- Ethereum’s value momentum is slowing regardless of a current 48% rally, with a 17% drop in TVL and rising competitors from Solana suggesting weaker community fundamentals.

- Decentralized change exercise is up, however Ethereum has slipped to 3rd place behind BNB Chain and Solana, as new tasks discover different chains.

- Institutional curiosity stays sturdy, with $700M flowing into ETH ETFs not too long ago, however futures markets present little bullish conviction, making a breakout previous $3K unlikely for now.

Ethereum’s Value Strikes, However the Community Tells a Completely different Story

Ethereum made a stable bounce — 48% between Might 5 and June 5 — however that momentum’s slowing. ETH has been flirting with the $2,700 mark, but hasn’t actually pushed previous it. Regardless of sturdy beneficial properties, there’s some hesitation within the air. An enormous a part of that comes from weak community knowledge and rising competitors. Ethereum’s whole worth locked (TVL) slid 17% up to now month, touchdown at 25.1 million ETH. In the meantime, Solana’s TVL ticked up by 2%, hitting 65.8 million SOL. That hole is shrinking.

A number of the drop got here from key gamers. Sky, which was MakerDAO, misplaced almost half its deposits. Curve Finance slipped 24%. And whereas which may sound grim, there’s a twist — community charges on Ethereum jumped 150% over the identical stretch. Which may sound unhealthy, however really, it boosts ETH’s burn price and helps curb inflation. So, much less ETH floating round might assist in the long term, even when it stings quick time period

DEX Exercise Heats Up, However Ethereum Isn’t Main

An enormous purpose for these increased charges? Decentralized change (DEX) exercise has gone wild. Uniswap’s seeing over $2.6 billion in each day quantity this June, in comparison with $1.65 billion in early Might. That sort of quantity needs to be factor for ETH, proper? Kinda. The issue is, whereas Ethereum’s DEX exercise has surged, others have surged more durable. Proper now, Ethereum’s really third behind BNB Chain and Solana.

Now, it’s value noting — BNB’s low charges may inflate their stats a bit. However Solana? Its numbers are holding up even whenever you regulate for that. It’s gaining actual traction. Plus, some new heavy-hitting tasks like Hyperliquid and Pump are skipping Ethereum altogether. They’re both launching their very own chains or selecting different networks. That claims lots about the place builders see higher alternatives.

Futures, ETFs, and the $3K Ceiling

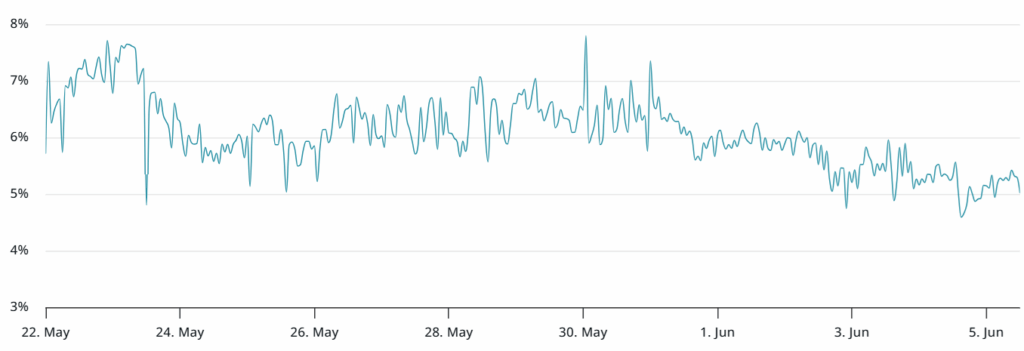

ETH futures provides you a peek into how professionals really feel — and proper now, they’re not overly bullish. Usually, ETH futures commerce at a 5–10% annualized premium. As of June 5, it was proper at 5%, down a notch from final week. That’s impartial territory. Nothing too bullish. And we haven’t seen that premium push previous 10% since again in January, which says lots about market confidence (or the dearth of it).

Nevertheless it’s not all sideways information. Institutional traders are nonetheless eyeing ETH. Between Might 22 and June 4, U.S.-based spot Ether ETFs noticed $700 million in internet inflows — with zero days of outflows. That sort of regular curiosity is a giant purpose ETH has held above $2,500. So yeah, help is there. Nonetheless, regardless of the sturdy backing from establishments, most indicators counsel a clear break above $3K won’t be within the playing cards… at the least not but.