- Abraxas Capital shorted main tokens together with SUI, anticipating deeper market drops throughout the latest crypto downturn.

- SUI worth is hovering round $3, a key assist—holding it might result in a rebound towards $3.90 or greater, however breaking it’d ship the token tumbling beneath $2.

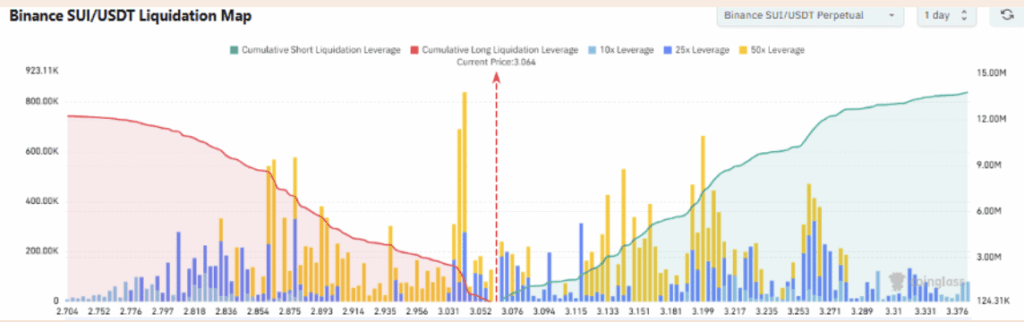

- Liquidation maps present intense stress from each longs and shorts, with $13M in shorts in danger if SUI rallies, and susceptible longs able to fold if assist breaks.

Abraxas Capital didn’t flinch throughout the newest crypto shake-up—they jumped straight into shorting motion. Based on OnChain Lens, the agency opened shorts on heavyweights like Bitcoin, Ethereum, Solana, and newer names like Hyperliquid and Sui Community. These trades, tracked by way of two wallets, weren’t refined. They had been anticipating issues to slip… onerous.

SUI, specifically, took a success consequently. And with that drop to $3.00, the token now stands at a vital junction. Whether or not that is only a small pullback—or the beginning of a breakdown—is the query.

Will $3 Be the Bounce Level or the Breaking Level?

SUI’s worth hovering round $3 might go both approach. It’s a key stage—if it holds, there’s a shot at reclaiming $3.90 and possibly pushing again up towards its latest excessive close to $5.36. But when that assist cracks, look out beneath. The following pit stops might be down within the $2.00 and even $1.38–$1.50 zone, the place patrons beforehand stepped in again in March and April.

Technical indicators aren’t screaming bearish simply but, although. The MACD histogram remains to be within the inexperienced, which means momentum hasn’t turned totally bitter. However the chart’s displaying some decrease highs, which—in the event that they proceed—might sign deeper hassle forward.

If bulls do step in and worth bounces from $3.00, there’s a shot at shocking the bears. A brief-covering rally might ship SUI ripping upward. However that’s an enormous “if.”

Liquidation Stress Builds From Each Sides

Zooming into the liquidation map, it’s a tense setup. There’s roughly $13.78 million price of brief positions stacked between $3.05 and $3.39—a lot of them utilizing excessive leverage. If SUI pushes by way of that $3.06 stage, it might kick off a brutal squeeze as these shorts get torched.

Nevertheless it’s not simply shorts which are susceptible. Longs are piling up too—particularly between $2.70 and $2.95. If the worth slips below $3 once more, that would set off a panic unwind from bulls hoping to guard positive aspects—or restrict the injury.

Proper now, sentiment is tilted towards extra draw back. However in crypto, sentiment flips quick. All it takes is a clear transfer previous resistance or a brief squeeze spark to alter the entire sport.