- JPMorgan will quickly settle for Bitcoin and crypto ETFs like IBIT as collateral for loans.

- The financial institution will depend crypto holdings in internet value assessments for wealth shoppers.

- This marks a significant reversal from CEO Jamie Dimon’s earlier anti-crypto stance.

In a significant pivot from its historically cautious stance on crypto, JPMorgan is making ready to just accept Bitcoin and crypto-based ETFs as collateral for loans. This consists of merchandise like BlackRock’s iShares Bitcoin Belief (IBIT), marking an enormous milestone for the $3.6 trillion banking big. The choice displays a rising wave of crypto adoption inside conventional finance circles.

Regardless of JPMorgan CEO Jamie Dimon’s previous criticism of Bitcoin—calling it a “Ponzi scheme” simply months in the past—the financial institution is now quickly increasing its crypto publicity. With President Trump’s administration pushing pro-crypto insurance policies, establishments like JPMorgan are being nudged into alignment with the brand new regulatory local weather, making strikes that appeared unlikely only a yr in the past.

A Main Shift in Conventional Finance’s Crypto Technique

JPMorgan’s newest transfer sends a robust message: crypto belongings are actually being handled on par with conventional monetary devices. The financial institution is just not solely accepting Bitcoin ETFs for collateral however will even issue crypto holdings into wealth assessments for shoppers. This implies traders’ BTC and ETF positions may instantly affect their borrowing energy and internet value calculations.

This coverage change is anticipated to roll out within the coming weeks and marks one other large step towards crypto’s institutional mainstreaming. It additionally provides weight to a broader trade development the place main banks, as soon as skeptical, are actually racing to innovate within the area resulting from altering market circumstances and regulatory assist.

Crypto Market Positive factors Additional Legitimacy

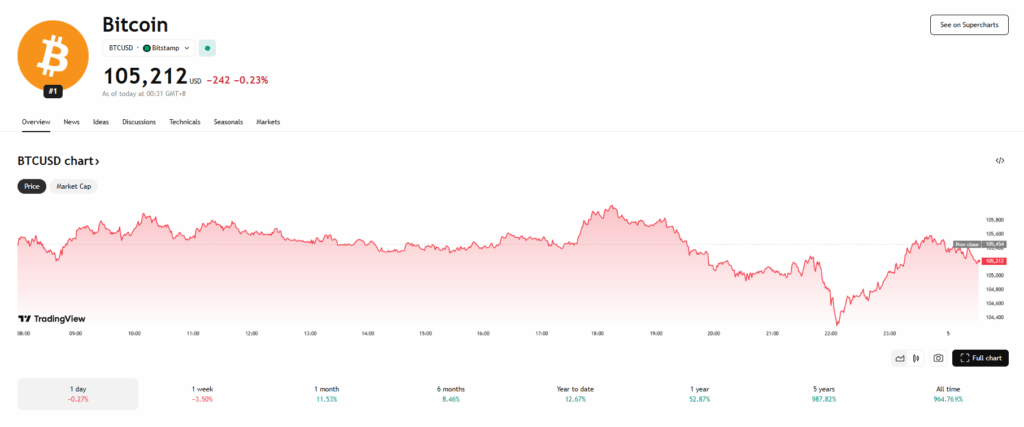

JPMorgan’s resolution is very important given its CEO’s long-standing opposition to crypto. The stark distinction between Dimon’s public opinions and the financial institution’s inner strikes underscores how highly effective the momentum for crypto integration has develop into. With Bitcoin hitting a brand new excessive of $111,000, conventional finance can now not ignore the market’s influence.

This shift might spark a domino impact amongst different establishments. As crypto ETFs achieve legitimacy and utility, extra banks may observe swimsuit—providing shoppers new methods to leverage their digital belongings inside legacy programs. It’s now not a query of if crypto goes mainstream—it’s occurring now.