Tron (TRX) has skilled a powerful worth rise, reaching a 5-month excessive. Nonetheless, the current bullish momentum seems to be shedding steam, signaling the potential for a worth correction.

Whereas the asset has carried out effectively, there are indicators that TRX might be overvalued within the brief time period, which can immediate a pullback.

Tron Is Overvalued

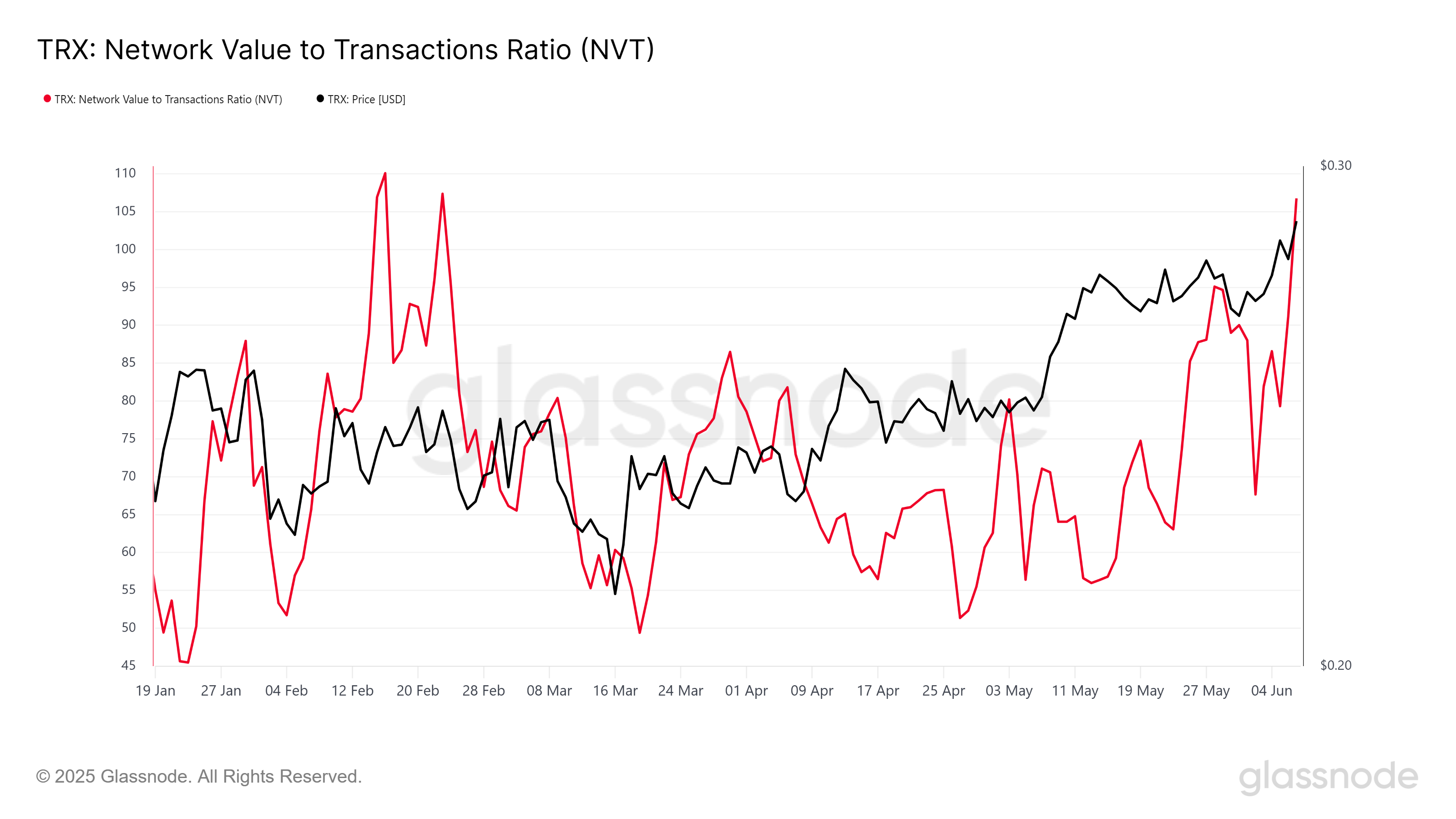

The Community Worth to Transactions (NVT) ratio for Tron has spiked, reaching its highest stage in a month and a half. NVT measures the ratio between a community’s market worth and its transaction quantity.

A rising NVT usually alerts that the market worth of an asset is outpacing its transactional exercise, suggesting overvaluation. Within the case of TRX, this enhance in NVT is a possible pink flag.

With the NVT ratio rising, TRX might face downward stress as buyers modify their expectations. The token’s overvaluation might result in a sell-off, particularly if market sentiment shifts towards warning.

Because of this, a worth correction appears doubtless, particularly if the broader cryptocurrency market experiences a cooling-off interval.

Regardless of the issues about overvaluation, the general macro momentum for TRX might not result in a pointy correction. The IntoTheBlock’s IOMAP indicator exhibits a powerful demand zone between $0.268 and $0.276, the place round 13.89 billion TRX, value practically $4 billion, was bought.

This substantial accumulation zone supplies a buffer for TRX, as buyers who purchase at these ranges are unlikely to promote and not using a revenue.

The demand zone is essential as a result of it represents a worth ground which will stop TRX from falling too far. Because the market has demonstrated curiosity on this worth vary, the possibilities of TRX dropping under $0.276 within the brief time period are lowered.

If TRX does expertise a correction, it’s anticipated to search out stable assist inside this zone, retaining the worth above the essential $0.276 stage.

Will TRX Worth Take A Dip?

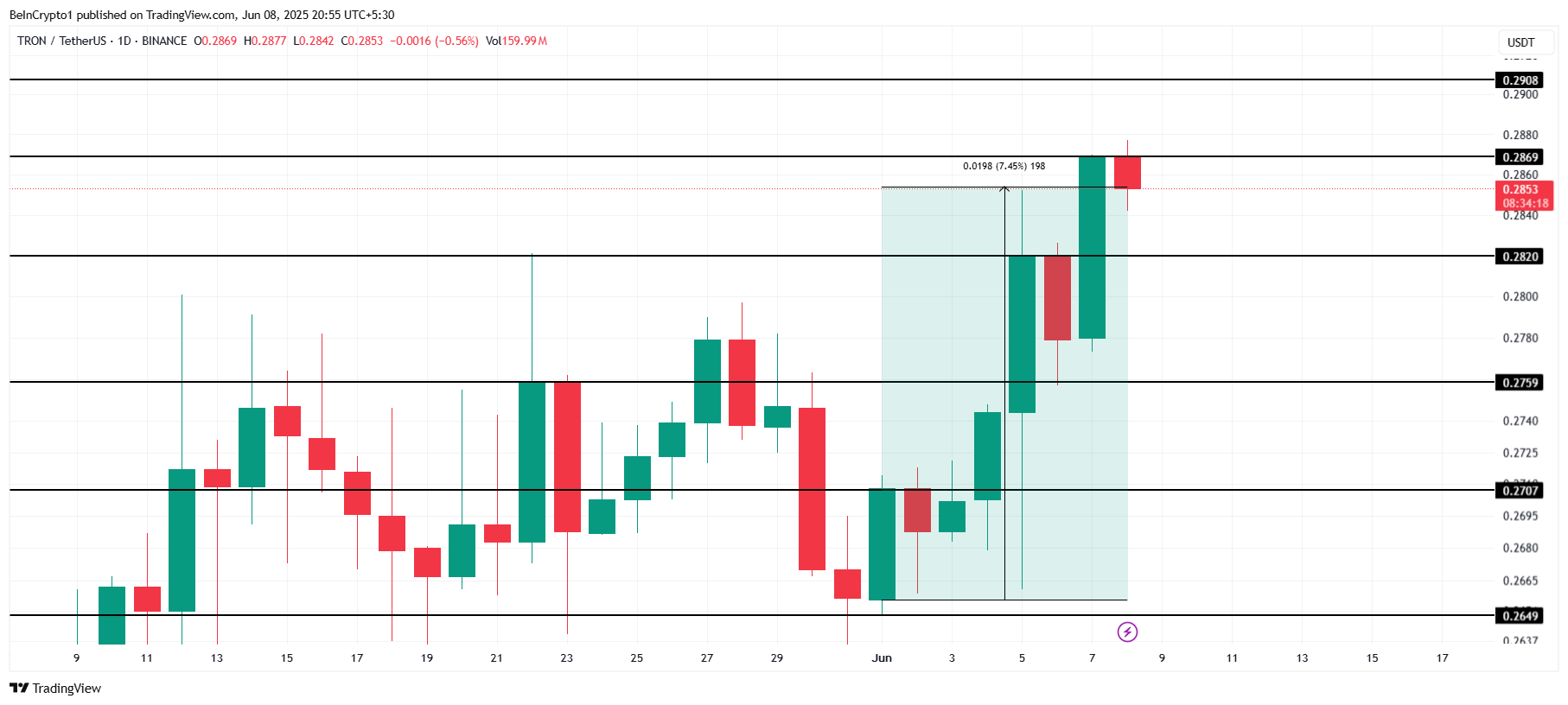

TRX has gained 7.45% over the previous week, buying and selling at $0.285 on the time of writing. It’s at present going through resistance at $0.286, which has confirmed to be a difficult stage to interrupt. Given the current rise in worth, the token is nearing a essential level.

If TRX fails to breach the $0.286 resistance, it might face a pullback as buyers take earnings.

Ought to the overvalued situation set off a worth decline, TRX might drop under $0.282 and head towards the $0.275 assist stage. A fall under this stage is unlikely as a result of robust demand zone round $0.268 to $0.276, which ought to present assist for the worth. The correction is anticipated to be reasonable, with the demand zone stopping a extra extreme decline.

Alternatively, if the broader market stays bullish, TRX might push previous the $0.286 resistance stage. A profitable breach of this barrier might see TRX transfer towards $0.290. This could invalidate the bearish outlook and set the stage for additional worth appreciation.

Disclaimer

According to the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.