Cryptocurrency, significantly Bitcoin (BTC), has typically been touted as having the potential to ship huge good points for traders. Nonetheless, many now consider Bitcoin is also the important thing to retiring early.

With its spectacular development and the promise of long-term worth, Bitcoin presents a singular alternative for these in search of monetary independence. Thus, some specialists have outlined a number of methods for reaching retirement by Bitcoin investments.

How A lot Bitcoin Do You Have to Retire with $100,000 Yearly?

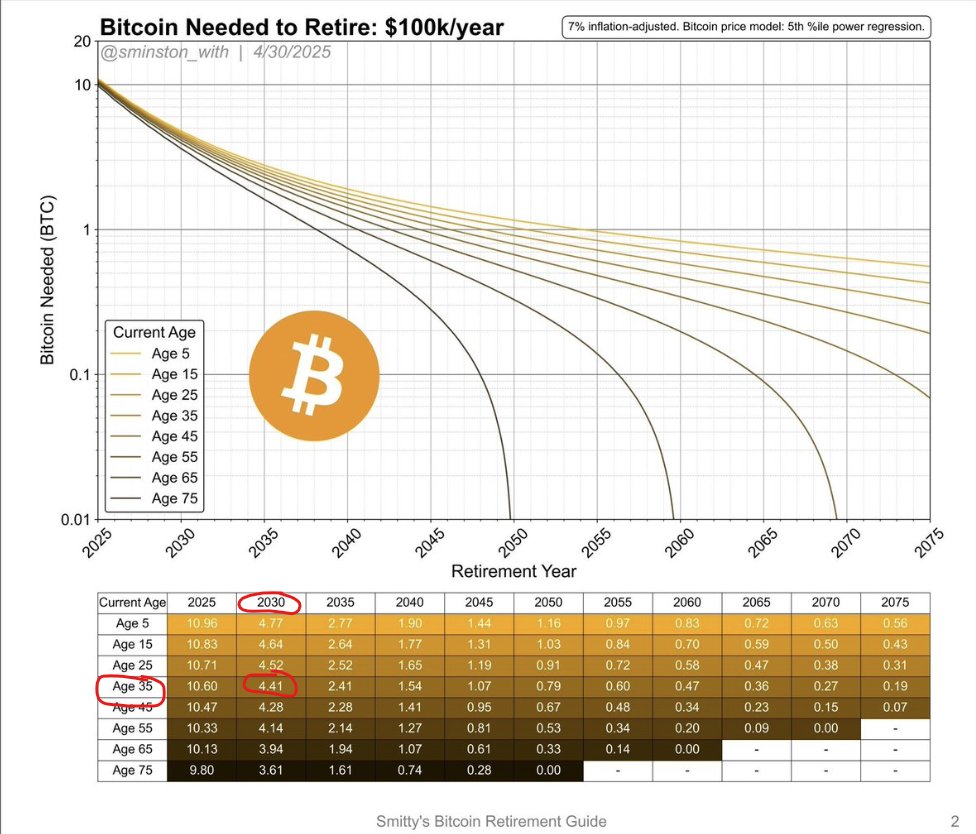

David Battaglia, a cryptocurrency analyst, just lately shared an in depth evaluation on X. He introduced a mannequin that estimates the quantity of Bitcoin required to retire with $100,000 per 12 months by factoring in two key parts.

First, a 7% annual inflation charge is taken into account, which adjusts for the growing value of dwelling and the reducing worth of cash over time. Second, the mannequin makes use of a Bitcoin worth mannequin primarily based on a fifth percentile energy regression. This offers a conservative estimate of Bitcoin’s future worth.

The info reveals that the variety of BTC wanted for retirement is influenced by the 12 months wherein retirement begins and the person’s age. The sooner the retirement date, the extra BTC is required.

For instance, somebody aged 35 and planning to retire in 2030 would require roughly 4.41 BTC ($460,000 at present costs).

“This means that the worth of Bitcoin in 2030 can be excessive sufficient for 4 BTC to be price an quantity that, when invested or spent progressively, would give you $100,000 yearly,” Battaglia mentioned.

Battaglia defined that if traders withdraw 4% or its inflation-adjusted equal yearly (frequent in Monetary Independence, Retire Early), these 4 BTC needs to be price at the very least $2,500,000 in 2030. Meaning every BTC needs to be price $584,112 in 2030.

“The secret is inflation and Bitcoin’s worth development: The mannequin adjusts the worth of $100,000 for a 7% annual inflation, which means that the buying energy of $100,000 in 2030 will likely be decrease than in 2025. Moreover, the worth of Bitcoin grows in line with the regression mannequin, which reduces the quantity of BTC wanted over time (the descending strains),” he added.

He steered two main strategies to entry this revenue: promoting Bitcoin progressively over time or entrusting the belongings to an establishment for a set annual payout.

Nonetheless, he cautioned in opposition to the dangers of third-party custody. Battaglia additionally emphasised the significance of tax technique, recommending residency in a zero-tax jurisdiction like Paraguay to maximise returns.

“What is obvious is that we’re getting nearer to the purpose the place the worth of Bitcoin will present monetary independence for holders for the remainder of their lives. The dangerous information is that there isn’t sufficient Bitcoin for individuals who don’t take motion within the coming years. We additionally assume a really modest Bitcoin worth for 2030,” he remarked.

Complementing Battaglia’s method, an analyst who goes by the pseudonym Hornet Hodl has developed a Bitcoin calculator impressed by the FIRE mannequin utilized in conventional finance.

This device incorporates numerous Compound Annual Progress Fee (CAGR) fashions tailor-made to Bitcoin’s distinctive market cycles. The calculator permits customers to venture Bitcoin’s future worth and decide sustainable withdrawal charges primarily based on completely different development situations.

“It is a nice retirement planning device for Bitcoiners. Select a mannequin, select when you will retire, estimate the quantity,” Fred Krueger said.

As an example, Mannequin 6, which makes use of a conservative median line of the Energy Regulation, balances early-stage worth development with diminishing returns in later years, guaranteeing lifelike projections for retirement planning.

This device helps traders estimate how a lot Bitcoin they want and the way to withdraw funds with out depleting their portfolio. By smoothing out yearly returns with CAGR, Hodl’s calculator offers a sensible framework for long-term retirement planning with crypto.

May Bitcoin Result in Early Retirement? Mark Moss Explains His 5-Yr Plan

In the meantime, Mark Moss presents a definite technique targeted on tax effectivity and asset preservation. In a YouTube video, Moss outlined a “5-year retirement plan.”

It includes accumulating Bitcoin, leveraging it for tax-free loans, and utilizing the asset’s development to generate wealth with out depleting the principal.

“The wealthy use debt to leverage investments and create further revenue streams. Whereas the typical individual makes use of debt to purchase issues that make wealthy folks richer. Don’t do it that means. We would like to have the ability to purchase belongings that make us extra rich. Okay, let’s discuss concerning the cheat code. Now, the cheat code is Bitcoin,” Moss mentioned.

Moss argues that this methodology permits the Bitcoin portfolio to proceed appreciating whereas offering a gentle revenue stream. He claims this method can result in retirement in as little as 5 years, because the borrowed funds can cowl dwelling bills whereas the underlying asset grows in worth, doubtlessly leaving a legacy for future generations.

“We consider that by the top of that runup in about 5 years, Bitcoin will likely be about the identical dimension of world retailer worth belongings as gold. Bitcoin and gold will likely be about on par, about 20 trillion every,” he claimed.

Nonetheless, not everybody agrees with crypto’s retirement potential. Sibel, a crypto dealer, argued that it’s practically unattainable to “retire” from crypto.

“You may’t ‘retire’ from crypto. Have you ever ever seen somebody from our trade that made it and left? Besides folks that needed to ran away. Even these folks turned again with newly created accounts. You turned too connected to playing in some unspecified time in the future that it’s unattainable to depart,” she famous.

She highlighted how even high-profile figures who made thousands and thousands briefly left the trade, solely to return in search of extra wealth and clout. Sibel means that the crypto house features like an countless on line casino, the place people can by no means totally break away from the buying and selling cycle, irrespective of how a lot they’ve earned. The lure of revenue and recognition retains folks tethered to the trade, no matter their preliminary intentions to retire.

In conclusion, Bitcoin presents a singular alternative for early retirement by numerous methods, from David Battaglia’s inflation-adjusted mannequin to Mark Moss’s tax-efficient method.

Instruments just like the Bitcoin FIRE calculator additionally assist traders plan their retirement. Nonetheless, as Sibel factors out, the crypto market’s addictive nature could make it tough for some to step away totally. Whereas Bitcoin can present a path to monetary independence, it requires cautious planning, market understanding, and self-discipline.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. The methods mentioned are speculative and will not materialize as anticipated. Cryptocurrency investments are extremely risky and contain important dangers. All the time conduct thorough analysis and seek the advice of with a monetary advisor earlier than making any funding selections.

The publish How you can Retire Early with Bitcoin (BTC): Specialists Reveal Key Methods appeared first on BeInCrypto.