China’s finance suppose tank gently pushes Bitcoin into reserve asset highlight

The Worldwide Financial Establishment (IMI), China’s state-backed finance suppose tank, has republished an article that quietly elevates Bitcoin within the reserve asset debate.

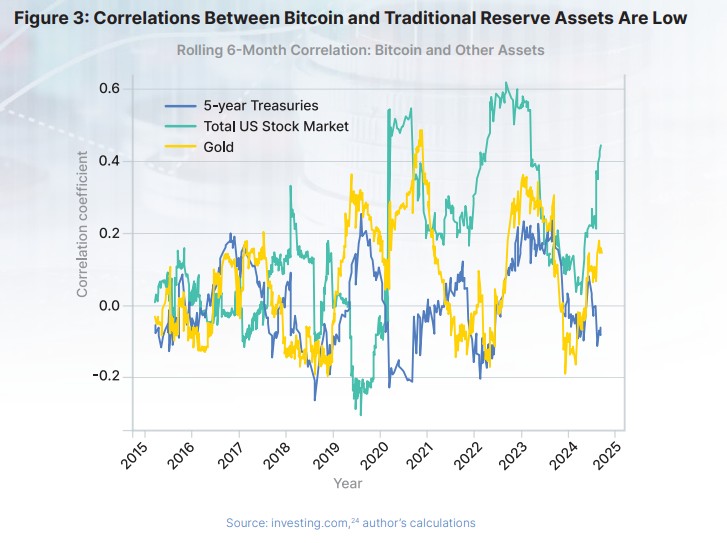

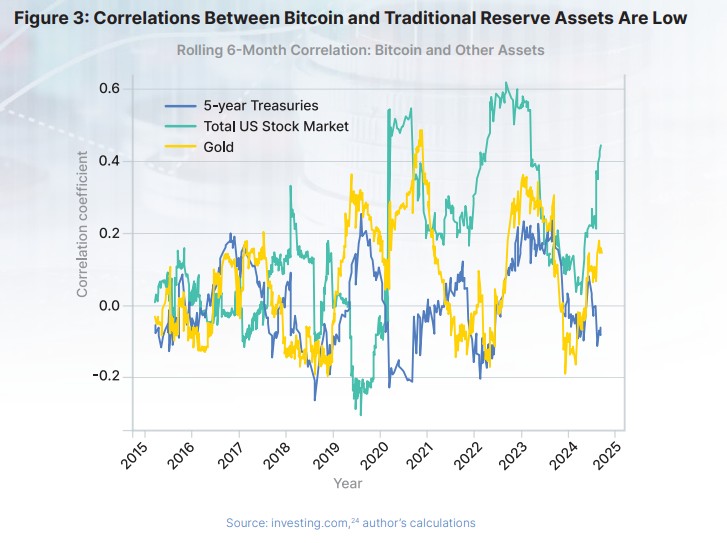

The report by former White Home economist Matthew Ferranti, initially revealed in October by the Bitcoin Coverage Institute, argues that Bitcoin can function a hedge for central banks in growing economies, notably these uncovered to US greenback weaponization. It was republished by the IMI on its official WeChat account on Might 28 with an editorial notice stating Bitcoin’s rise as a reserve asset “deserves continued consideration.”

The IMI’s editorial notice lays out that the enchantment of US greenback belongings is waning because of deficits, inflation and falling actual yields. Because of this, gold faces new challenges and Bitcoin is rising as a critical contender for strategic reserves.

“Bitcoin is transitioning from a speculative asset to a strategic reserve asset,” IMI wrote.

IMI was established in 2009 to deal with analysis in financial finance idea, coverage and technique. It operates as a non-profit establishment inside the Renmin College of China, a state-owned college co-founded by the Ministry of Schooling and the Beijing Municipal Authorities. IMI’s management contains senior lecturers and coverage advisers.

In contrast to central financial institution statements or legislative adjustments, the IMI’s commentary acts as a policy-side whisper that subtly introduces Bitcoin as a reputable participant in world reserve technique. Whereas stopping wanting formal endorsement, it alerts a rising institutional curiosity about Bitcoin’s function.

Whereas Chinese language regulators proceed to implement a sweeping ban on crypto actions like buying and selling and mining, it’s notable that certainly one of its most distinguished monetary suppose tanks is publicly discussing Bitcoin’s function as a hedge towards the issues China has lengthy warned about — US greenback hegemony and financial danger.

China has banned cryptocurrency buying and selling and mining, however continues to develop its personal central financial institution digital forex, the e-CNY, and it stays extremely engaged in world fintech debates.

Longest-serving South Korean crypto trade CEO resigns

Lee Sirgoo, CEO of Upbit operator Dunamu and South Korea’s longest-serving crypto trade chief, has stepped down.

“I made this choice based mostly on the assumption that new challenges and adjustments are needed for Dunamu’s continued progress, in addition to because of private well being points,” mentioned Lee Seok-woo in a press release.

His resignation will take impact on July 1, after which he’ll stay with the corporate as an adviser.

Lee’s departure got here as a shock to many within the native crypto business, as he had been anticipated to steer the nation’s largest crypto buying and selling platform via December 2026.

In February, South Korea’s Monetary Intelligence Unit (FIU) imposed a three-month partial suspension on Upbit for alleged violations associated to buyer verification and failure to report suspicious exercise. Dunamu challenged the order in courtroom, which later quickly lifted the ban.

Regardless of the timing, a Dunamu spokesperson mentioned that Lee’s resignation is “because of private causes and is unrelated to the FIU sanctions.”

“The well being issues aren’t critical. He’s merely been fatigued from overwork and felt this was the appropriate second to step again and get better,” the spokesperson informed Journal.

Dunamu has nominated Oh Kyung-seok, CEO of attire firm Panko and a former decide, as Lee’s successor. Oh is predicted to be formally appointed following approval at a shareholders’ assembly and board assembly on June 27.

Learn additionally

Options

Off The Grid’s ‘greatest replace but,’ Rumble Kong League assessment: Web3 Gamer

Options

Are CBDCs kryptonite for crypto?

Even Sony’s banking unit will get into the blockchain enterprise

Sony Financial institution, a subsidiary of Sony Group Company, has introduced the institution of a brand new wholly owned firm centered on Web3 enterprise.

Sony Financial institution cited the rising significance of blockchain-integrated companies, reminiscent of cryptocurrency wallets, NFT infrastructure and exchanges as core causes behind the brand new enterprise.

The transfer was permitted at a Sony Financial institution board assembly held on Might 27. The brand new subsidiary’s formal institution is predicted in June, and enterprise operations are set to start within the fall.

The corporate will function in shut coordination with Sony Financial institution’s present Web3 initiative, the cell app Sony Financial institution CONNECT, which provides entertainment-oriented monetary companies. In 2024, Sony Financial institution examined Japanese yen-backed stablecoins for gaming.

Sony Group additionally operates Soneium, the Ethereum layer-2 blockchain.

Learn additionally

Options

Twister Money 2.0: The race to construct secure and authorized coin mixers

Options

Sexual Violence in India: Blockchain’s Function in Empowering Survivors

Thailand slashes funds and hypothesis for upcoming G-token

Thailand’s Securities and Trade Fee has dominated out funds and speculative buying and selling for the nation’s upcoming G-token initiative, the Bangkok Publish reported.

Thailand’s G-token is a brand new digital monetary instrument aimed toward serving to fund the nationwide finances. The Ministry of Finance will reportedly distribute $150 million price of digital funding tokens via an preliminary coin providing portal (ICO) scheduled to go dwell in July.

Finance Minister Pichai Chunhavajira mentioned the G-Token initiative will enable retail buyers better entry to authorities bonds. He added that the digital nature of G-Token is predicted to yield higher returns than financial institution deposits.

Whereas G-Token’s use shall be tightly managed, transfers outdoors or throughout exchanges shall be prohibited and enforced via sensible contract mechanisms. The SEC mentioned that G-Token ought to be considered as a savings-oriented funding fairly than a typical cryptocurrency, with secondary market buying and selling permitted underneath regulatory oversight.

Particulars reminiscent of rates of interest, collateral, and maturity durations shall be introduced by the Finance Ministry. Buyers with digital wallets should purchase tokens straight, whereas these investing through securities corporations can have their tokens held in custody. The SEC is requiring exchanges to implement safeguards like market surveillance, indicative pricing, and non-obligatory market makers to make sure transparency and investor safety.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.