- Bitcoin’s weekly Doji and trendline breakout sign a potential rally, however analysts say affirmation continues to be wanted.

- A 2024 fractal sample suggests BTC may repeat historical past and push towards $120K.

- Lengthy-term holders are accumulating BTC whereas short-term merchants take earnings, echoing pre-2020 bull market habits.

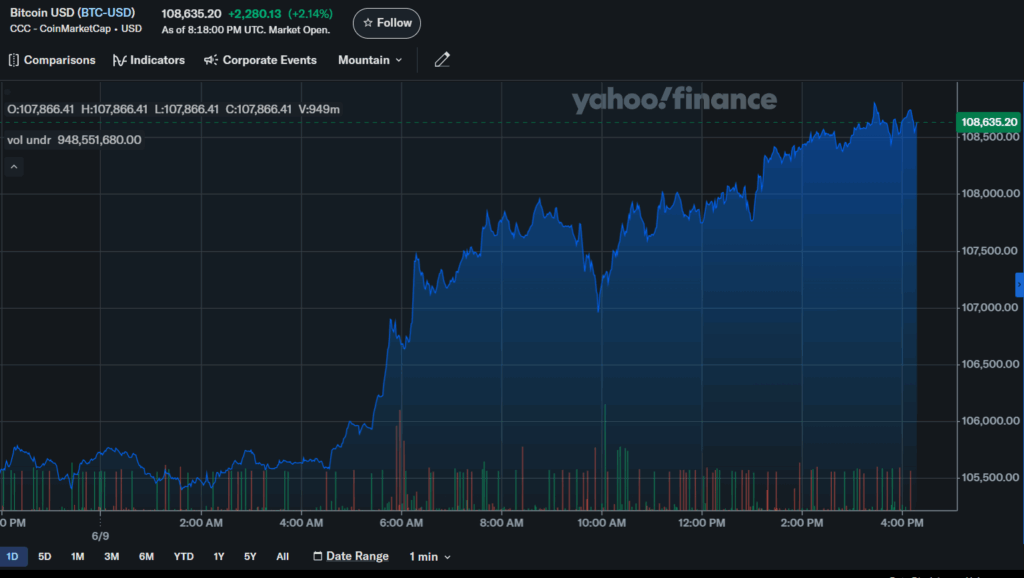

Bitcoin lately broke above a descending trendline after discovering a neighborhood backside at $100,300 on June 6. On the weekly chart, a Doji candle has fashioned—a sample with a small physique and lengthy wicks—sometimes signaling indecision available in the market. With sell-side liquidity now absorbed, this might point out the fading of bearish momentum and set the stage for a potential rally.

Nonetheless, crypto analyst Jackis urged warning, noting that the Doji alone isn’t sufficient. He emphasised the necessity for a transparent value breakout above current highs earlier than confirming a bullish pattern. With out that transfer, any assumptions of an uptrend might be untimely.

Fractal Patterns Trace at $120K Upside

Dealer Krillin identified a repeating fractal from early 2024—proper after the approval of Bitcoin ETFs—that resembles at this time’s value motion. That earlier setup included a pointy upward “god candle” and triggered a robust breakout. If the sample holds, Bitcoin may quickly bounce towards $110,000–$120,000 in an identical transfer.

These kinds of fractals, when seen on larger timeframes, have traditionally confirmed dependable. With Bitcoin now hovering above $106,000, merchants are maintaining shut look ahead to a repeat efficiency.

Bitcoin Holders Take the Wheel

Spot buying and selling quantity has plummeted to ranges not seen since October 2020, whereas futures exercise stays excessive. This dynamic suggests many buyers are transferring into “HODL” mode, just like what occurred forward of Bitcoin’s historic bull run later that yr.

On-chain habits reinforces this. Over the previous month, short-term holders offloaded round 592,000 BTC—seemingly taking earnings—whereas long-term holders amassed 605,000 BTC. This type of provide shift sometimes builds the muse for sustained upward value motion.