- Ethereum’s community exercise is booming, with a file 17.4 million weekly lively addresses and Layer 2 utilization multiplying, suggesting a surge in demand and attainable breakout momentum.

- DeFi capital is flowing again into Ethereum, pushing TVL to $86.63B, whereas change outflows trace at a provide squeeze — bullish alerts stacking up throughout the board.

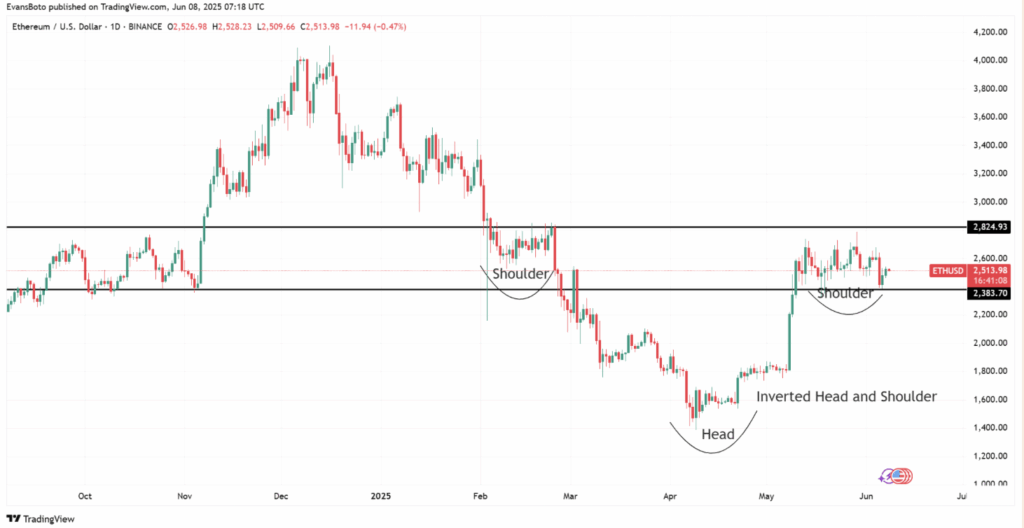

- ETH is forming an inverted head-and-shoulders sample, with $2,824 performing because the breakout line; a clear transfer above may ship costs towards $3K, however failure would possibly lure worth in consolidation.

Ethereum’s ecosystem simply lit up this June. Weekly lively addresses shot previous 17.4 million — yeah, that’s a model new all-time excessive. What’s much more fascinating is the wild 18.43% surge in Layer 2 interactions. Multiply that by 7.55x and also you get a transparent sign: persons are piling into these scaling options quick.

Cross-chain stuff would possibly’ve dipped slightly, positive, however core Ethereum utilization is roaring. That sort of consideration — from on a regular basis customers and large gamers alike — is perhaps the spark ETH wants for a breakout. Or possibly only a tease. Time will inform.

DeFi Confidence Creeping Again In

Let’s discuss DeFi — as a result of it’s not lifeless. Not even shut. Ethereum’s Complete Worth Locked (TVL) simply nudged as much as $86.63 billion, with a 1.28% leap in a single day. Not a moonshot, however regular is sweet, proper?

Clearly, capital is trickling again into Ethereum’s lending, staking, and liquidity protocols. Some would possibly say it’s gradual… others would name it conviction. Both method, it’s serving to ETH’s fundamentals look slightly sturdier. And when DeFi thrives, ETH normally does too.

Exchanges Dropping ETH — Is a Provide Squeeze Brewing?

Right here’s a juicy one: change balances are dropping. Netflows turned unfavorable by 1.59%, which suggests of us are yanking ETH off exchanges and stashing it elsewhere — possibly in chilly wallets, possibly in staking. Both method, it’s not sitting round ready to be dumped.

Fewer cash on exchanges normally means much less promote stress. If this retains up and demand sneaks in, we may see costs shoot up quick — traditional provide crunch transfer.

Merchants All-In on Longs… However Is {That a} Pink Flag?

Now right here’s the difficult half — dealer habits. Volatility fell off a cliff, from over 80% to round 47% in two days. In the meantime, Binance’s ETH lengthy/quick ratio is sitting at 1.84, with practically 65% of oldsters betting lengthy.

That’s confidence — possibly slightly an excessive amount of. Overcrowded trades like this? They don’t all the time finish properly. If sentiment flips, longs may get smoked. However proper now? The bulls nonetheless have the ball.

All Eyes on $2,824

Ethereum’s buying and selling between $2,383 and $2,824 proper now, carving out an inverted head-and-shoulders sample — a traditional bullish setup. The latest bounce to $2,515.80 is promising, nevertheless it’s that $2,824 neckline that basically issues.

Break it, and ETH would possibly simply dash towards $3K. Miss it, and we’re in all probability taking a look at extra sideways chop. All the things — from on-chain energy to market vibes — is leaning bullish. However till ETH clears that resistance, it’s nonetheless caught in wait-and-see mode.