Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

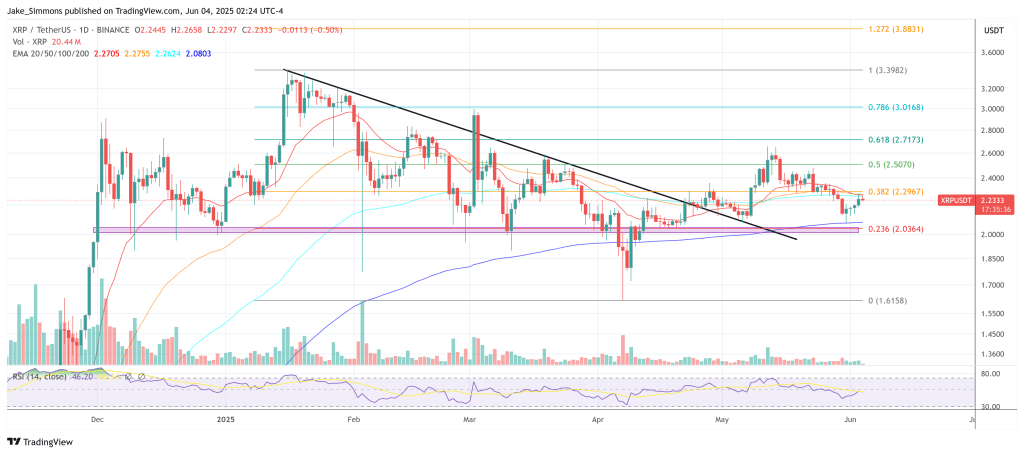

XRP’s weekly construction has seldom appeared as compressed because it does within the chart printed this morning by unbiased analyst Maelius. The view pulls information from the BITSTAMP feed and applies a 50-period exponential transferring common (EMA) in blue, at present monitoring at roughly $1.78.

This XRP Chart Screams 2017

Worth is perched above that dynamic help zone at $2.25, including 3.33% to date within the current weekly candle, and has spent the previous 4 months knitting out what the analyst calls a “giga bull flag.” The flag is outlined by a sequence of progressively decrease weekly highs that cease simply in need of the $3.40 line and better swing-lows that backside close to $1.61, making a converging wedge whose decrease edge and the rising EMA50 now coincide.

Maelius overlays the 2017 XRP advance—scaled to the present log axis—as an instance why the sample issues. Within the earlier cycle the token erupted vertically as soon as the flag was resolved, blasting from sub-dollar costs to a peak above $3.00 in a matter of weeks.

Associated Studying

The black schematic sketched on the right-hand margin recreates that transfer and initiatives it ahead: as soon as consolidation ends, the fractal implies a breakout first by the $4 shelf and in the end into the double-digit territory. The label “XRP 2017” is pinned to the $19 mark, the extent the place the composite hint tops out on this overlay.

Momentum information beneath the chart reinforce the comparability. The weekly Relative Energy Index (RSI) printed two pronounced peaks within the 2017 run, separated by a flat plateau; Maelius has marked these crests “1” and “2” on each the historic part and the present vary.

Associated Studying

The primary modern-cycle surge despatched RSI briefly into the high-80s earlier this 12 months and has since cooled again towards the mid-40s, a zone the analyst shades “FLAT.” An arrow then extends towards the mid-90s, signalling that Maelius expects a minimum of yet another momentum pulse earlier than the construction is exhausted.

From a purely technical perspective essentially the most instant ranges to look at are the higher flag boundary close to $2.50 and the EMA-anchored help round $1.80. A weekly shut above the previous would full the flag and open the best way to the $4.40 and $6.00 horizontals seen on the value scale, whereas a decisive break under $1.80 would invalidate the sample and depart the market leaning on the $1.30 cluster the place the EMA turned larger final 12 months.

Crucially, the analyst frames his outlook in risk-aware phrases: even the “worst-case” situation he sketches nonetheless contains one ultimate impulse wave. “Worst case is there may be just one impulse left. Bearish, proper?!” he writes.

As all the time, merchants might be on the lookout for affirmation from quantity and broader market sentiment earlier than treating the fractal as greater than an instructive historic rhyme, however the chart makes clear {that a} single weekly candle settling above the $2.50 deal with could possibly be all it takes to remind contributors of how shortly XRP has moved prior to now.

At press time, XRP traded at $2.23.

Featured picture created with DALLE, chart from TradingView.com