- BNB is buying and selling at $644, recovering above its 100-day EMA, however faces resistance on the $700 stage.

- RSI is selecting up, and the EMAs stay bullishly aligned, however a drop beneath $624 might drag it all the way down to $600 or decrease.

- Regardless of the value rebound, open curiosity and funding charges in derivatives sign rising bearish strain from quick sellers.

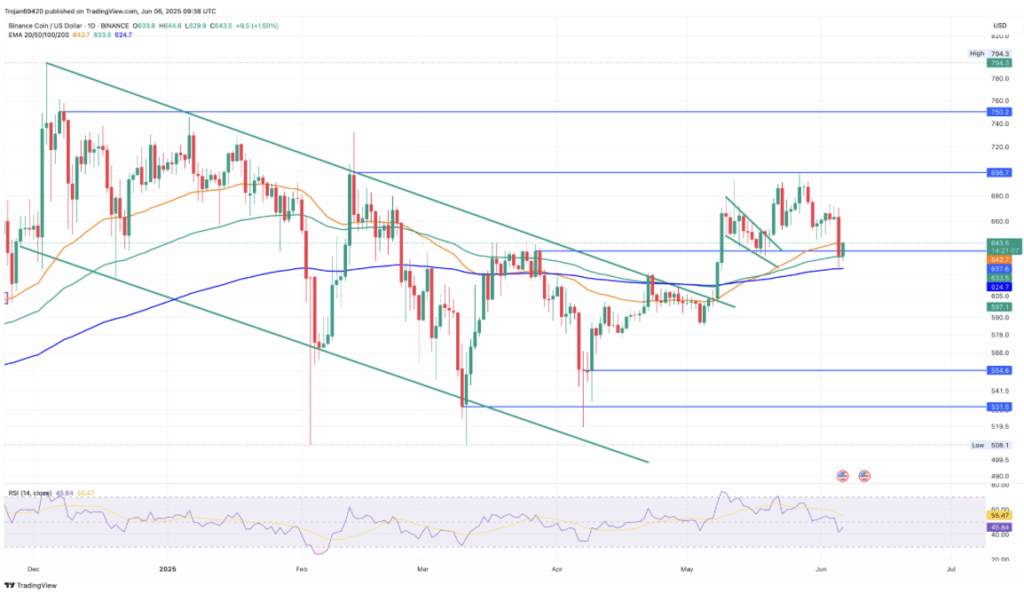

Binance Coin (BNB) is displaying indicators of life once more after the current market-wide wreck. It’s buying and selling at $644—simply above that 100-day EMA line, which is performing like a skinny lifeline proper now. After Thursday’s tough 4.4% dip, BNB bounced about 2% on Friday, however let’s be trustworthy—it’s nonetheless acquired work to do.

Merchants are watching carefully to see if this mini bounce has sufficient steam to get BNB again close to the $700 mark. That’s a serious psychological barrier, and up to now, the coin’s been getting rejected arduous earlier than it may possibly even sniff it. Nonetheless, with the value hovering above the 50-day and 100-day EMAs, there’s at the very least a glimmer of hope for bulls hanging in there.

Technicals Present a Tug-of-Warfare in Movement

On the day by day chart, BNB’s value construction is sending combined indicators. After getting knocked round final week, dropping over 1%, and dipping one other 2.5% early this week, the coin is clawing its approach again. Friday’s intraday push helped it stick above that 100-day EMA at $633, and it’s additionally barely clearing the 50-day EMA at $642.

Momentum-wise, RSI dipped beneath impartial however is curling again up—if it may possibly climb above that midway level once more, it might verify a potential short-term bounce. The EMAs (50, 100, 200) are nonetheless aligned in a bullish order, in order that’s at the very least one thing to hold onto.

If BNB can get a powerful day by day shut above $642, bulls may begin gearing up for an additional shot at $700. But when the ground falls by means of and value slips below the 200-day EMA at $624? Issues might unravel quick, with $600—and even $554—coming again into play.

Derivatives Market Hints at Bother Below the Hood

Now right here’s the place it will get a bit shaky. Even with the spot value recovering, the derivatives market isn’t shopping for the bounce. Open curiosity is down 3.61%, touchdown at round $757 million. That’s not simply noise—it reveals some merchants are backing away.

Liquidations are additionally stacking up—$2.18 million wiped in simply 24 hours. Longs acquired torched. The lengthy/quick ratio is all the way down to 0.7361, which principally means shorts are flooding in. And with the funding fee dropping to 0.0178%, it’s clear that bears are prepared to cough up charges simply to remain quick.

So yeah, BNB’s holding floor for now, however the basis? It’s trying a little bit shaky.