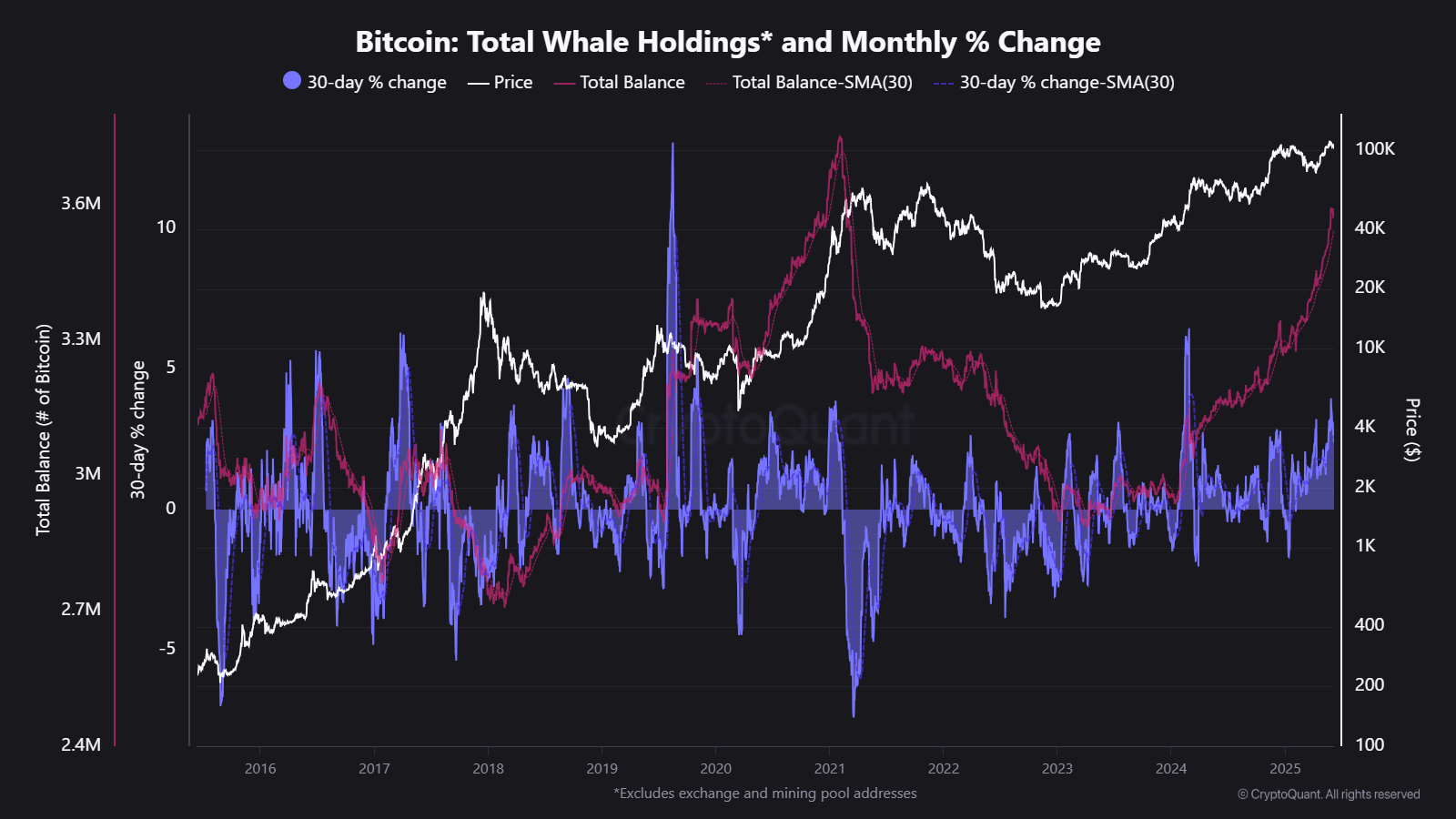

Indicators from Bitcoin whales and miners trace at a possible rally on the horizon. New information from CryptoQuant reveals that giant Bitcoin holders now maintain a stability of three.57 million BTC.

This approaches the earlier excessive of three.74 million BTC set in early 2021.

Bitcoin Whales are Rising their Holdings

When whales steadily add to their reserves, they act as highly effective demand sinks. Their growing accumulation reduces the obtainable provide and supplies value assist.

The present uptrend in whale holdings means that establishments and high-net-worth buyers view dips as shopping for alternatives and anticipate greater costs forward.

“This metric displays the true balances of enormous holders by excluding alternate and mining pool addresses. This presents a clearer view of strategic accumulation by massive buyers. Remained progress in whale holdings typically indicators institutional confidence and robust underlying demand, that are key drivers of longer-term bull cycles,” CryptoQuant analyst JA Maartunn informed BeInCyprto.

However not all indicators level upward. In line with CryptoQuant, the Hash Ribbons metric—monitoring miner stress—not too long ago flashed a purchase sign.

This sometimes displays short-term turbulence as miners face profitability points, forcing some to promote Bitcoin to remain operational.

Traditionally, these short-term stresses typically set the stage for sustained rallies. Miner capitulation can set off preliminary value drops.

However finally, it clears weaker gamers from the market and tightens provide.

Final week, the Bitcoin value demonstrated notable volatility. Influenced by a heated public dispute between Elon Musk and Donald Trump, Bitcoin briefly dipped under $101,000. This prompted almost $1 billion in liquidations.

But, Bitcoin shortly recovered to above $105,000, indicating resilient shopping for strain.

Technical analysts are additionally optimistic. They spotlight a “cup-and-handle” formation on Bitcoin’s each day chart, suggesting a bullish breakout if costs surpass $108,000.

Furthermore, institutional exercise helps this bullish outlook. Bitcoin futures open curiosity rose by greater than $2 billion in current days, whereas funding charges stayed low.

This state of affairs creates fertile floor for a possible brief squeeze.

Will BTC Maintain the $100,000 Psychological Assist?

For now, the whale accumulation and miner stress information establish a transparent buying and selling vary. Sturdy assist sits between $100,000 and $102,000.

This implies BTC will seemingly keep its $100,000 psychological stage even throughout short-term corrections.

In the meantime, resistance awaits on the $108,000–$110,000 zone, the place a breakout might speed up costs towards $120,000.

Merchants ought to watch carefully for catalysts, equivalent to additional miner promoting, as these might swiftly affect value motion.

Moreover, macroeconomic headlines involving the Fed and world commerce dynamics will seemingly preserve volatility elevated.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.