HBAR has not too long ago skilled a decline in worth, as merchants’ optimism fades, marking a shift in the direction of bearish sentiment.

This downward development, mixed with fading bullish indicators, means that the altcoin could also be heading for a extra extended interval of worth declines.

HBAR Merchants Are Unsure

Up to now 10 days, HBAR’s funding charge has seen two shifts from optimistic to unfavourable, the primary prevalence in a month. This transformation in sentiment indicators that merchants are adjusting their positions, favoring brief positions over lengthy ones.

The growing dominance of shorts signifies that market individuals are betting on an additional worth drop. This shift suggests a lack of confidence amongst merchants, who now anticipate a decline in HBAR’s worth.

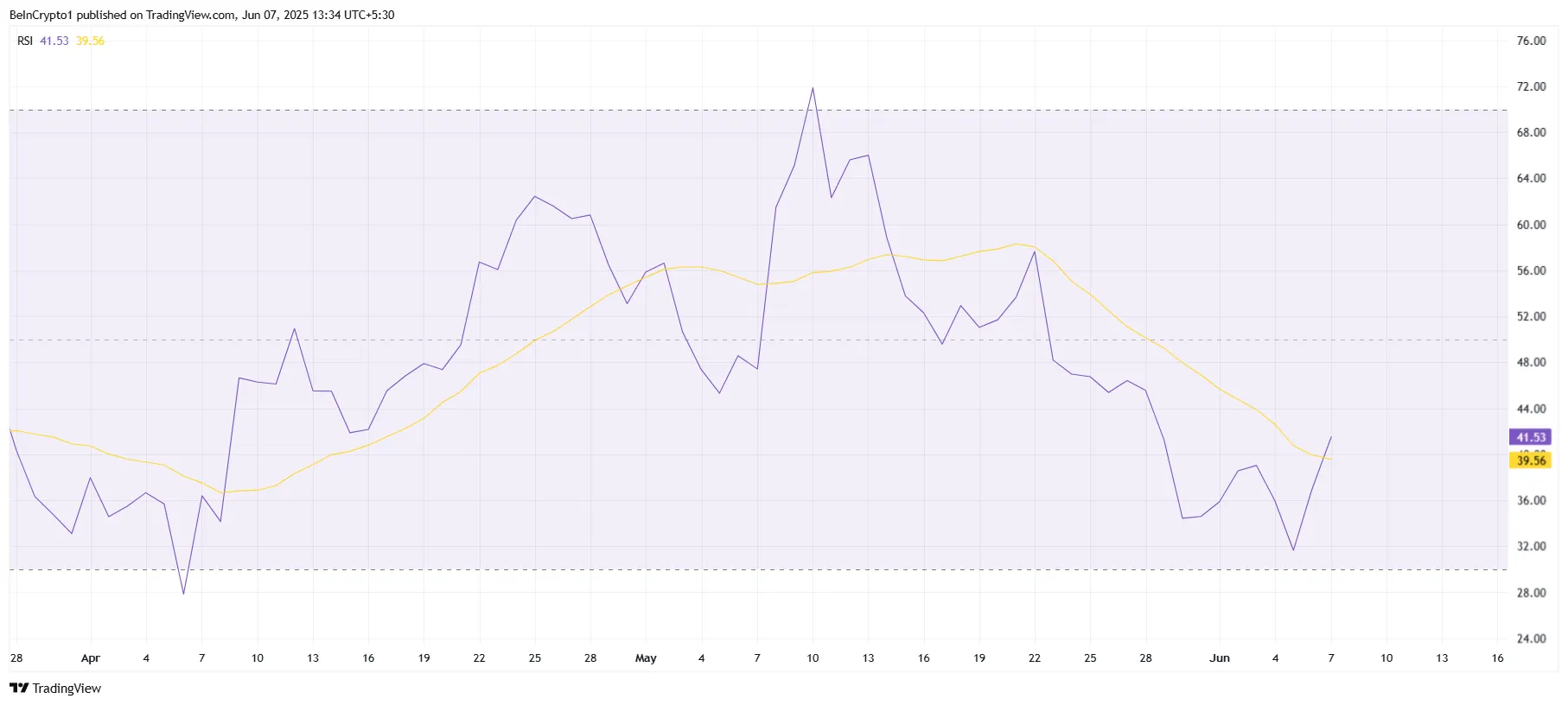

From a macro perspective, HBAR’s technical indicators have additionally taken a bearish flip. The Relative Energy Index (RSI), which slipped into the bearish zone in the direction of the top of Could, reached its lowest level in two months this week.

The dip within the RSI is a robust indication that HBAR is going through rising promoting strain. As momentum weakens, the chance of continued declines within the worth of HBAR will increase.

This technical sign, coupled with the unfavourable funding charge, means that HBAR could proceed to battle within the close to time period, with the potential for additional draw back if present circumstances persist.

HBAR Value Wants To Decide A Course

Presently, HBAR is priced at $0.168, slightly below the resistance of $0.172. Given the combined market sentiment, which mixes bearish indicators and fading bullishness, a decline in worth appears doubtless.

The resistance stage at $0.172 stays a big barrier for HBAR, and failure to interrupt by way of this stage may result in additional worth weak point.

If the $0.163 help stage fails to carry, HBAR may expertise an additional decline, probably reaching $0.154. This drop would lengthen the present losses and will sign a deeper bearish development, prompting extra merchants to rethink their positions and additional fueling the downtrend.

Nevertheless, if HBAR manages to interrupt previous the $0.172 resistance stage, it may push towards the subsequent resistance at $0.182.

A profitable breach of this stage would doubtless instill confidence amongst merchants and traders, reversing the present bearish sentiment and invalidating the unfavourable outlook for HBAR.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.