- Solana whales are cut up—one staked 61K+ SOL, whereas one other bought 44K+ for revenue, signaling combined sentiment.

- Dormant tokens moved for the primary time in ages, whereas retail merchants present heavy lengthy bias—elevating danger of a reversal.

- Key resistance at $155 may stall any rally; if SOL fails to interrupt by, liquidations could drag worth decrease.

Within the final 24 hours, Solana’s whale exercise took a bizarre flip. One whale locked up 61,838 SOL into staking—most likely betting on long-term beneficial properties. However proper after that, one other whale pulled out 44,539 SOL and bought, pocketing $649K in earnings. Yeah… combined indicators a lot? This sort of opposing transfer exhibits there’s no clear consensus proper now. Some are betting huge on what’s subsequent, whereas others are grabbing their beneficial properties and stepping again.

In the meantime, the market’s nonetheless wanting twitchy. Retail of us are inclined to comply with the massive fish, and with whales exhibiting each dedication and exit indicators, no person actually is aware of which route issues would possibly swing.

Dormant SOL Strikes, Longs Overheat

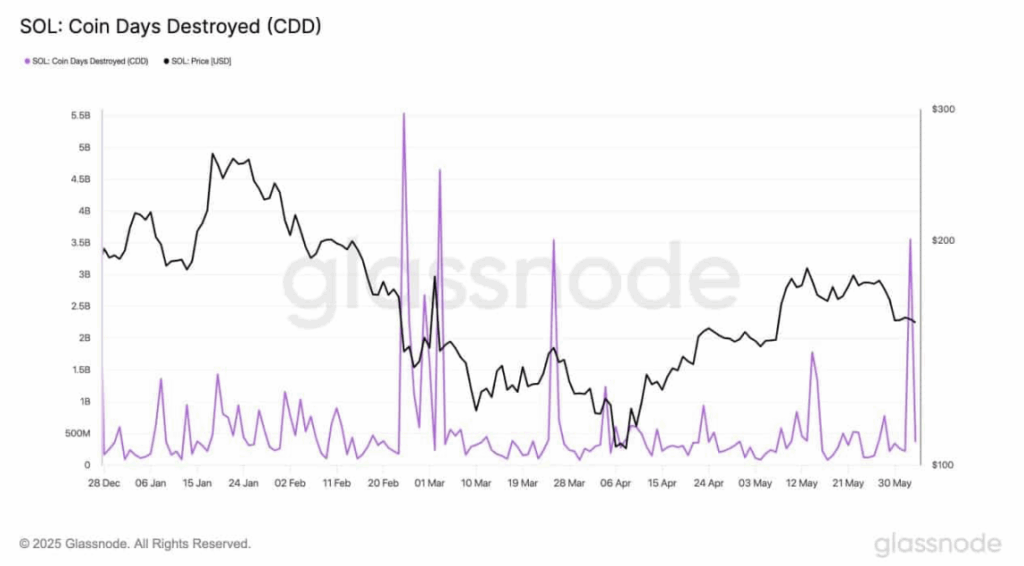

Right here’s the place it will get attention-grabbing—Solana simply noticed its third-largest Coin Days Destroyed (CDD) spike this yr, at 3.55 billion. Mainly, long-held SOL that hadn’t moved in ages simply got here again to life. This often factors to some huge wallets transferring stuff round—both lining up for a promote or getting ready for a shift in technique.

Add that to the truth that over 75% of Binance merchants are in lengthy positions, and also you’ve bought a recipe for… potential chaos. That long-to-short ratio? It’s sitting at 3.15. Shorts misplaced $1.73M not too long ago, whereas longs barely misplaced $96K. Might be a brief squeeze, or simply bulls overplaying their hand. But when momentum fades, the reversal could possibly be sharp.

Technicals Wanting Fragile, Eyes on $155

Proper now, SOL is buying and selling round $148.71—nonetheless caught below its 9- and 21-day transferring averages. These are at $154.91 and $165.31. Not superb. The RSI is down at 36.84, so yeah, getting near oversold territory. Till bulls get the worth again above these MAs, issues look tilted towards the bears. Additionally, the bearish crossover doesn’t precisely assist confidence.

Open Curiosity on SOL futures dropped 4.26%, now at $380M. That dip exhibits some of us are backing off leverage, perhaps anticipating a cooldown. So between all of the heavy lengthy positions and dropping Open Curiosity, you’ve bought loads of uncertainty within the air.

Resistance Zones Might Choke the Rally

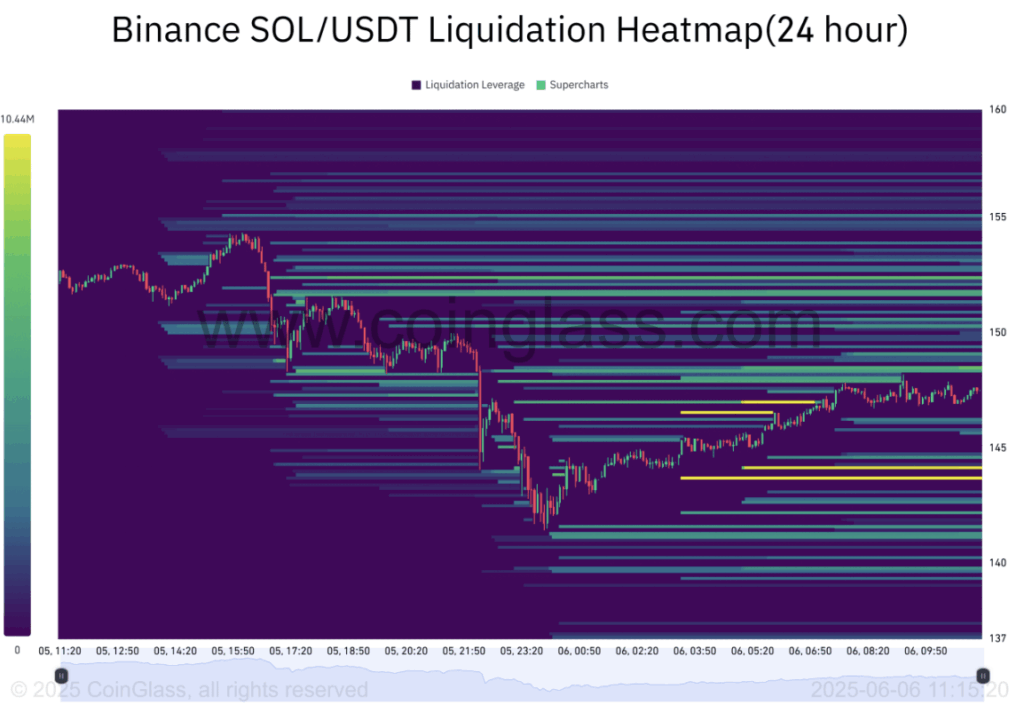

Binance’s liquidation heatmap, there’s a chunky resistance cluster between $148 and $155. This zone has already slowed the bounce, and until SOL bulldozes by, it may entice a bunch of leveraged longs. If that occurs, cascading liquidations aren’t off the desk.

That mentioned, if SOL breaks out above $155 cleanly, there’s a good shot at a quick climb. However for now, that stage appears to be like just like the ceiling fairly than the ground.