with total revenue‐taking after the $111,000 peak two weeks in the past.

World macro and crypto‐particular triggers additionally weigh on worth. Stories of revenue‐taking by giant establishments and merchants preemptively decreasing threat amid unsure price‐minimize cues have contributed to promoting stress.

Whale Psychology and Self-Fulfilling Strikes

Wynn’s colossal positions can amplify volatility. When a effectively‐identified whale posts liquidation costs publicly, some merchants might view it as an invite to wager in opposition to him.

Excessive‐leverage longs usually carry cascading dangers. One compelled sale triggers margin calls and deeper worth declines. But saying whales single-handedly drive worth disregards broader market forces.

Merchants may quick or promote just because Bitcoin’s rally felt overextended. Wynn’s tweets may reinforce bearish sentiment, however they don’t create it.

For instance, if Bitcoin breaches $104,500 and triggers Wynn’s subsequent liquidation, that compelled promote might prolong declines to $103,500 or decrease.

However that transfer often displays current momentum, not a brand new catalyst. Market makers and enormous merchants usually hedge positions slightly than coordinate assaults on people.

Wynn’s narrative frames his liquidations as concerted manipulation.

In actuality, any spike in promote orders at his thresholds probably comes from algorithmic buying and selling and liquidations. That is frequent in excessive‐leverage markets.

Conclusion: Extra Than a Whale’s Woes

James Wynn’s leveraged longs and colourful tweets add drama to Bitcoin’s pullback. He may exacerbate volatility close to his liquidation thresholds.

However attributing the broader 11% drop solely to his positions oversimplifies market dynamics. Revenue‐taking, technical resistance, and shifting macro cues play bigger roles.

Whereas Wynn’s compelled gross sales might nudge costs decrease in tight markets, the first drivers lie past one dealer’s drama.

The publish Is Bitcoin Worth Dropping Due to James Wynn’s Lengthy Bets? appeared first on BeInCrypto.