- TRX is underneath stress once more, falling 1.65% and hovering close to key help on the 50-day EMA round $0.2629.

- Regardless of stacked EMAs suggesting long-term bullishness, RSI and worth motion trace at short-term weak spot.

- Derivatives information exhibits bearish sentiment rising, with a unfavourable funding charge and rising brief positions.

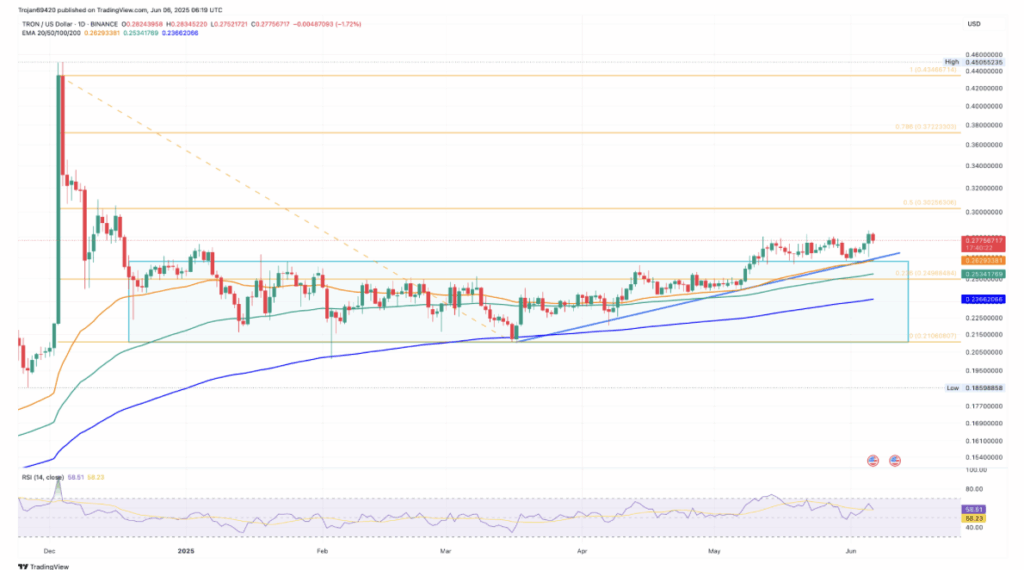

Tron’s been feeling the warmth currently. As markets cooled off heading into Friday, TRX dropped about 1.65%, with merchants now eyeing the 50-day EMA at $0.2629 as the following help zone. Thursday’s 2.5% rally didn’t maintain for lengthy, fading quick underneath mounting bearish stress. That three-day inexperienced streak? Appears prefer it hit a wall.

Now buying and selling round $0.2775, Tron is sliding again towards a key help pattern line. There was some hope for a breakout from its consolidation section, however the newest dip says in any other case. RSI’s been sagging too, displaying some divergence that hints at extra draw back forward. Except one thing flips, we’re a potential tumble towards that $0.26 zone.

Technicals Maintain… for Now

Technically talking, TRX nonetheless has some guardrails. The 50-, 100-, and 200-day EMAs are stacked in a bullish order, which often means longer-term energy isn’t damaged but. However this drop is testing nerves. If worth holds above $0.2628 and reverses, a climb again towards $0.2806—and even the 50% Fib stage at $0.30—isn’t off the desk.

Nonetheless, let’s not sugarcoat it. The rejection close to $0.28 plus the fading momentum means bulls want to point out up now in the event that they wish to shift the temper.

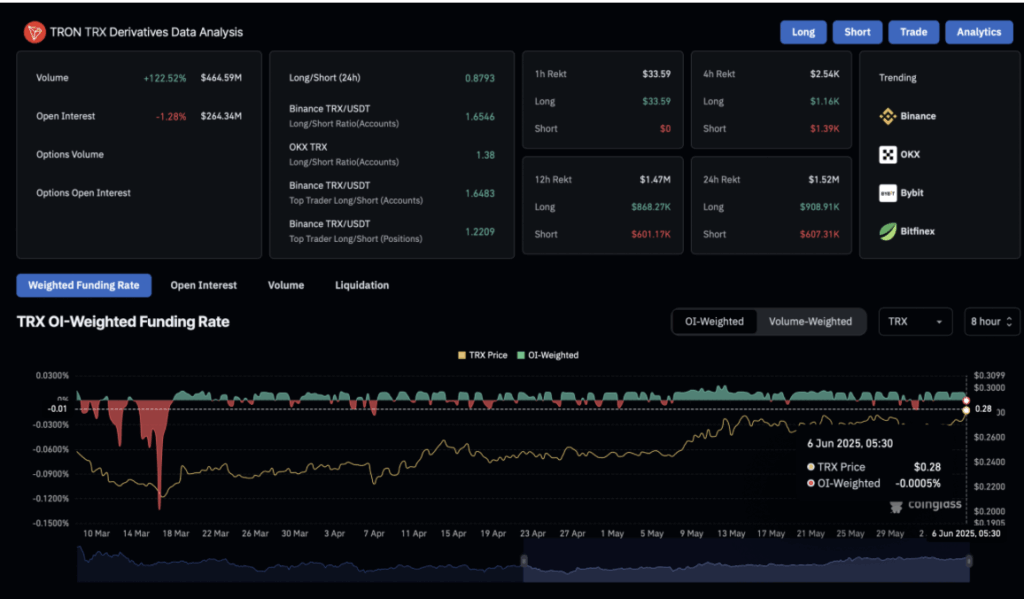

Derivatives Market Flips Bearish

On the derivatives facet, the temper’s taken successful. Open curiosity is right down to $264 million, a 1.28% dip, and lengthy merchants took a lot of the hit with $908K in liquidations. Shorts? They noticed $607K wiped, however they’re gaining steam quick. That’s why the funding charge flipped unfavourable (-0.0005%), displaying bears at the moment are keen to pay to maintain brief positions open.

The lengthy/brief ratio sits at 0.8793—extra shorts than longs—and that’s by no means an excellent look in a market already wobbling. Add within the broader volatility throughout altcoins, and it paints a cautious, perhaps even pessimistic, near-term outlook for Tron.