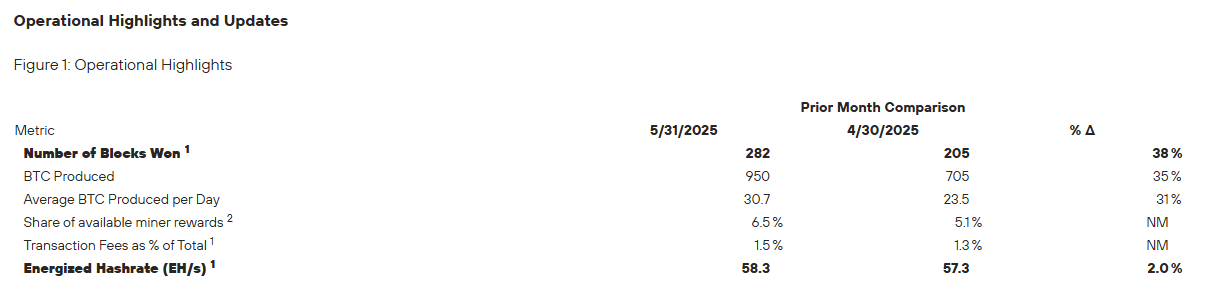

At the moment, MARA Holdings, Inc. (NASDAQ: MARA) reported a file excessive month of bitcoin manufacturing in Might 2025, mining 950 BTC value over $100 million on the time of writing. A 35% improve from April and the very best month-to-month output for the reason that April 2024 halving occasion. MARA didn’t promote any bitcoin in Might.

“Might was a record-breaking month for MARA with 282 blocks received, a 38% improve over April and a brand new month-to-month excessive,” mentioned the Chairman and CEO of MARA Fred Thiel. “Our whole bitcoin holdings surpassed 49,000 BTC throughout Might and the 950 bitcoin produced have been essentially the most for the reason that halving occasion in April 2024.”

The corporate mined 282 blocks throughout the month, a 38% rise over the earlier month, and now holds 49,179 BTC, value roughly $5.23 billion on the time of writing.

“Our totally built-in tech stack is a key differentiator, and MARA Pool is the one self-owned and operated mining pool amongst public miners, providing larger management and effectivity,” acknowledged Thiel. “Working our pool means no charges to exterior operators and retention of the total worth of block rewards. Manufacturing in Might also benefitted from block reward luck. Since launch, MARA Pool’s block reward luck has outperformed the community common by over 10%, contributing to our industry-leading block manufacturing.”

Operational effectivity additionally improved, with energized hashrate rising 2% from 57.3 EH/s to 58.3 EH/s. MARA’s common every day bitcoin manufacturing hit 30.7 BTC, which is 31% greater than the final month from April.

“We stay laser-focused on reworking MARA right into a vertically built-in digital vitality and infrastructure firm,” commented Thiel. “We imagine this mannequin provides us tighter operational management, improves cost-efficiency, and makes us extra resilient to shifts within the broader financial system.”

Earlier this month, on Might 8, MARA launched its first quarter 2025 earnings, posting 213.9 million {dollars} in income. A 30 p.c improve over the identical interval final 12 months. The corporate’s bitcoin holdings surged 174 p.c 12 months over 12 months, rising from 17,320 BTC to 47,531 BTC as of March 31, with an estimated worth of three.9 billion {dollars} on the time. In Q1, MARA mined 2,286 BTC and purchased a further 340 BTC. Operational efficiency additionally strengthened, with energized hashrate practically doubling from 27.8 EH/s to 54.3 EH/s, and price per petahash per day enhancing by 25 p.c.