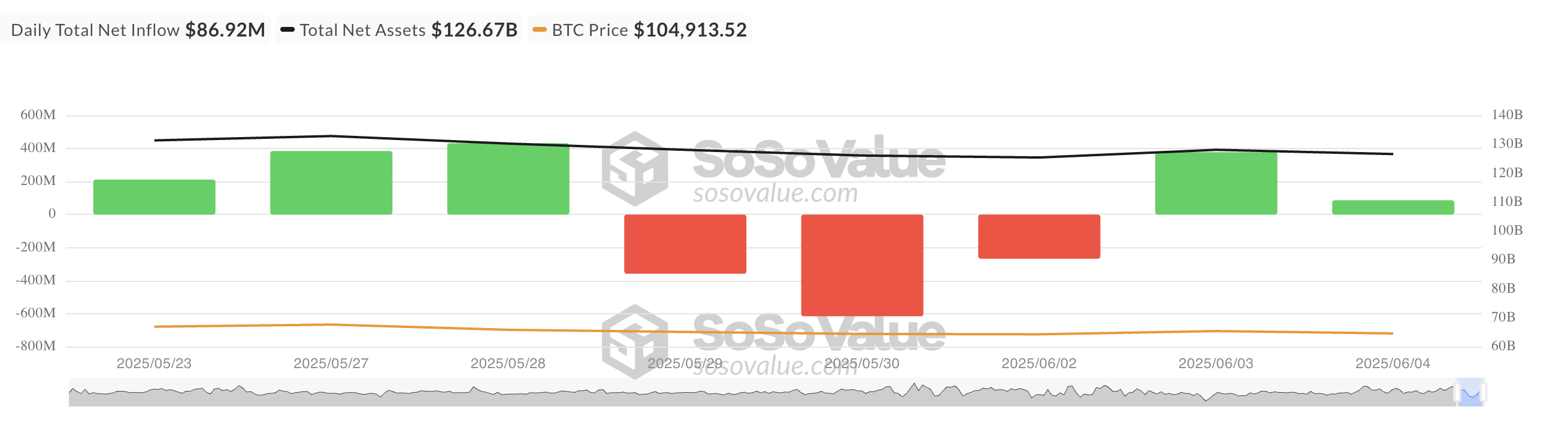

Bitcoin exchange-traded funds (ETFs) recorded a web influx of over $85 million on Wednesday, signaling that institutional curiosity within the asset class stays intact.

Nevertheless, the determine marks a pointy pullback from the $378 million registered on June 3, highlighting a slowdown in investor urge for food.

Bitcoin Merchants Pull Again as ETF Inflows Decline

On Wednesday, web inflows into US-listed spot BTC ETFs totaled $86.92 million. Though this determine marked continued investor curiosity in these funding funds, it represented a 77% decline from the $378 million posted on June 3.

The slowdown is essentially attributed to BTC’s worth stagnation across the $105,000 mark since Could 30. The coin’s incapacity to interrupt previous this essential resistance degree has dampened investor sentiment and curtailed recent capital inflows into US spot BTC ETFs.

Yesterday, BlackRock’s IBIT led the pack with the best day by day inflows, totaling $283.96 million, bringing its complete historic web influx to $48.78 billion.

However, Constancy’s FBTC noticed the biggest web outflow amongst these ETFs, with $197.04 million exiting the fund.

BTC Stalls Under $105,000: Futures Dip Whereas Choices Merchants Eye Upside

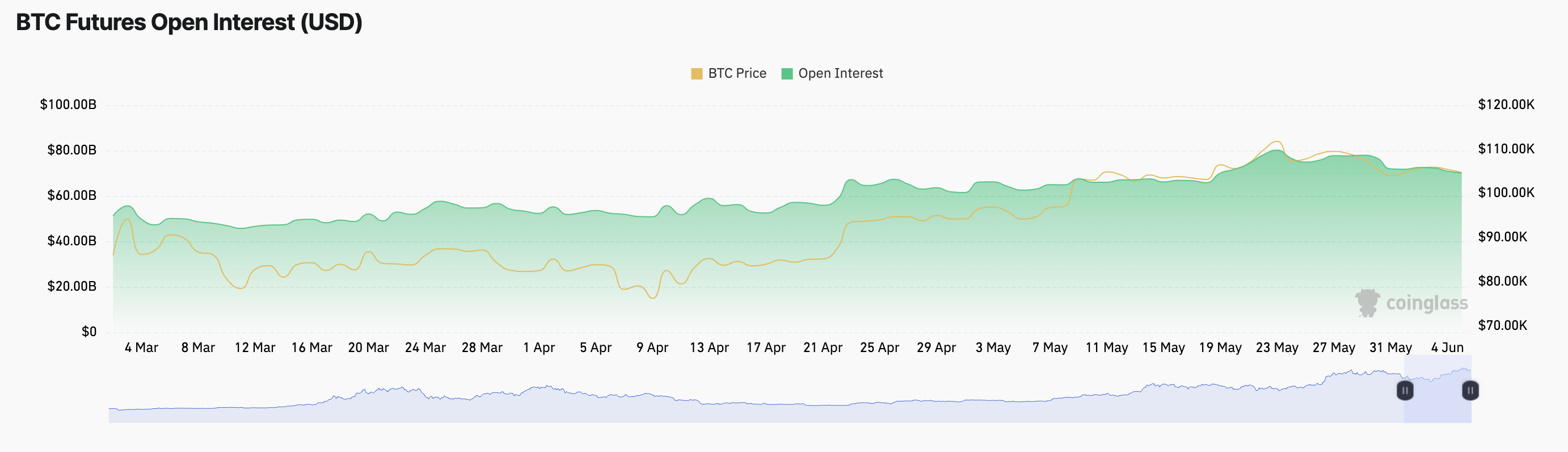

Presently buying and selling at $104,913, BTC is down 1% over the previous day, reflecting the prevailing sideways pattern. On the similar time, its futures open curiosity has declined barely, suggesting lowered exercise and a basic pause in market participation.

At press time, the coin’s futures open curiosity is at $70.09 billion, down by a modest 1%. This slight drop means that some merchants are lowering their positions amid the continuing worth stagnation across the $105,000 mark.

It indicators that market contributors are holding their palms from heavy trades and ready for a break above the important thing psychological resistance or an additional retracement.

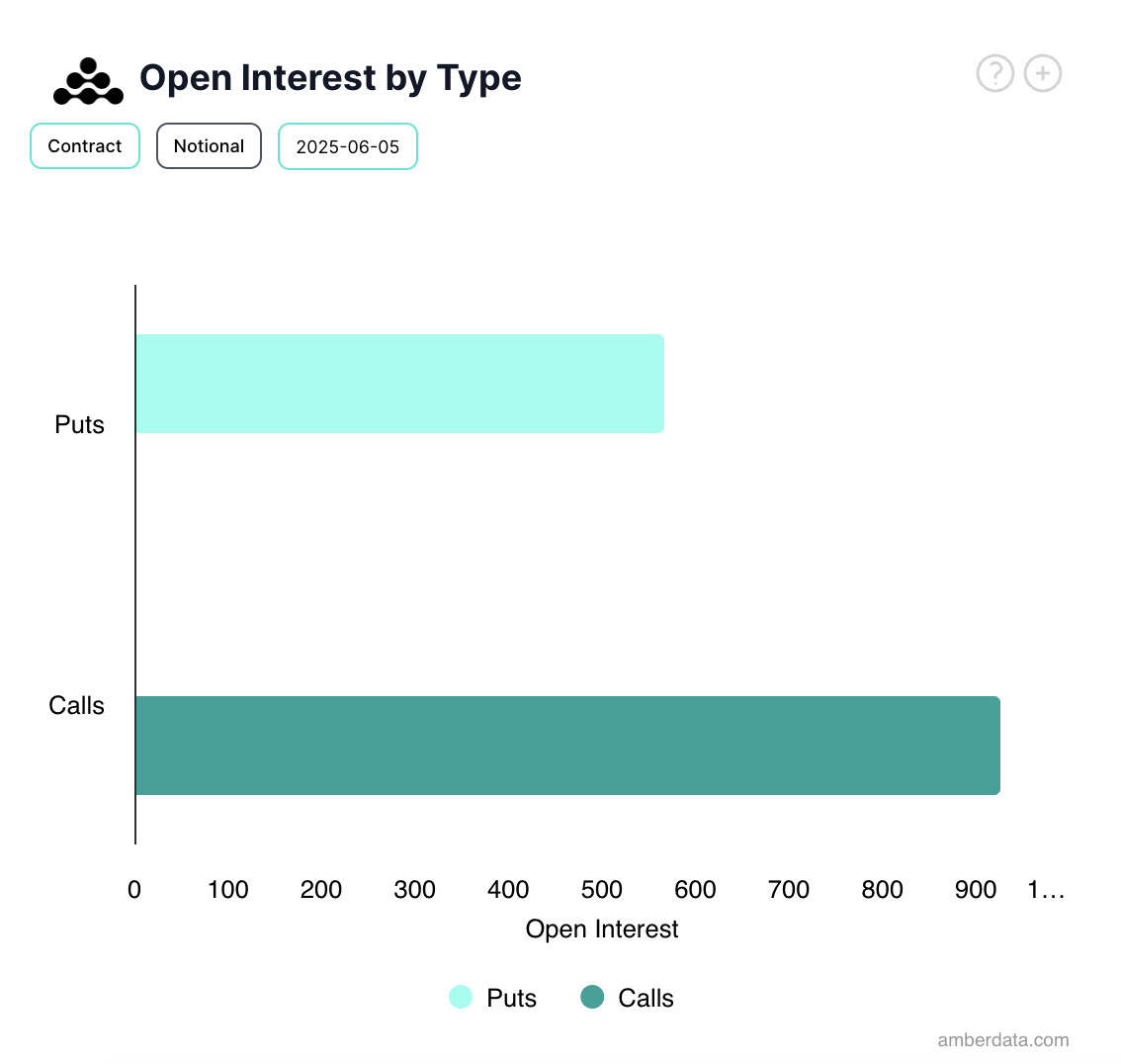

Curiously, regardless of BTC’s lackluster efficiency over the previous day, the choices market reveals optimism. In accordance with Deribit, the demand for name choices—bets that the worth will rise—is choosing up, hinting that some merchants are positioning for a possible upside breakout.

The dip in ETF inflows displays short-term warning because of BTC’s latest muted worth efficiency. The final market pattern reveals that buyers are ready for a catalyst to set off a rally previous $105,000 or an additional decline from that worth degree.

The submit ETF Inflows Tumble as Bitcoin Stalls Under $105,000 | ETF Information appeared first on BeInCrypto.